There’s no question the stock market had a bad week. The question most investors are asking this weekend is just how much more trouble lies ahead.

Since bottoming out in March 2009, stock prices have soared — up more than 160 percent — with periodic pullbacks along the way. The S&P 500 benchmark index closed out 2013 with a 29 percent gain, the best year since 1997. And the Wilshire 5000 index — the broadest measure of U.S. stock market gains — has risen $14.8 trillion from its post-recession low of March 9, 2009.

But that bull market stumbled badly this week, as investors stampeded out of stocks, sending prices falling faster than the thermometer. Some market watchers now say they hear bears growling on Wall Street, and warn that a bigger sell-off is coming.

Whoa! What happened?

Coming up with the exact cause of a one-day stock market sell-off is like trying to explain why Justin Bieber has 49 million Twitter followers. Much of it is just emotion and herd mentality.

Still, there was plenty of news this week to spook both Bieber fans and stock investors. For the market, there was some bad news about China’s economy slowing and currencies collapsing in Argentina and Turkey. But mostly there’s been a general sense building that last year’s surge in stock prices may be about to reverse course. Possibly with a vengeance.

Wait — isn’t the economy getting better?

It is — for the most part. And that’s part of why the stock market is worried.

Much of the rocket fuel that sent stock prices to the moon last year has been coming from the Federal Reserve, which began pumping money into the financial system five years ago after the worst banking collapse since the Great Depression. It took more than $3 trillion to fill in that giant money crater. Now that banks are back on their feet, house prices are rising again and the unemployment rate keeps falling, the Federal Reserve has made clear it's going to begin shutting down its massive money pumps.

That means the Era of Cheap Money is slowly coming to a close. The Fed is hoping that the economy is strong enough to keep gaining strength — even if interest rates begin to rise. The stock market seems to be having doubts about that.

So what makes the Fed think the economy is out of the woods?

The army of Ph.D. economists at the central bank crunch more numbers than a Las Vegas bookie, but there are a few data points they rely on most. One is inflation, and there’s little sign prices are rising too fast. The other is the unemployment rate. Now that it’s fallen below 7 percent, Fed policy makers have said it’s time to let interest rates begin rising again.

That makes sense. If things are improving, how come Wall Street is so worried?

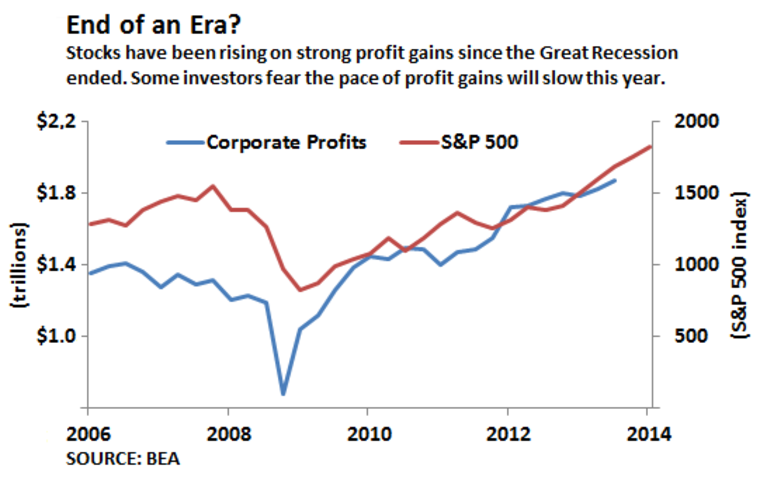

A stock’s price rises mainly because a company keeps boosting earnings. And so far, the stock market has risen about in line with a strong rebound in corporate profits since the Great Recession ended. The S&P 500 trades at about 15 times the estimated profits of the companies in the index. That’s a little higher than recent long-term averages, but nothing like the manic trading of the dot-com bubble, for example.

But for stocks to keep rising, earnings have to keep going up. And it’s not clear that companies can keep boosting their profits indefinitely at the pace they have been reporting.

Why not?

For one thing, if the Era of Cheap Money is ending, companies now face higher capital costs. When a retailer decides to open a new store, or an auto parts maker wants to open a new factory, that added capital cost comes out of profits.

The other main input to profits is labor costs. When the job market was lousy, and employers had no trouble finding workers, wages flatlined — and in some cases fell. But the days of cheap labor are ending in some industries, and as the jobless rate falls further, wages will likely begin rising again. That’s great news for workers — and the overall economy. But wage gains will reduce profits, which takes some of the wind out of the stock market’s sails.

So how far are stocks going to fall?

Sorry, our crystal ball is in the repair shop. But traders and market analysts are saying a 10 percent “correction” isn’t out of line. It wouldn't be a surprise; after last year’s gain, the bull was due for a breather. If the latest batch of corporate profits holds up, the setback could be temporary. But if the rebound in profits begins to cool off substantially later this year — or begins to reverse course — stock investors could be headed for a very bumpy ride.