Tesla stock took a slide Friday morning after its much-anticipated electric pickup truck met with more derision than cheers, with one analyst describing Musk's latest product as "like, really weird."

Shares in the California-based startup were down by more than 6 percent most of Friday.

Tesla has long counted on the “cool” factor to make it the brand to beat in the emerging electric vehicle market, but if it hoped to heat things up with the Thursday night debut of its new Cybertruck, it turns out that the battery-pickup is getting an ice cold reception.

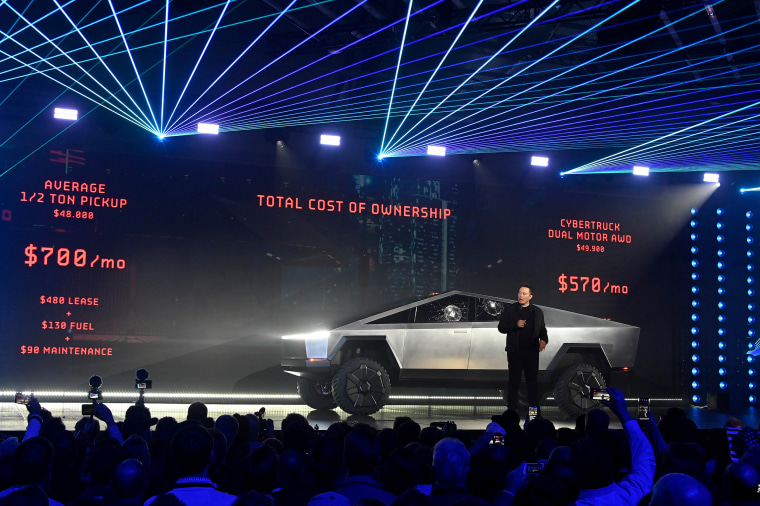

It was standing room only at the Hawthorne Airport hangar where Tesla unveiled the Cybertruck yesterday, capping off a year of tweets and teases by CEO Elon Musk that the upstart automaker was ready to attack Detroit’s Big Three in their most profitable market segment. But things clearly haven’t gone the way Musk and company had hoped.

It didn’t help that a demonstration of the Cybertruck’s ruggedness backfired when its supposedly bulletproof windows were smashed. Chief designer Franz von Holzhausen slammed a sledgehammer into the driver’s door, then threw baseball-sized metal balls at two windows. The door panel held up, but two windows shattered.

“Oh my f---ing god,” Musk blurted out as he realized things had gone horribly wrong.

That might just as well describe the overall reaction to the full-size pickup Musk has been teasing for several years.

“Tesla’s Cybertruck looks weird. Like, really weird,” said Toni Sacconaghi, an analyst with Wall Street investment firm Bernstein.

And that was perhaps one of the more polite descriptions on Twitter, Facebook and Instagram, with commenters suggesting it looked like a a doorstop on wheels, something from a bad 1980s sci-fi movie, and even the “Homer-mobile,” the design sketched out by patriarch Homer in "The Simpsons" TV series. Comparisons were repeatedly made to the Pontiac Aztek, the 1990s-era crossover routinely listed as the worst design in automotive history.

In profile, Cybertruck’s flattened pyramidal shape was all lines and angles, the only curves its wheels.

Company officials tried focusing on the vehicle’s specs. The electric pickup will have an estimated range of 250 miles, with options pushing that to as much as 500 miles. It will sprint from 0 to 60 mph in under 6.5 seconds in base form, and tow 7,500 pounds. CEO Elon Musk also promised a starting price of $39,900 — pushing above $60,000 when fully equipped.

Ahead of the Cybertruck debut, Gene Munster, an analyst with Loup Ventures, told CNBC that the all-electric pickup would help make Tesla “a much bigger business,” one that could eventually be selling 20 million vehicles annually, with a 25 percent share of the growing, global EV market.

The reality is that the automaker doesn’t need to make everyone fall in love with Cybertruck. All battery-electric vehicles combined generate less than 2 percent of the U.S. market, and only slightly more in China, the world’s largest market for plug-based vehicles.

If anyone might have been worried leading up to Thursday’s debut, it should have been Ford. Ironically, it was Detroit’s second-largest automaker that scored raves this week with the Los Angeles Auto Show debut of its new Mustang Mach-E, an all-electric SUV that will target the Model Y that Tesla also plans to bring out next year.

Additionally, Tesla has a long history of missing production and price targets. And it is now saddled with the fact that it is about to lose the federal tax incentives that had buoyed its sales.

The poor initial reception to Cybertruck doesn’t mean it won’t do well once it comes to market, but it will be facing a lot more competition than any other Tesla truck had seen in the past, with start-ups Rivian and Bollinger also bringing out new EV pickups — as are Ford, General Motors, and possibly Fiat Chrysler and Nissan. Meanwhile, Tesla will be facing challenges from a growing list of brands in every other market segment it competes in.

Going forward, it can’t afford to have even one of its new products flop. But Cybertruck could be off to a bad start.