In 2020, Safeway, the nation’s second-largest grocery chain, won an unwelcome distinction — it ranked first among companies in Washington state for the number of employees participating in the federal food assistance program known as SNAP. Some 1.4% of all food assistance recipients across the state worked at Safeway, a report from the Government Accountability Office said, or almost 1,200 employees in all.

Wealthy investors in Safeway’s parent, Albertsons Companies, have done better. And next week, they were slated to reap a $4 billion cash dividend in connection with a proposed $25 billion takeover of Albertsons by rival Kroger. Until Friday morning, that is, when a Washington state commissioner temporarily stopped the dividend payout until the court could hear arguments for and against it scheduled for Nov. 10.

Both deals announced by the companies — the takeover as well as the dividend — are encountering opposition from employees, state attorneys general and antitrust experts who contend they will result in store closures, fewer choices and higher prices for shoppers while imperiling pensions, pay and jobs.

The biggest beneficiary of the deal and the proposed dividend will be Cerberus Capital Management, a private-equity firm with $60 billion in assets that bought into Albertsons in 2006 and plans to exit the investment if the buyout goes through. Co-founded by Stephen A. Feinberg, an adviser to former President Donald Trump, Cerberus holds 29% of Albertsons stock, securities filings show. Based on that stake and the amount of the dividend, Cerberus stands to receive roughly $1 billion of the dividend payout.

Unlike many public companies whose shares are held by a broad array of institutional and individual investors, 75% of Albertsons' shares are held by six prosperous investment firms, including Cerberus, its filings show — and in this dividend deal’s structure, shareholders may get their money at the expense of other stakeholders, including creditors and pensioners, worker advocates and other critics say. Six of Albertsons’ 14 directors who voted for the dividend are affiliated with the major investors.

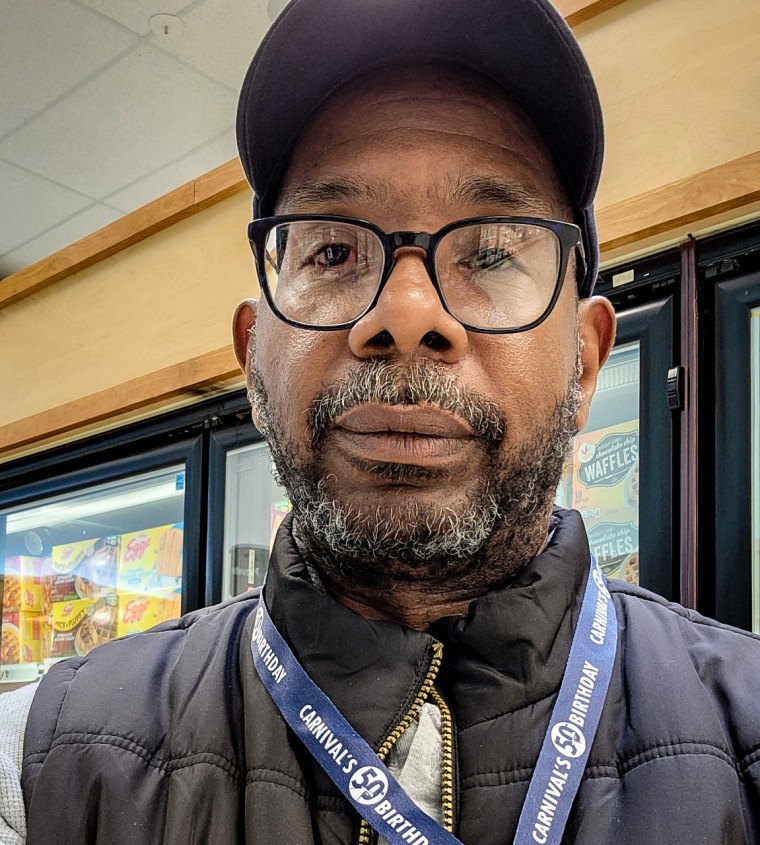

“Cerberus is going to get a substantial profit off of this and leave us high and dry,” said Phillip Contee, a 39-year Safeway veteran who oversees the dairy department at a store in Oxon Hill, Maryland. “Once they get their money out of it, they’ll dump the company off to fend for itself.”

A spokesman for Cerberus declined to comment.

Contee is not the only one who’s concerned about the deal. Four state attorneys general, in California, Illinois, Washington state and the District of Columbia, have filed emergency legal actions in state and federal courts asking to block the $4 billion payout.

“This is not your normal dividend — this is a big cash grab that would line the pockets of particular investors, including Cerberus,” said Karl Racine, attorney general for D.C., explaining why his office filed suit to stop it. “We hope to persuade the court that the cash grab should be put on pause until the final review of the merger takes place. What’s the hurry?”

An Albertsons spokesman called the suits meritless and said they provided “no legal basis for canceling or postponing a dividend that has been duly and unanimously approved by Albertsons Cos.’ fully informed board of directors.” The company said it intended to overturn the restraining order in Washington because it was based “on the incorrect assertion that payment of the special dividend would impair its ability to compete while its proposed merger with The Kroger Co. is under antitrust review.”

The special dividend returns cash to all Albertsons shareholders, the spokesman added, and the company “will continue to be well capitalized with a low debt profile and strong free cash flow. Given our financial strength and positive business outlook, we are confident that we will maintain our strong financial position as we work toward the closing of the merger.”

If the deal goes through, it would change control of Albertsons, generating significant payments to its top five executives. A company filing from earlier this year estimated such payments at almost $100 million. Vivek Sankaran, Albertsons' CEO and president since 2019, could receive almost $50 million in stock, salary and bonus, the filing said.

‘Out-of-control growth’

Albertsons operates 2,200 supermarkets under 20 banners across the country, including Safeway, Carr’s, Haggen, Jewel-Osco, Shaw’s and Vons. It has 290,000 employees, 200,000 of whom are covered by collective bargaining agreements.

The $25 billion proposal to combine Albertsons and Kroger is likely to come under antitrust scrutiny by the Federal Trade Commission, lawyers say, because merging the companies would result in about a 20% market share in the grocery business.

Allowing the combined companies to have that much market power would result in “higher prices, lower quality, less innovation and less choice,” said Diana Moss, president of the American Antitrust Institute, a nonprofit organization. “Consumers are already dealing with food inflation running at about 12%. To pile on higher prices from the almost-certain, exercised market power of a merger of Kroger and Albertsons will really harm consumers at a bad time.”

Smaller independent grocers and their suppliers will also be hurt if the merger goes through, said Chris Jones, senior vice president and counsel at the National Grocers Association. “It’s creating another dominant player, second to Walmart, that will have the ability to have greater power over suppliers in the food supply chain, to the detriment of competition,” he told NBC News.

Another concern from workers: Stores whose employees are represented by a union may be shuttered after the companies merge. As Jonathan Williams, communications director at the United Food Company Workers Union, Local 400, explained, “If there’s a nonunion store, say, a Harris Teeter in D.C. operated by Kroger, across from a union store, a Safeway operated by Albertsons, then the company may opt to close or divest from the union store.” This would drive down pay and benefits, he said.

Albertsons rejects the criticism, saying its combination with Kroger “will provide significant benefits to consumers, associates, and communities and offers a compelling alternative to larger and non-union competitors,” according to a spokesman. “The merger announcement and special dividend mark the successful outcome of the strategic review we launched in February, which considered a wide range of options to build on our success and deliver enhanced value for all our stakeholders,” he said.

It is something of a paradox, but because the FTC has let Walmart, Amazon, Costco and other supercenter operators come to dominate the grocery market in recent years, the Albertsons-Kroger merger could give some much-needed competition to those behemoths, none of which are union shops.

That’s the view of Burt P. Flickinger III, managing director at Strategic Resource Group, a retail consulting firm; he has worked with supermarket company executives — including those at Safeway and Albertsons — as well as union leadership over many years.

“During the FTC’s 25 years of ‘laissez-faire,’” Flickinger said, “supercenter operators have been gaining the majority of food retail market share. The Albertsons deal is the only way to checkmate their out-of-control growth. This is the last, best and final hope for a truly unionized chain.”

Nervous about the pension

The proposed $4 billion cash dividend is large by many measures. It is greater than the $3.07 billion in net income Albertsons reported during the past five years and exceeds Albertsons' most recent cash position of $3.4 billion.

Some employees are worried that the dividend payment will hobble the company financially and threaten their pensions.

Jane St. Louis has worked for Safeway for 30 years; she is a scan coordinator in a store in Damascus, Maryland, creating new tags when prices change. “We’re pretty nervous about the pension,” she told NBC News. “A lot of people are retiring and if they don’t get it, they will have to go back to work.” Several years ago, Safeway’s unionized employees had to threaten a strike to get funding for the pension, St. Louis said.

Albertsons has three primary company-sponsored pension plans with $1.66 billion in assets, the spokesman said. “We believe the plans are currently sufficiently funded to pay future annual benefit payments for several years to come,” he added, including $190 million in 2022 and 2023. The assets currently fund approximately 86% of the plans’ obligations, up from a 73% funded status in 2015, the spokesman said.

Asked about the workers’ pension fears, the Albertsons spokesman said in a statement, “The plans we participate in are projected to remain funded through at least 2051. We are fully committed and able to fund and pay all benefits earned by our employees.”

The company also contributes to so-called multi-employer plans — those in which two or more unrelated companies participate. At the end of last year, Albertsons estimated its share of those plans’ underfunding was $4.9 billion. The company also says that it is “not obligated nor the guarantor for any of the underfunding of multi-employer plans to which we contribute,” the filings show.

A major criticism of the $4 billion dividend lodged by Andrew Park, senior policy analyst at Americans for Financial Reform, a left-leaning think tank, is that many of the Albertsons board members who approved the payment work at firms that stand to reap large rewards under it.

Shareholders are usually the last to be paid at a company after debt holders and other creditors in a liquidation, for example. But in this deal, the shareholders are at the front of the line, said Park. “Because the Cerberus consortium effectively controls the board of directors,” he added, “they are making this decision to skip the line and drain Albertsons of all its cash. The other stakeholders — the debt holders, the pensioners, the employees — don’t seem to have a say.”