One in four millennials doesn't expect to receive any Social Security benefits in retirement.

But if one of the most popular federal programs does survive in its current form — and that is a big if — the average millennial married couple could actually receive nearly double the average Social Security benefits that current retirees collect, according to a new analysis by the Urban Institute.

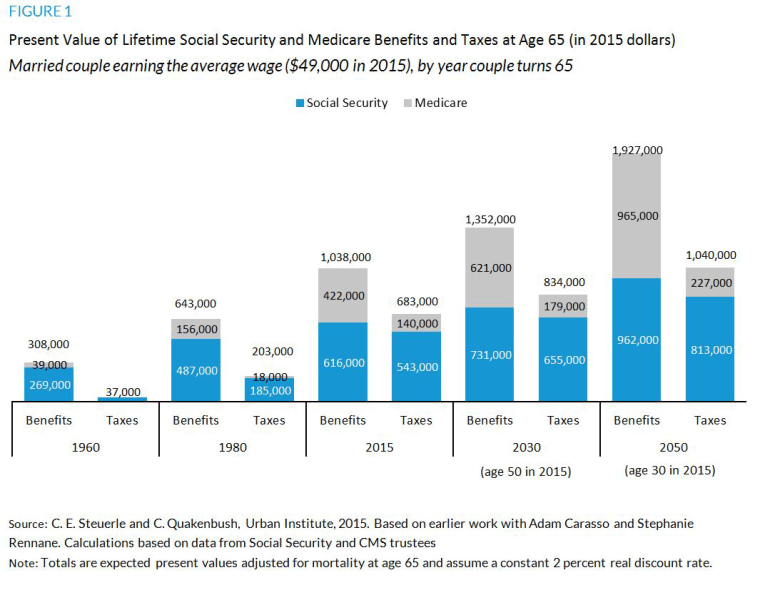

Here's the breakdown: In 1960, a married couple in which each spouse earned average wages over a career beginning at age 22 and retired on his or her 65th birthday would receive about $300,000 in health and retirement benefits.

Today, that figure is more than $1 million in health and retirement benefits from Social Security and Medicare. The expected benefits in 2050 for a couple in which both partners are 30 years old today, earn an average annual wage of $49,000 and expect to start collecting at age 65 are scheduled to rise under current law to nearly $2 million adjusted for inflation, the Urban Institute found. (See chart below.)

The larger benefits for millennials are mainly because of cost of living increases, more years of benefits due to expected longer lifespans, and better and more expensive health care, said C. Eugene Steuerle, an economist with the Urban Institute who co-authored the analysis.

Still, the analysis comes with a big caveat. The estimates assume individuals receive all benefits scheduled under current law, regardless of the financial status of the Social Security or Medicare trust funds.

The trust fund for Social Security retirement benefits is expected to be depleted by 2034 if Congress doesn't act. At that point, the Social Security Administration would only be able to pay about 75 percent of promised benefits. For Medicare, the hospital insurance trust fund is forecast to be exhausted by 2030. After that, Medicare would have dedicated revenue to pay a projected 86 percent of the hospital insurance program's costs.

Five Ways to Cut Your Social Security Tax Bill

Given the financial state of Social Security and Medicare, the Urban Institute's analysis likely overstates the future benefits and understates the taxes to be paid by millennials, Steuerle said.

"The growing cost of Social Security and Medicare benefits is taking away federal spending for society's other needs," Steuerle said.

Keeping benefits at their current levels required under law will mean less federal spending on education, infrastructure and defense unless Congress cuts benefits, raises taxes or both. Because people are living longer, "we have a middle-age retirement system where less money is going to the truly elderly," Steuerle said.

Congress is likely to step in at some point to shore up reserves before the trust funds for Medicare and Social Security are depleted, but that could result in an increase in the age at which people are eligible to collect benefits or a decrease in the amount they can receive.

Will Social Security Survive to Your Kids’ Retirement?

So, what does this mean for retirement planning?

Rob Kron, BlackRock's head of investment and retirement education, recommends millennial investors concentrate on saving as much as they can for retirement and worry about Social Security and Medicare benefits when they turn 60.

"Focus on what you can control," Kron said. "You can't control what will happen to Social Security by the time you retire."