World stock markets nosedived for a fourth day running on Tuesday, having seen $4 trillion wiped off from what just eight days ago had been record high values.

Europe's main markets started down as much as 3 percent and shares tumbled in Asia after a wild day for U.S. markets.

Two days of steep losses have erased the U.S. market's gains from the start of this year, ending a spate of record-setting calm for stocks.

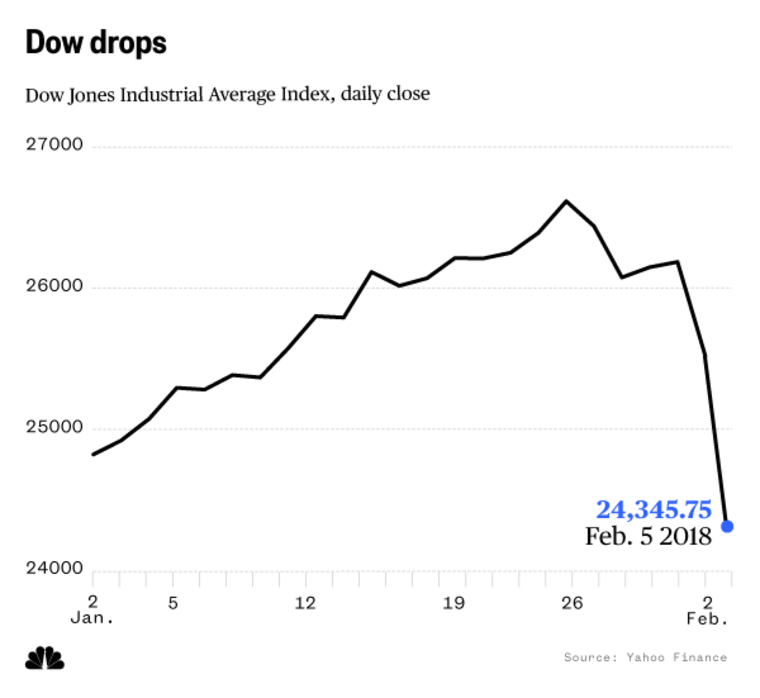

The Dow Jones industrial average closed down 1,175 points on Monday, as the market bet on more interest rate hikes, the same day that a new Federal Reserve chairman was sworn in.

On Tuesday, Taiwan's main index lost 5.0 percent, its biggest since in 2011 and Hong Kong's Hang Seng Index dropped 4.2 percent. Japan's Nikkei dived 4.7 percent, its worst fall since November 2016, to four-month lows. Australia's benchmark S&P ASX 200 slid 3.4 percent, South Korea's Kospi declined 2.4 percent and the Shanghai Composite index was off 2.2 percent.

Monday's selling spree also occurred the same day that Jerome Powell was sworn in as chairman of the Fed, which is in charge of setting the potentially higher interest rates that are driving the sell-off.

The Dow recovered after briefly dropping 1,500 points, the largest intraday drop in the index's history, to break below the psychologically important level of 25,000.

But the overall pullback was only 4.6 percent, not record-setting on a percentage-wise basis. The S&P 500 would have to drop 7 percent or more to trigger a halt in trading, and it would have to drop 10 percent or more to be considered a "correction."

Still, the plunge had markets heading to their lowest close of the year, and it followed a dip on Friday, which itself was the sixth-largest point drop in the Dow's history.

On Sunday, the central bank’s departing leader sounded a note of caution on stock prices.

“It is a source of some concern that asset valuations are so high,” outgoing Fed chair Janet Yellen told CBS News, highlighting price-earnings ratios in equities.

Now, as Powell takes the reins, he and the rest of the Fed Board of Governors will have to determine if that long-running trend is starting to reverse — and how to respond.

“Everybody knew this was coming — stocks are close to record valuations and it was a matter of when it was going to happen, not if,” said Dan North, chief economist at Euler Hermes North America. “I would expect that at this point, it’s probably sentiment-driven and we’ll get a rebound."

After the market's big gains in 2017 and early 2018, stocks were overdue for a drop, said David Kelly, the chief global strategist for JPMorgan Asset Management.

"It's like a kid at a child's party who, after an afternoon of cake and ice cream, eats one more cookie and that puts them over the edge," Kelly said.

"Since last autumn, investors had been betting on the 'Goldilocks' economy"

Market observers debated whether this was reflective of a short-term breather for a meteorically rising market, or the harbinger of a more broad-based correction. The appearance of higher wage growth in Friday’s jobs report was good news from a Main Street economic growth standpoint, but it spooked Wall Street as investors pondered whether this would give the Fed more incentive to raise interest rates at a quicker pace.

Under Yellen, the Fed had set a course for three interest rate hikes in 2018. Economists debated whether this would be too much, or too little — a question with higher stakes in light of the market’s dramatic movements over the last two days.

“There’s a lingering fear of inflation at the Fed that may cause the Fed to tighten in anticipation of further improvement we might never see,” said Lindsey Piegza, chief economist and managing director at Stifel Fixed Income.

Piegza said an overly aggressive Fed risked blowing out rather than stoking the nation’s economy. “You’ve got a lot of volatility in the equities market. The big question is, ‘Why rush?’"

While Powell has a similar outlook as Yellen, Piegza said the other members — and the three vacancies that President Donald Trump's administration has yet to fill — make monetary policy movements hard to predict. “There is no consensus among Fed officials,” she said. "We don’t know where the Fed is going from here. … That certainly adds some increased volatility for market participants.”

“For stocks, two or three hikes — the market has been fine with that for a long time. It’s once you get north of there that I think is a headwind,” said Scott Wren, senior global equity strategist at the Wells Fargo Investment Institute.

Wren said he believed the chance for a fourth rate hike this year is slim, but pointed to Friday and Monday’s falloff as evidence that some consider it more likely. “I think the market is concerned and that’s part of the sell-off — that they would do more than three,” he said.

Monday's drop was bad, but there were worse days during the financial crisis. The Dow's 777-point plunge in September 2008 was equivalent to 7 percent, far bigger than Monday's decline.

"Since last autumn, investors had been betting on the 'Goldilocks' economy — solid economic expansion, improving corporate earnings and stable inflation. But the tide seems to have changed," said Norihiro Fujito, senior investment strategist at Mitsubishi UFJ Morgan Stanley Securities.

One worry is the psychological impact a protracted market slide could have on consumer confidence. In reality, market fluctuations have little to do with Americans’ day-to-day finances — the majority don’t own stocks — but the halo effect of that growing wealth is very real, and a market rout could throw cold water on the consumer spending the economy needs.

“Yes, investors should be mentally prepared for more downside,” said Mitchell Goldberg, president of ClientFirst Strategy, although he added that he didn’t expect the major indices to fall more than another 1 to 3 percent in the near term.

Other experts said that the long bull market could leave stocks open for a more sizable setback. “Corrections of around 10 percent or so are really quite common,” said Martin Baily, a senior fellow at the Brookings Institution. “It wouldn’t be a surprise … particularly when the market has grown as strong as it has for as long as it has.”