First Read is your briefing from Meet the Press and the NBC Political Unit on the day's most important political stories and why they matter

Four roadblocks that could wreck Trump's tax plan

The Trump administration today is expected to unveil a tax-cut blueprint that would slash the tax rate to 15% for corporations, small businesses, and firms like the president’s own company, NBC’s Kristen Welker confirms. On “Today” this morning, NBC’s Peter Alexander added that the proposal also would increase the deductions that individuals claim. But the outline, according to our eyes, faces four political and mathematic challenges:

1) How do you pay for it? Or does it increase the deficit? Earlier this week, Treasury Secretary Mnuchin told reporters that economic growth would pay for the tax plan (read: it likely WILL increase the deficit). And if that’s the case, it would make all of the GOP criticism of higher deficits and debt during the Obama years seem incredibly hypocritical. Yet there are Republicans who appear concerned about how the Trump proposal could grow the deficit. Sen. John Cornyn (R-TX) “described Mr. Trump’s plan to cut the corporate income tax to 15 percent as ‘pretty aggressive,’ with unknown consequences for the deficit,” per the New York Times.

2) Can Republicans stay unified to pass it? The GOP plan to pass any tax cut through Congress is to use reconciliation to prevent a Democratic filibuster against the legislation, so that it will need just 51 Senate votes instead of 60. But that means, with a 52-48 majority, there’s little margin for error. And by the way, using reconciliation presents its own challenges — due to the rule that it can’t increase deficits beyond a 10-year budget window. That’s why the Bush tax cuts expired after 10 years. But: “Even a temporary tax cut in the corporate tax rate as short as three years might cost the government revenue beyond 10 years and run afoul of those reconciliation rules,” the Wall Street Journal says. “Lower rates mean that businesses will use fewer tax credits, said a senior aide to House Speaker Paul Ryan (R., Wis.). As a result, they will carry those credits forward and reduce revenues in future years.”

3) How much will it benefit the highest earners? Increasing the standard deduction would help middle-class Americans. But reducing the business tax rate to 15%, especially for small businesses, seems to be a big help to the wealthiest. Here’s why, according to the Times: “The 15 percent rate would apply both to corporations, which now pay 35 percent, and to a broad range of firms known as pass-through entities — including hedge funds, real estate concerns like Mr. Trump’s and large partnerships — that currently pay taxes at individual rates, which top off at 39.6 percent.” Going from 39.6% to 15% is a big break, right? Don't forget this Trump exchange on "Today" last year:

SAVANNAH GUTHRIE: Do you believe in raising taxes on the wealthy?TRUMP: I do. I do. Including myself. I do.

4) How much will it benefit Trump himself? This might be the biggest challenge of all, especially with Democrats saying that their side will oppose any Trump tax plan unless Trump finally releases his own tax returns to show how much he might personally benefit under any proposal.

Court deals Trump another immigration setback (but one he can exploit with his base)

“A federal judge Tuesday blunted the impact of one of President Donald Trump's executive orders on immigration, forbidding the White House from withhold federal funds from sanctuary cities — local governments that limit police cooperation with federal immigration authorities,” NBC’s Pete Williams reports. “Federal District Court Judge William Orrick issued a nationwide injunction in response to a lawsuit filed by San Francisco and nearby Santa Clara County. They argued that the president's January 25th executive order, declaring sanctuary cities ineligible to receive federal grants, was unconstitutional.” Don’t forget: Immigration has been the one place where Trump’s early administration has made an impact -- and where the president hasn’t backed down. So this is a blow to his administration before his 100th day in office. Then again, nothing more might fire up his base with the line: “A federal judge in San Francisco…”

More Michael Flynn troubles for the White House

The more we learn about former Trump National Security Adviser Michael Flynn, the more striking it is that he got as high as he did in the Trump White House (before being ousted). “President Donald Trump’s former national security adviser, Michael Flynn, appeared to violate federal law when he failed to seek permission or inform the U.S. government about accepting tens of thousands of dollars from Russian organizations after a trip there in 2015, leaders of a House oversight committee say,” the AP writes. “The congressmen also raised new questions about fees Flynn received as part of $530,000 in consulting work his company performed for a businessman tied to Turkey’s government.”

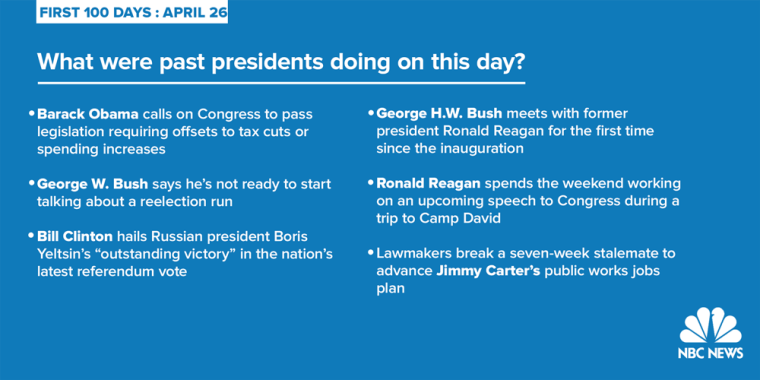

What were other presidents doing on April 26?