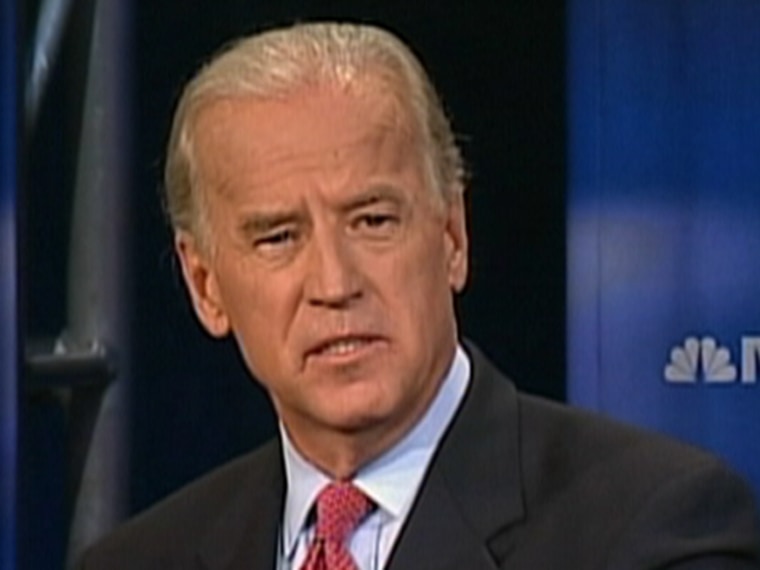

Democratic presidential hopeful Joe Biden released a plan to protect Americans' retirement savings and even help children begin to sock away money.

He said his plan would give a boost to Social Security, secure pensions and expand personal savings and retirement options. Such policies are needed because there are serious hurdles facing workers who are trying to save money, he said.

"What's happening is average Americans are really getting hung out to dry," Biden said in a telephone interview with The Associated Press.

The Delaware senator had been scheduled to present his plan and host campaign events in Iowa on Wednesday, but he delayed the stops because of debate on legislation to regulate troop combat tours.

Protecting pension plans

In the 1980s, Biden said 83 percent of American workers were covered by pension plans, but today only 20 percent have pensions and many of those are not secure. He said in order to keep companies from going into bankruptcy and wiping out pension plans, more must be done to make top executives accountable for the accuracy of companies' financial statements.

"Do not allow (the companies) to be subject to bankruptcy unless you subject the big guys, the guys getting the golden parachutes," he said.

Biden said half of the American work force has no retirement plan, and that the personal savings rate in the U.S. is less than 1 percent. He added that the majority of workers believe they'll have to push back retirement because of their situation.

To protect Social Security, Biden said he would bring both parties to the table to keep the plan paying out. That would include discussing options such as upping the retirement age and raising the cap on income subject to the Social Security tax past the $97,500 it was in 2007.

"It ain't broke — it doesn't need privatization," he said of Social Security. "There's other ways to help savings."

Contributions and tax credits

The senator said he would make it easier for workers to save by requiring employers who don't offer retirement plans to allow employees to contribute to individual retirement accounts, with deposits to the accounts coming directly from the employees' paychecks. That makes saving even small amounts easier, he said.

Biden said he would also push for automatic enrollment in 401(k) plans, where workers would have to opt out of the plans if they didn't want to contribute, instead of opting in as they do now. He said only one in four eligible employees now takes advantage of such plans. Rollover of the retirement accounts would be made automatic so they would follow people to new jobs, he said.

To help low- and middle-income families save, Biden said he would expand certain tax credits on savings that now disproportionately favor the wealthiest Americans. Low-income families in need of government assistance such as food stamps would also be helped by preventing the government from using their retirement savings in assessments to determine if they can get assistance, he said.

The plan would also allow children, parents and grandparents to contribute up to $1,000 a year into a Kids Account, which the government would kick-start with a $500 contribution. When a child reaches age 18, they could use that money for education, to buy a home or to invest in retirement with one catch — they would have to pay back the initial $500 investment when they turn 30.

In the end, Biden said he doesn't wants Americans left "high and dry" like his dad, whose pension didn't come through and who ended up with only Social Security payments after many years in the work force.

"The American promise that no one who works hard their whole life should end up with nothing is in jeopardy," he said. "We need to make it clear to all Americans that they can trust that their lifetime of hard work will be rewarded and protected."