Christopher Hoffman had the telltale symptoms: a dry cough, trouble breathing and a missing sense of smell. In early March, before the coronavirus shut the country down, the 25-year-old New Yorker went to urgent care, where he was diagnosed with pneumonia.

"Because I didn't have a fever, they didn't think to test me for COVID-19," Hoffman said. A week later, he was in the hospital on an IV.

He recovered, but his battle with what he is certain was COVID-19 left him with more than $3,800 in out-of-pocket expenses and no clue exactly how much his insurer will cover — a common refrain in the age of the coronavirus.

"I'm going to have to duke it out with my insurance company," said Hoffman, who was never formally diagnosed with the disease and got sick before many measures to cut the cost of catching it were in effect.

Full coverage of the coronavirus outbreak

The government and insurance companies have vowed to pick up much of the tab for coronavirus testing and treatment. But insurance experts, doctors and health care economists told NBC News that because of the fragmented nature of the U.S. health care system, they're already seeing holes in this impromptu safety net.

Even in normal times, they say, doctors and hospitals have to navigate dozens of health care plans, public and private. Now all those plans are changing their policies to address the coronavirus, and the providers — the ones who compute the cost of your care — struggle to keep up, leading to surprise bills even after promises that costs would be waived.

The experts caution that it is still early in the outbreak and that the government and the insurers are adjusting their responses daily, but they've already seen gaps in coverage that fit into a few broad categories. Here are five things they say to watch out for in your medical bills:

- If, like Hoffman, you were infected early in the pandemic, you may find yourself scrambling to prove your illnesses was virus-related.

- Insurers may still not cover all the costs that accompany testing, even if they waive the costs of the tests themselves.

- Others infected later in the pandemic still can't get tested and may not be able to prove they had the coronavirus.

- Insurance doesn't always cover the cost of experimental or unapproved drugs and procedures.

- Despite federal assurances, if you're uninsured you may still be billed for testing and treatment.

Tests that aren't free

On March 18, President Donald Trump signed legislation requiring private insurers to waive testing costs. State authorities have also stepped in, although the measures vary from state to state.

But that doesn't mean insurers are covering all the costs related to testing.

Evan S.'s wife is a nurse at a hospital in the Washington, D.C., area. Amy, whose last name is being withheld because of concern for her job, started showing symptoms March 11. Two days later, she had a sore throat, a cough and chest pain.

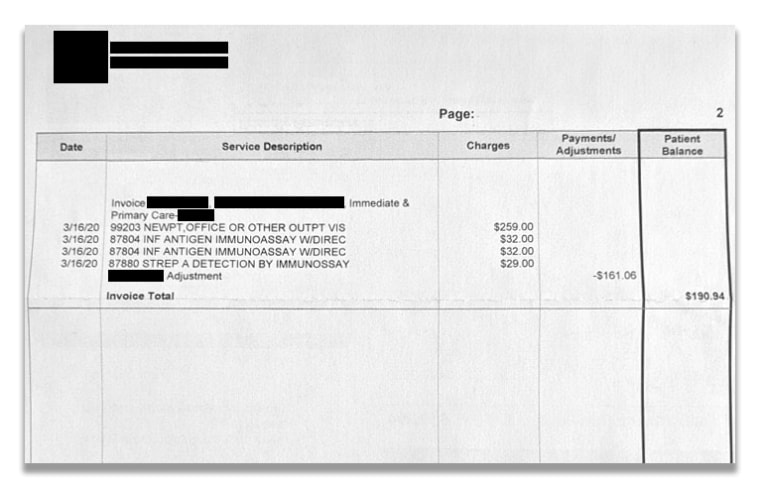

Test results took more than two weeks. Amy came up negative. Not long after came the bill, which NBC News reviewed. The family is being charged $190 for the clinic visit, plus flu and strep tests run before Amy was tested for COVID-19.

Because Amy was tested on March 16, two days before Congress passed legislation requiring that the cost of testing be waived, the family may get a bill for the coronavirus test, too, the insurer said.

"We've been promised that the costs for testing and treatment are going to be covered," Evan said. "Now I've got a $200 bill."

Front-line workers elsewhere have also received big bills for tests. A nursing home employee in Washington state is among a handful of people who have filed complaints with state authorities saying that despite promises to cover testing, they're still getting charged.

The complaint, filed by the woman's daughter-in-law, said the woman worked at a nursing home with 30 confirmed COVID-19 cases. But when she went to get tested, her insurance covered just $7.15 of the $578.87 bill, according to the complaint, submitted to the state Office of the Insurance Commissioner on March 3.

"This is shameful," the complaint said. "She's called a hero wherever she goes, but her insurance can't take care of more of this bill."

A month and a half later, doctors and policymakers are now worried about the thousands who, because of a continued shortage of tests, almost surely contracted the virus but may not be able to prove it to insurers.

"I'm routinely sending half of the patients who have COVID symptoms home without a test," Dr. Rob Davidson, a Michigan emergency room physician who heads the Committee to Protect Medicare, which advocates for Medicare expansion. "They still have X-rays and labs, and yet they still don't have a positive test. Are they going to pay for those people?"

Take Tylenol and pray

Some of the current treatments for the coronavirus are experimental, like the hydroxychloroquine the president has touted to much controversy.

But consumers are finding that experimental measures aren't necessarily covered by insurance — even when they're cleared by the Food and Drug Administration.

Anne Bakjian, 40, of Georgia spent two weeks in the hospital with COVID-19, fighting for each breath. She needed more oxygen, and doctors warned that a ventilator could come next.

Doctors initially gave her Tylenol and told her to "pray," she said. A week later, they put her on hydroxychloroquine.

Bakjian's eyes turned yellow and her vision became distorted, she said, but after two days, her lungs opened up. The hospital sent her home March 30 with a prescription for eight hydroxychloroquine pills.

Weeks later, she received a statement indicating that her insurer, Peach State Health Plan, the Medicaid program for low-income Georgia residents, hadn't paid her $48,000 hospital bill.

A representative for Peach State told her that the care wouldn't be covered because it hadn't been pre-approved, Bakjian said.

After calls from Bakjian and NBC News, the hospital told NBC News that Peach State had cleared the bill. But Bakjian and her family still paid $700 for the eight hydroxychloroquine pills.

The FDA had issued emergency approval to use the drug for COVID-19, and Bakjian had trouble finding pills, which generally cost a small fraction of the price. Friends started a GoFundMe campaign to pay the cost, something that hundreds of patients across the country have done to help cover bills linked to COVID-19.

"If you're on Medicaid, you don't have that kind of money," Bakjian said.

Peach State didn't respond to a request for comment.

'This should alleviate any concern'

More than 28 million people lacked health insurance of any kind, government or private, in the most recent tally, and that total has surely grown as millions have lost their jobs during the pandemic.

The federal government's message has been that for the uninsured, treatment will be covered.

"Hospitals and health care providers treating uninsured coronavirus patients will be reimbursed by the federal government," Trump said during a White House briefing April 3. "This should alleviate any concern uninsured Americans may have about seeking the coronavirus treatment."

The federal government has allocated $1 billion to test the uninsured, and it has announced plans to use part of the $100 billion slated for health care providers in the coronavirus response legislation known as the CARES Act to reimburse hospitals for the costs of treating the uninsured.

But snags continue to emerge. A woman interviewed by NBC San Diego received a bill for nearly $1,500 for a coronavirus test. The hospital told the station that while federal legislation made tests free, it didn't cover the uninsured.

The head of Carbon Health, a startup promoting rapid testing in the San Francisco Bay Area, also argued that health care providers should be allowed to charge the uninsured.

"The supplies and labs for COVID-19 testing are very expensive," CEO Eren Bali wrote April 14 on Twitter. "Would be ridiculous to expect the healthcare providers to take the tab instead of insurance/government."

Three days later, in response to an email from NBC News, a spokesperson for Carbon Health said that testing fees will be waived for uninsured patients and that the company is refunding those who paid fees.

The Families First Coronavirus Response Act, passed in March, allows states to tap Medicaid, the country's program that insures the poor and the disabled, to cover the cost of testing the uninsured, including people who are undocumented.

Texas, where nearly 20 percent of residents lack insurance, just announced that it is requesting funds. That will likely prove crucial in places like Cameron County, in the state's southernmost tip. About 30 percent of its residents are uninsured, according to federal data, but new coronavirus cases are being detected every day. More than 300 residents have tested positive, and nine have died.

Actually covering coronavirus treatment for the uninsured could reach $40 billion, according to an analysis from the Kaiser Family Foundation. The government hasn't addressed how it would address the ongoing care some uninsured may need for a disease that affects not just the lungs but also the kidney, the heart and the brain.

"We know people who have been on a ventilator for a long time may need care down the road," said Jennifer Tolbert, director of state health reform at Kaiser. "This would not cover all of that care."

What's next

Will the surprise medical bills keep arriving?

More than a month into the global pandemic, states have issued more than 320 mandates, orders and requests for insurers to make accommodations to ease access to care during the pandemic, according to the National Association of Insurance Commissioners.

Insurance commissioners in states such as California, Washington, New York and New Jersey now require some health insurers to waive most costs related to COVID-19 testing.

However, 22 states, including Alabama and Texas, ask only that insurers look at waiving fees and preventing out-of-network charges for those who cannot get care in their networks.

This patchwork, said Katherine Baicker, dean of the Harris School of Public Policy at the University of Chicago, "is symptomatic of the challenges of our system."

Many insurance companies have announced that they are voluntarily eliminating copayments and deductibles for some treatment.

"We were making these commitments before we knew what testing or treatment could cost," said Kristine Grow, spokesperson for America's Health Insurance Plans, an industry trade group. "We're committing to doing everything we can to protect patients."

Several insurers and medical providers NBC News spoke with said they are working with patients to address costs. Several waived charges for specific patients after NBC News inquiries.

Health insurance companies have made good-faith efforts to remove barriers to care and to curb the epidemic, said Vivian Ho, a health economist at Rice University in Houston.

"They're worried that this is something that will continue to spread, so they want to do their part to make sure it doesn't," Ho said.

Baicker said making sure care is affordable — especially making sure testing is widely available — is fundamental to moving the country forward. "Any cost barriers to that are wildly counterproductive," she said.

Download the NBC News app for full coverage and alerts about the coronavirus outbreak

In the long run, however, Americans could still end up paying insurance companies extra for the coronavirus.

COVID-19 could cost insurance companies as much as $556 billion over two years, according to an estimate prepared for America's Health Insurance Plans, which is lobbying Congress to implement measures to offset the costs, among them keeping people on their employer-sponsored coverage.

What isn't paid now might come due later in the form of steep increases to buy insurance. One analysis found that premiums could rise by 40 percent in 2021 if regulators don't step in.

The pandemic will inevitably reshape the country's health care system, Ho said, but it's still too early to know how.

"There are going to be some drastic changes," she said. "I'm just not sure which ones."