Waiting for the last minute to file your taxes? You're not alone. While the vast majority of Americans file in time for the government's April 15 deadline, many wait until the last minute to bite the financial bullet.

The week of April 15 is the busiest single week for tax filings, according to data from the Internal Revenue Service, averaged from the last five years of tax seasons. Nearly 13 percent of taxpayers put off filing until the last week possible, more than double the 5 percent average through the month of March.

Three percent of filers get around to it in the weeks after the April filing deadline and another 9 percent file for extensions and finish up in October and November each year.

Electronic filing has certainly made it easier for many to get their returns together. E-filing has boomed 80 percent since 2013, according to a report from the Adobe Digital Index. IRS data show that 84 percent of filers last year did so electronically, and 92 percent of this year's filers have, as of March 27. Tax season beings when electronic filing becomes available in January—nearly a fifth of Americans waste no time in ponying up to the government and get their taxes filed that month.

If you've already taken care of your taxes for 2014, or if you are going to get it done this weekend, you're like most everyone else. If you're still putting it off, maybe it's because you're rich.

Of the 150-some million tax returns filed each year, 88 percent make it to the IRS in time for the April 15 deadline, meaning that 12 percent are either tardy or request extensions.

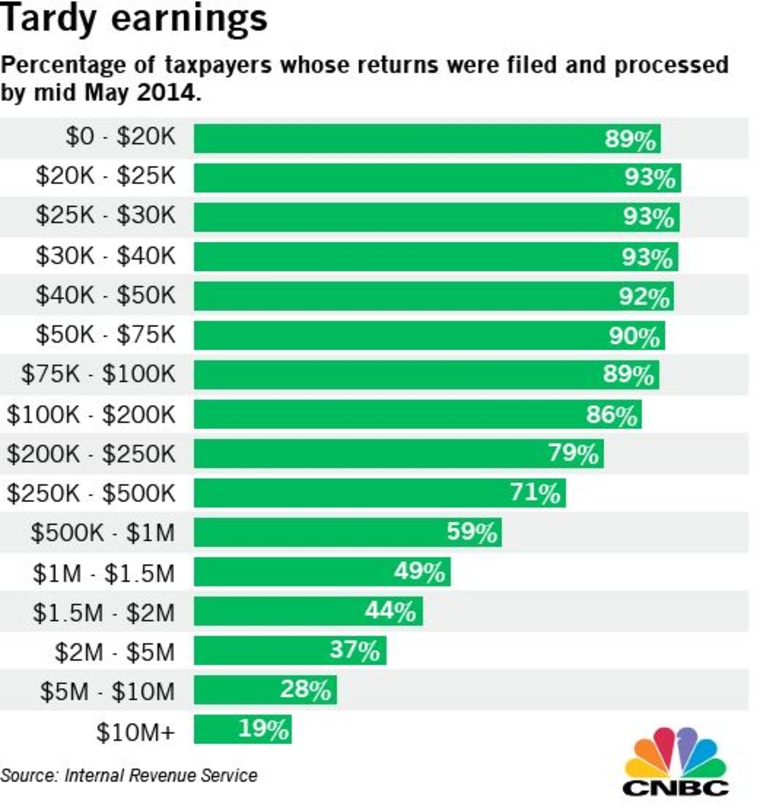

Ninety-one percent of taxpayers who earned less that $100,000 in 2013 had filed their taxes by the end of May 2014, according to IRS data. For the same period, 43 percent of those making more than $1 million had filed by June 1, possibly because their tax returns require more complex accounting.

The more you make, the more likely you are to miss Tax Day. Last year, 2,308 filers with an adjusted gross income of more than $10 million had their taxes finished by the end of May—a meager 19 percent of that income group. The other 81 percent eventually filed by November.