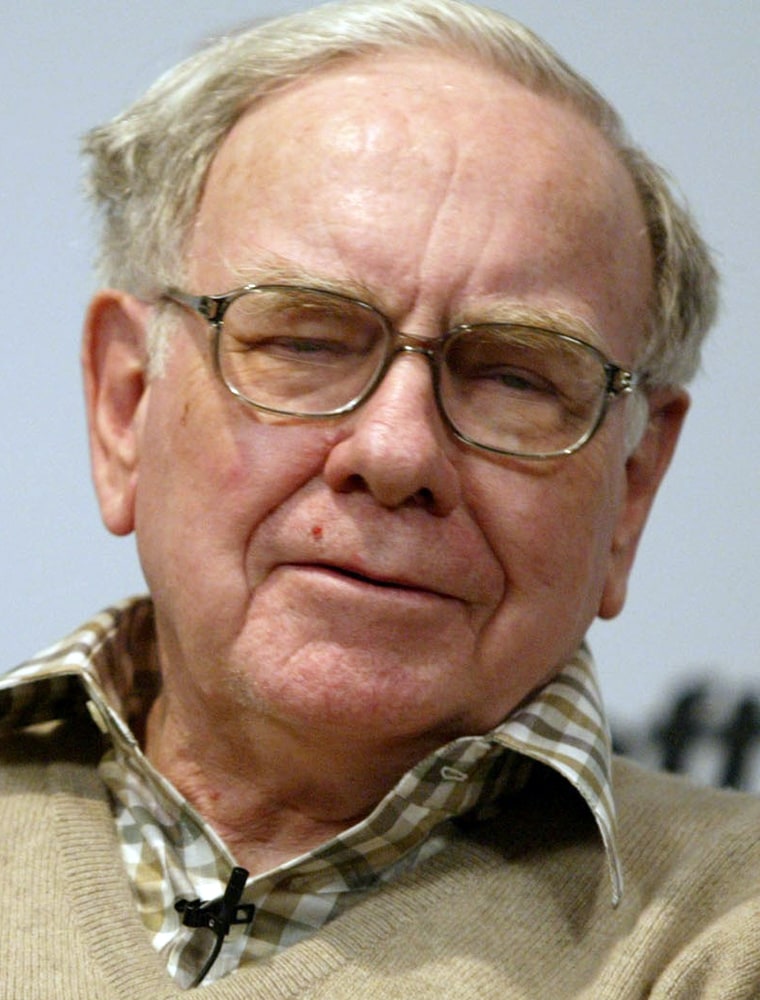

Thousands of investors will descend on Omaha, Nebraska beginning Friday, eager to hear the latest pearls of wisdom from U.S. billionaire Warren Buffett, widely regarded as one of the world's savviest investors.

Buffett, the world's second richest person, rarely appears in public, so many view the annual meeting of his insurance and investment company Berkshire Hathaway Inc. as a key opportunity to gain sage investment advice.

Investors pay close attention to companies that Buffett invests in, as well as his views on longer-term trends in the global economy. The "Oracle of Omaha" has for years expected the U.S. dollar to weaken, and years ago took a large position in silver.

"It's a required pilgrimage every year. The faithful have to go," said Mohnish Pabrai, managing partner at Pabrai Investment Funds, who oversees funds that own $30 million of Berkshire shares. He is attending his ninth annual meeting.

The meeting draws more than 20,000 people, including many who have made healthy gains from Berkshire stock. Though Berkshire has far outperformed benchmark indexes since Buffett took over the company in 1965, it has lagged the Standard & Poor's 500 index since peaking in Feb. 2004.

Buffett won a loyal following by buying stakes in companies such as soft drink maker Coca-Cola Co., and more recently retailer Wal-Mart Stores Inc. and brewer Anheuser-Busch Cos.

Berkshire also owns some 50 businesses, selling things ranging from underwear to insurance -- with the door always open for more acquisitions.

This year alone, Buffett, who favors industry-leading companies with easy-to-understand businesses and potential for growth, has snapped up sporting goods maker Russell Corp. , Applied Underwriters Inc. and Business Wire, a distributor of corporate press releases. An affiliate also paid $5.1 billion to buy a western U.S. utility, PacifiCorp.

He also made a 20-year, $14 billion bet on rising stocks by acquiring equity index put contracts.

Where next?

Yet Buffett has also over time moved beyond just acquiring companies.

Berkshire's stake in foreign currency contracts, a bet the U.S. dollar will fall, declined to $13.8 billion in nine currencies from $21.4 billion in 12 currencies a year earlier.

Yet Buffett, who began trading currencies in March 2002, has said he remains concerned that soaring U.S. trade and budget deficits will cause international investors to yank money from the United States. He has been buying shares of companies that earn large profits outside the country.

Buffett jumped into silver in 1998 when he bought 129.7 million ounces -- a fifth of the world's mine supply that year -- at $6 an ounce. Silver hit a 23-year peak of $14.68 an ounce about two weeks ago.

Buffett's yearly gathering in his hometown of Omaha, a city of 409,000 people about 1,250 miles west of New York, which he dubs "Woodstock for Capitalists," is unlike almost any other annual meeting in corporate America, with its party-like atmosphere and band of followers.

The billionaire, worth an estimated $42 billion but who draws only a $100,000 annual salary to run Berkshire, wins praise for his folksy manner and penchant for thrift. Only Microsoft Corp. founder Bill Gates, a Berkshire director and Buffett bridge partner, is worth more.

This year, in his annual shareholder letter, Buffett criticized companies that spend too much money on unworthy chief executives, and faulted the potentially "huge" costs of hedge fund and private equity investments.

‘Wizard of Omaha’

Various events for shareholders kick off Friday in Omaha, where Buffett still lives and works, and where hotels have been sold out for weeks.

"I'm always rather amazed that people from all over the world gather and have a great time in Omaha," said Sherrie Gregory, a Berkshire shareholder who lives in Lincoln, Nebraska's capital, about 50 miles southwest of Omaha. "People usually make reservations a year in advance for hotels."

The meeting itself starts on Saturday with a movie historically produced by Buffett's daughter Susie. Last year, it featured advertisements for Berkshire businesses and a cartoon spoof of "The Wizard of Oz" titled "The Wizard of Omaha."

In an adjoining hall, Berkshire's businesses will display their products, including paint producer Benjamin Moore underwear maker Fruit of the Loom and Geico Corp., the auto insurer. The booth for ice cream maker Dairy Queen will display a ukulele autographed by Buffett, and to be auctioned on eBay Inc.'s Web site to raise money for an Omaha hospital.

Buffett and his trusted 82-year-old partner Charlie Munger will spend several hours answering shareholder questions. Neither historically gives stock tips or hint at what they may buy, but they might comment on industry sectors.

Berkshire estimates that since 1964, its book value per share has risen 305,134 percent, compared with a 5,583 percent rise for the S&P 500 with dividends reinvested. Net income last year rose 17 percent to $8.53 billion.

Though Berkshire shares have dropped 7 percent since February 2004, lagging the S&P 500 by more than 21 percentage points, this has not dampened investor enthusiasm.

"It's a prestigious thing to belong to the Berkshire group: that's one of the reasons people come to Omaha," said Gregory. "It's a mixture of business and fun."