Donald Trump used money from his charitable foundation to settle legal disputes concerning his business enterprises, court and tax filings show — a practice that charity experts say raises red flags and may violate IRS laws.

But the Trump campaign is defending the practice, with campaign manager Kellyanne Conway noting that it hadn’t yet drawn IRS scrutiny.

A review of legal documents and interviews by NBC News found that $258,000 in Donald J. Trump Foundation donations was used to settle two separate suits against Trump’s private companies, which was first reported by the Washington Post.

In one case, Trump agreed to donate $100,000 to the Fisher House Charity to settle a lawsuit brought by the Town of Palm Beach over a sizable flagpole Trump erected on the grounds of Mar-a-Lago, his Palm Beach club.

That contribution came from the Trump Foundation’s coffers, according to a review of the foundation’s tax filings and documents provided by the Town of Palm Beach.

But Conway, speaking on CNN Tuesday night, described the episode as “classic Donald Trump."

"He wanted to raise the American flag as high as he possibly could over Mar-a-Lago. I think a lot of Americans at this point would applaud that,” she said, noting the town assessed a fine because Trump refused to reduce the height of his flagpole and emphasizing that the money from the settlement went to help veterans.

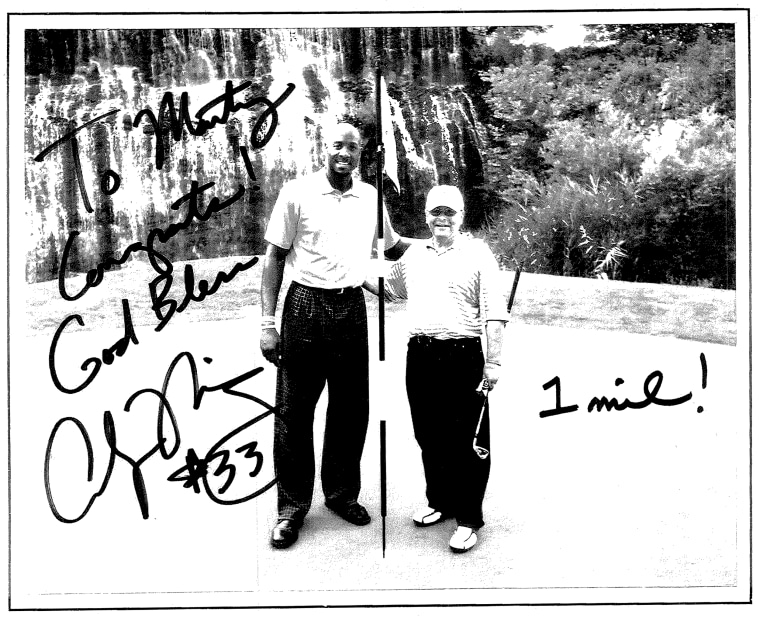

In a separate case, Trump National Golf Club in Westchester County, N.Y., agreed to contribute $158,000 to a charity of the plaintiff’s choice to settle a suit concerning a charity golf tournament held on the course in August 2010.

That contribution again came from the Trump Foundation, according to tax filings.

At issue was a million-dollar award promised to any player that sunk a hole in one on the 13th hole during the charity tournament.

Martin Greenberg, the CEO of Sterling Commodities Corp., managed to achieve the feat, but never received his award money. His shot, the event’s insurers said, was short of the minimum yardage requirement outlined in the contest rules.

So Greenberg sued — and ended up hammering out a settlement with the Trump National Golf Club and Alonzo Mourning Charities, which had hosted the tournament, that required both make a donation to his own charitable foundation.

But two sources directly involved in the matter told NBC News that Trump’s attorneys significantly negotiated down his liability in the settlement, shifting the majority of the financial burden to Alonzo Mourning Charities.

An initial settlement agreement reviewed by NBC News required the golf course contribute half a million dollars to a charity of the plaintiff’s choosing. Alonzo Mourning Charities was initially on the hook for just $260,000.

But the initial settlement included a stipulation that if “Trump National Golf Club declines to make the payment set forth ... the settlement terms are null and void.” And two sources directly involved in the lawsuit said that’s just what happened —Trump refused to pay half a million dollars, and indeed initially his lawyers insisted he had no liability at all in the suit.

But Trump eventually chose to settle rather than take the matter to trial — evidence, one source directly involved in the case on the plaintiff’s side said, that indicates Trump knew he did in fact have some liability in the case and might have lost if it had gone to trial.

Trump’s lawyers and the attorneys for Alonzo Mourning Charities worked out the final breakdown in payments among themselves, resulting in the Trump Foundation contributing just $158,000.

It’s unclear how much Alonzo Mourning Charities was required to contribute in the final settlement, but a review of the Martin Greenberg Foundation’s tax filings that year shows a contribution of $617,346 from the organization — nearly four times as much as the Trump Foundation paid to settle the case.

The new revelations surrounding Trump’s unusual use of his charitable foundation add to a mounting list of questions concerning the organization sparked by an extensive Washington Post review of the candidate’s charitable contributions. The Post first reported on the legal payments.

Trump was recently forced to pay a penalty to the IRS over an improper political contribution from the charity to Florida Attorney General Pam Bondi. And the New York Attorney General’s office is now looking into whether the Trump Foundation broke any laws.

And Trump’s use of his charitable foundation’s funds to pay legal settlements may violate IRS rules against “self-dealing,” which bar nonprofit managers from using their charity’s funds to benefit themselves.

The IRS did not respond to a request for comment, but 1985 guidance issued by the IRS does include “a grant or other payment made by a private foundation which satisfies the legal obligation of a disqualified person” as an example of self-dealing.

The use of Trump Foundation funds to pay settlements was, at the very least “clearly unethical,” according to Daniel Borochoff, president of CharityWatch, a nonprofit that evaluates charitable organizations.

“It is clearly unethical to use charitable dollars to pay for expenses that one ought to be paying for out of their own pocket, particularly since the money being used through the Trump Foundation is tax-subsidized,” he said.

Borochoff also noted that, because of the tax breaks enjoyed by charities, “we as Americans are paying for, partially, the fines and penalties of the Trump business organization, and that shouldn’t be happening. That is not the intent of the charitable rules.”

Conway on CNN noted that Trump was initially the sole donor to the Trump Foundation — although tax records show he hasn’t contributed to the organization since 2008 — and that it has no overhead.

"And I want to point out to you that the Trump Foundation has no permanent, no paid staff, no overhead, no one from the Trump family takes a penny as a salary or as benefits,” she added.