Intel announced on Tuesday that it will spend $20 billion to build two new chip factories, called fabs, in Chandler, Arizona.

The announcement, coinciding with new CEO Pat Gelsinger’s first public remarks since taking over the job, signals that Intel will continue to focus on manufacturing during industry shifts that have led competitors to increasingly separate chip design and chip fabrication.

The news comes during a global chip shortage that is snarling industries from automobiles to electronics and worries the U.S. is falling behind in semiconductor manufacturing.

A slide displayed by Intel suggested that companies including Amazon, Google, Microsoft and Qualcomm could be customers for the business.

“Intel is and will remain a leading developer of process technology, a major manufacturer of semiconductors, and the leading provider of silicon globally,” Gelsinger said.

Intel also said that it will act as a “foundry,” or a manufacturing partner, for other chip companies that focus on semiconductor design but need a company to actually make the chips. Intel said its foundry division will be called Intel Foundry Services and will be led by Randhir Thakur, a current Intel senior vice president.

Gelsinger said the foundry business will compete in a market potentially worth $100 billion by 2025 and will manufacture a range of chips, including chips based on ARM technology, which are used in mobile devices, and has historically competed with Intel’s favored x86 technology.

A slide displayed by Intel suggested that companies including Amazon, Google, Microsoft and Qualcomm could be customers for the business. Microsoft CEO Satya Nadella appeared at Gelsinger’s talk in a show of support for Intel’s move.

Intel’s commitment to manufacturing has national security implications. Intel said it is entering into a partnership with IBM to improve chip logic and packaging technologies, which will “enhance the competitiveness of the U.S. semiconductor industry and support key U.S. government initiatives.”

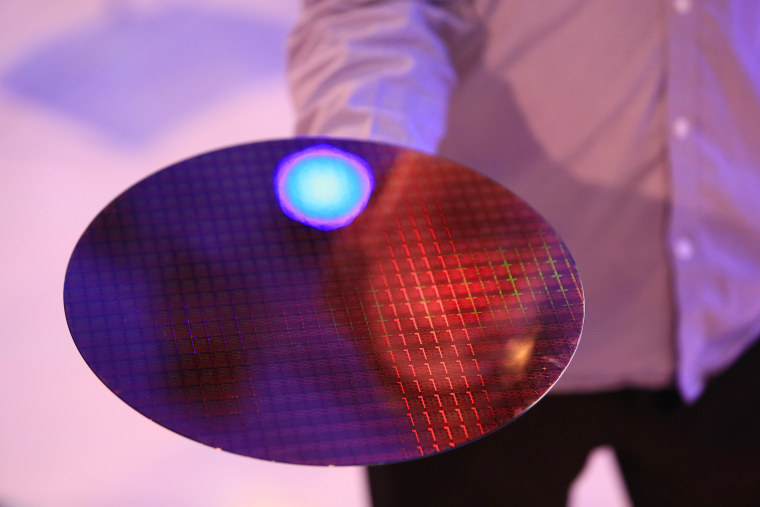

Intel currently operates four factories, called “wafer fabs,” in the United States. In addition to its site in Arizona, which is being expanded, it also has fabs in Massachusetts, New Mexico and Oregon. It also makes chips in Ireland and Israel and has a single fab in China.

Intel’s foundry will offer an alternative to Asian chip factories.

Biden has said he hopes to address concerns that outsourcing chipmaking has made the U.S. more vulnerable to supply chain disruptions.

In February, President Joe Biden said domestic semiconductor manufacturing is a priority for his administration. His administration hopes to fix ongoing chip shortages and address lawmaker concerns that outsourcing chipmaking had made the U.S. more vulnerable to supply chain disruptions.

In an executive action, Biden started began a 100-day review that could boost American chip companies with additional government support and new policies.

“Today’s Executive Order, combined with full funding for the CHIPS Act, can help level the playing field in the global competition for semiconductor manufacturing leadership, enabling American companies to compete on equal footing with foreign companies heavily subsidized by their governments,” Intel said at the time in response to the executive order.

Gelsinger took over Intel on Feb. 15 from former CEO Bob Swan. Although he was most recently the CEO of VMWare, he started his career at Intel and his appointment has been regarded as a homecoming.

He took over a company facing a variety of challenges. Intel had lost its semiconductor manufacturing edge to Asia-based rivals, most notably TSMC. Intel’s most advanced chips use a 14-nanometer or a 10-nanometer process. Intel both designs the chips, then makes them in its own factories, called fabs.

But competitors, including Intel customers like Apple and rivals like AMD, just design the processor, then have it manufactured by an outside chip factory. These chip factories, like TSMC and Samsung, use a more advanced 5-nanometer process, which is superior because more transistors can fit in the same sized chip, boosting power and efficiency.

“We will pursue customers like Apple” for Intel’s foundry business, Gelsinger said.

Gelsinger said on Tuesday that its 7-nanometer chips are on track to hit a milestone in the second quarter and that it plans to manufacture the majority of its products itself. Still, Intel will increase its use of third-party foundries, including TSMC, Samsung, and GlobalFoundries, he said.