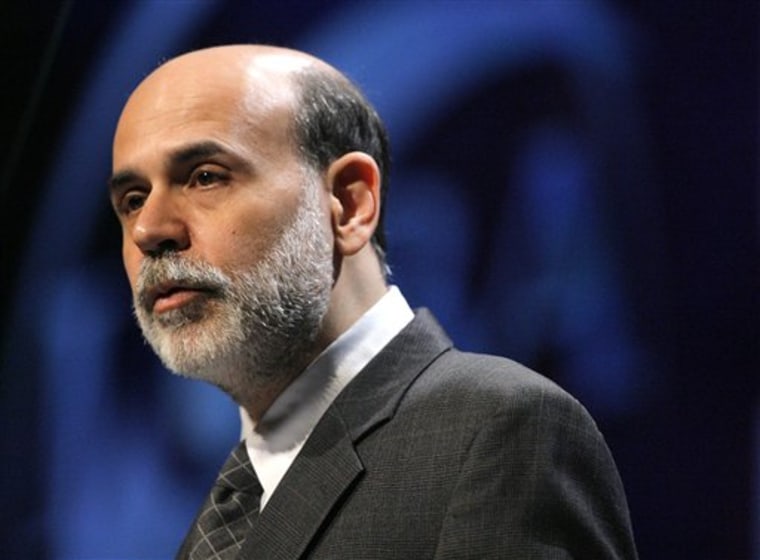

Federal Reserve Chairman Ben Bernanke served up "intellectual food" to visiting bankers Friday, offering a smorgasbord of high-calorie topics like mortgage markets, inflation expectations and optimal monetary policy.

"Bon Appetit!" Bernanke exclaimed, as he welcomed participants in an international monetary policy conference at Fed headquarters. Although the sit down came at around the breakfast hour, it seemed pretty much an eat-your-peas event.

"You have a very full agenda for the next two days," Bernanke warned. "The topics represent a good mix of theoretical work as well as empirical work based on both calibration and econometric estimation."

In his brief remarks, he didn't even mention the hottest potato around _ the question of what direction interest rates will take in the United States in the new year.

Many economists believe the Fed will again hold an important rate steady at 5.25 percent when it meets next, on Dec. 12, in its last such session for this year.

After steadily boosting rates for two years to combat inflation, the Fed, against the backdrop of a slowing economy, has left rates alone since August.

In extensive remarks about the economy Tuesday, Bernanke had delivered a mostly positive assessment, suggested the economy is weathering well the strains of the crumbling housing market and the struggling auto industry.

He also made clear the Fed will keep its eye firmly focused on the threat of inflation, especially from a good jobs market that is producing solid wage gains for workers. Economists viewed those comments as dashing hopes that the Fed would lower rates any time soon.