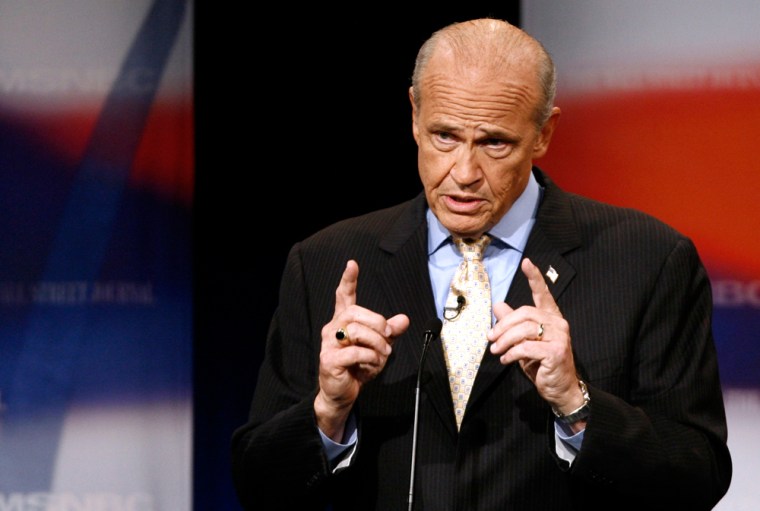

Fred D. Thompson, venturing into the treacherous political territory of changing Social Security, called yesterday for slowing the growth of benefits for future retirees by using a different yardstick on which to calculate the monthly payouts.

Mr. Thompson said that annual increases in benefits for future retirees should be based on the cost-of-living index, not the wage index, as is done now. Since the price index typically rises more slowly then the wage index, this would likely slow the growth of benefits. The change would not apply to current retirees.

He also called for allowing workers to divert 2 percent of their paychecks — to be matched by the federal government — into individual investments that are an “add on” to the Social Security program. But he did not recommend diverting existing payroll taxes into private accounts, as President Bush and conservatives have proposed.

To keep Social Security solvent over the long run, Mr. Thompson proposed a sharp break with the current policy of having the system financed entirely by payroll taxes on workers and their employers. He said he would use general tax revenues to help bolster the system.

Because his plan would create a new pool of savings through 401(k)-style investment accounts, Mr. Thompson forecast that the economy and federal tax revenues would be larger than otherwise, and that it would therefore be justified to divert a portion of those additional tax revenues back into the retirement system.

Mr. Thompson’s plan, while missing many details, was more specific than what the Bush White House put on the table when it sought to overhaul the system. It also varied substantially from the traditional conservative approach of focusing primarily on personal investment accounts.

“There’s no reason to run for president of the United States if you can’t tell the American people the truth about complex issues like Social Security,” Mr. Thompson, a Republican, said in a written statement announcing his proposals. “As we speak, Congress is raiding the Social Security Trust Fund. If we don’t act soon, the politicians in Washington will either repay those ‘IOUs’ through tax hikes or benefit cuts.”

Unlike some Democrats running for president, Mr. Thompson said he opposed increasing Social Security taxes on high-income earners to help make the system solvent. He also did not propose raising the age at which citizens are eligible for full benefits; it is now gradually being phased toward 67.

Mr. Thompson, a former senator from Tennessee, has made reining in entitlement costs a central theme of his campaign.

In calling for private accounts, Mr. Thompson said he would like to allow workers who are not currently receiving Social Security benefits to invest in personal “add-on accounts” that would resemble 401(k) plans. Workers would be able to invest 2 percent of their monthly wages, matched by the federal government. Mr. Thompson is the only one of the Republicans running for the White House who has made Social Security a central theme of his campaign.

There are political risks inherent in tackling the solvency of the program, with older voters particularly wary of changes to a system that they view as critical to their well-being.

Mr. Bush saw his major push to overhaul Social Security fizzle under political pressure. He, too, proposed private savings accounts. Mr. Thompson said his plan was different in that the private accounts he is proposing are not only voluntary, but also an additional savings plan, not a replacement for Social Security.