Money should never be a taboo subject between parents and their children. Your kids don’t need to be sheltered from financial matters. That’s why all dads and moms need to have that “money talk” with their kids.

Take for example, Jim Cramer, host of CNBC’s “Mad Money.” He recalls valuable money lessons he got from his dad over the years.

“People always ask me about how I know so much about money,” he said. “I have to say, some of the best lessons I learned about money were from my father.”

Cramer recalls experiencing some very down days. After having all his possessions stolen while living in Los Angeles, he was forced to live in his 1978 Ford Fairmont. Cramer said he was in a jam, money-wise. “I didn’t have enough money to make a phone call,” he said.

He decided it was time to reach out to his dad for some guidance. His dad told him that he needed to find ways to get some money in order to start investing, Cramer said.

When Cramer reiterated that he was living in his car and had no extra money to invest, his dad insisted, advising that “the secret is to invest $10 at a time.”

Somehow, Cramer said, he was able to scrap together $10 every other week, and he invested that money in mutual funds. It paid off in the long run. All these years later, Cramer admits: “Pop, you were right.”

“One of the things I am most proud of with ‘Mad Money’ is that so many families watch us together, ” he said. “When I hear that kids get started [investing] early, that’s when I know we are doing things right.”

He said it’s those early money lessons from his “Pop” that still inspire him today.

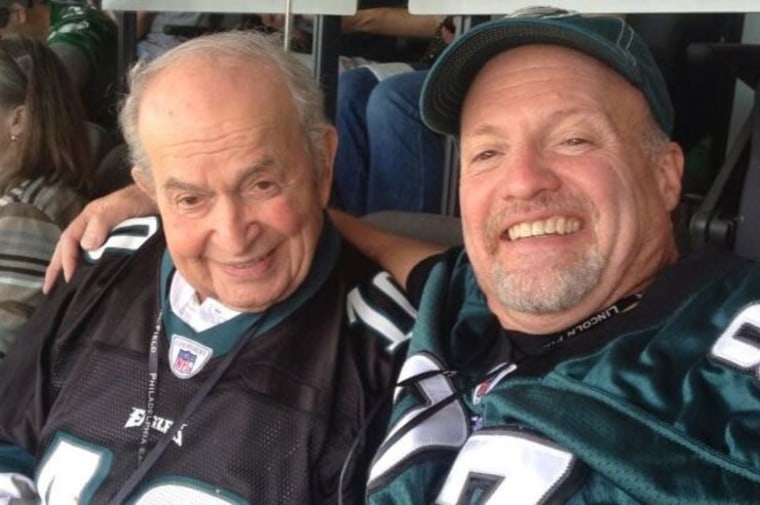

Just like Cramer’s father, my dad, who was a banker and a CPA, had those “money talks” with me. I learned many valuable financial lessons at our dinner table. That’s why I was always comfortable talking to my own son and daughter about money.

Two main points I wanted to drive home with my kids was to avoid debt and to simply live within your means.

Basically, you cannot spend more money than you bring in. It may sound simple, but it’s a lot easier said than done. Credit cards and loans allow people to buy more things than their income would allow. Of course, that kind of lifestyle isn’t sustainable.

It’s also important to start saving early and be able to support yourself. I urged my kids to get their own savings and checking account early in life. They both also started to fund retirement accounts while in college.

Once they were gainfully employed, I stressed that they take advantage of their company’s 401(k) plan and to contribute enough to receive any match offered by the firm.

I also taught my kids the difference between need and want. Living frugally doesn’t mean missing out on life. It means spending money on life experiences that mean something to you personally and not spending money on things or stuff.

One lesson my dad stressed to me when I was a kid is one I passed to my kids: Avoid debt. If you cannot afford to buy something with cash, you cannot afford it. Save up for that purchase and avoid using a credit card. Only use that card when it’s absolutely necessary. And, if you need to use a credit card, always pay the balance in full each month.

It’s also great to focus on the importance of giving back. I told my kids to find a project that means something to them. Volunteer at a soup kitchen or donate money to a charity. This will teach you the true value of money. Earmark a percentage of your paycheck to charity. By doing so, you will see how giving doesn’t just affect the people you give to, but the giver, as well.

Nan Morrison, the president and CEO of the Council for Economic Education and member of CNBC’s Financial Wellness Advisory Council, says that parents need to include their kids in money conversations, like whether to eat out, where to go on vacation, or if it’s better to take an Uber or just walk.

She also urges parents to encourage kids to start to save part of the money gifts or allowances they receive.

“Talk to them about what they might be saving for, in the short and/or longer term,” she said.

The earlier your kids learn about money, savings and investment, the better money managers they will become when they are adults. It also helps children understand the value of money at an early age and will show them how to make better future financial decisions.

Disclosure: Invest in You: Ready. Set. Grow. is a financial wellness and education initiative from CNBC and Acorns, the micro-investing app. NBCUniversal and Comcast Ventures are investors in Acorns.

MORE FROM BETTER

- Want to get out of debt and save money? Try the 50/20/30 rule

- How to budget (and get out of debt) if you live paycheck-to-paycheck

- How to create an emergency fund in just 90 days

- Smart financial planning strategies to borrow from women and millennials

Want more tips like these? NBC News BETTER is obsessed with finding easier, healthier and smarter ways to live. Sign up for our newsletter and follow us on Facebook, Twitter and Instagram.