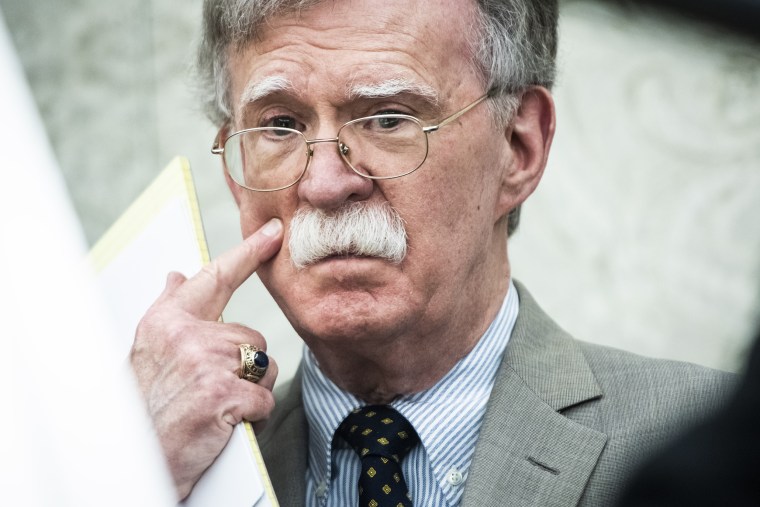

The odds of a lengthy impeachment trial in the Senate are still very much in play, but new revelations from former national security adviser John Bolton’s forthcoming book about President Donald Trump’s involvement in holding up military aid to Ukraine in exchange for investigations he believed would harm political rivals is forcing investors to confront the prospect of a protracted, partisan fight and the slim possibility — albeit one that remains remote — that Trump could be removed from office.

“I don’t think it’s going to have much of a longer-term impact, but I do think there is going to be more volatility this year than we saw last year,” said Michael Joyce, president of advisory firm Agili.

Although the combination of the Chinese coronavirus threat and earnings season are top-of-mind for Wall Street this week, Joyce said the impeachment narrative could have an impact on the markets if it drags on into a less eventful news cycle. “What it will do is it can create more volatility in the absence of other news that might impact the market,” he said. “When you have a vacuum there, that’s going to play an outsized role in the day-to-day market moves.”

Peter Cardillo, chief market economist at Spartan Capital Securities, argued that investor uncertainty is on display already. Although Monday’s market rout was sparked by fears about the expanding Chinese coronavirus outbreak, Cardillo said, it also was inflamed by new uncertainty about the trajectory of the impeachment process.

Full coverage of President Donald Trump's impeachment trial

“I think yesterday’s debacle has to do with the fact that Bolton’s book could change the scope of the trial,” he said. “Besides the virus, the impeachment trial could be one of the silent factors that’s weighing on this market.”

“Certain sectors are more at risk of a drawn-out impeachment,” said Tom Elliott, international investment strategist at the deVere Group, an advisory firm. “Expect banks, pharma and energy to lead market volatility if Bolton is called,” he said.

“Clearly, this has come out of left field in a lot of ways. To the extent that the process gets extended and anything else comes out of left field, clearly that would change things,” said Mark Heppenstall, chief investment officer of Penn Mutual Asset Management.

By and large, conventional wisdom assumed that the Senate trial would conclude quickly, include no witness testimony, and result in an acquittal on party lines. Upending that throws not only the trial outcome into question, but raises the specter of the president being removed from office.

“It’s no longer 100 percent certain that there will be no witnesses,” Cardillo said. “And if we do get witnesses… if the witnesses are in tune with the Democratic accusations, then there could be a possibility that acquittal is not in the cards. I would say right now it’s a long shot, but it’s a possibility.”

Market professionals say removing Trump from office would be the kind of “black swan” event that takes investors on a wild, if short-lived, ride.

Market professionals say removing Trump from office would be the kind of “black swan” event that takes investors on a wild, if short-lived, ride.

“If the Senate takes testimony from witnesses, and the testimony is damming for the president and it looks like the Senate is beginning to turn, then investors will react,” said Mark Zandi, chief economist at Moody’s Analytics. “But under any scenario, including if the president is removed, the impact on markets will be short-lived,” he said.

“I think we could certainly see a 10 to 20 percent correction,” Joyce predicted. “A lot of times corrections like that are four- to eight-week events and I think that’s certainly plausible,” he said, adding that strong economic fundamentals would help mitigate the duration of potential volatility and facilitate the market’s recovery.

“I’m presuming that he would be replaced by Mike Pence, whom the markets might actually view as being more business-friendly than Trump, especially on trade issues,” he said. “The economy is… not without headwinds but it is extremely strong.”

Download the NBC News app for full coverage of the Senate impeachment trial

The other possibility is that witnesses give damaging testimony but the Senate lacks the two-thirds majority needed to vote the president out of office, which is still considered far and away a more likely outcome than removal. These revelations still could sour swing voters on Trump and the GOP in November, Heppenstall suggested.

“The longer the process goes, there is a higher risk that it may somewhat impact President Trump’s odds of reelection,” he said. “There’s such a small number of voters who are going to change the equation. I think the margin of error is going to be pretty slim for the ultimate outcome.”