Does the smart money know something about George Bush’s election prospects in New Mexico, Minnesota and Missouri that pollsters, pundits and campaign workers don’t know?

If you look at a few of the state contracts in the Intrade electoral vote trading system, you might wonder if the traders in the presidential election futures market have been paying enough attention to the polling data, the TV ad buys, and the number of candidate visits to toss-up states such as New Mexico, which Bush lost by the smallest number of votes of any state in 2000: a breath-taking 366, out of a total of more than 598,000 votes cast.

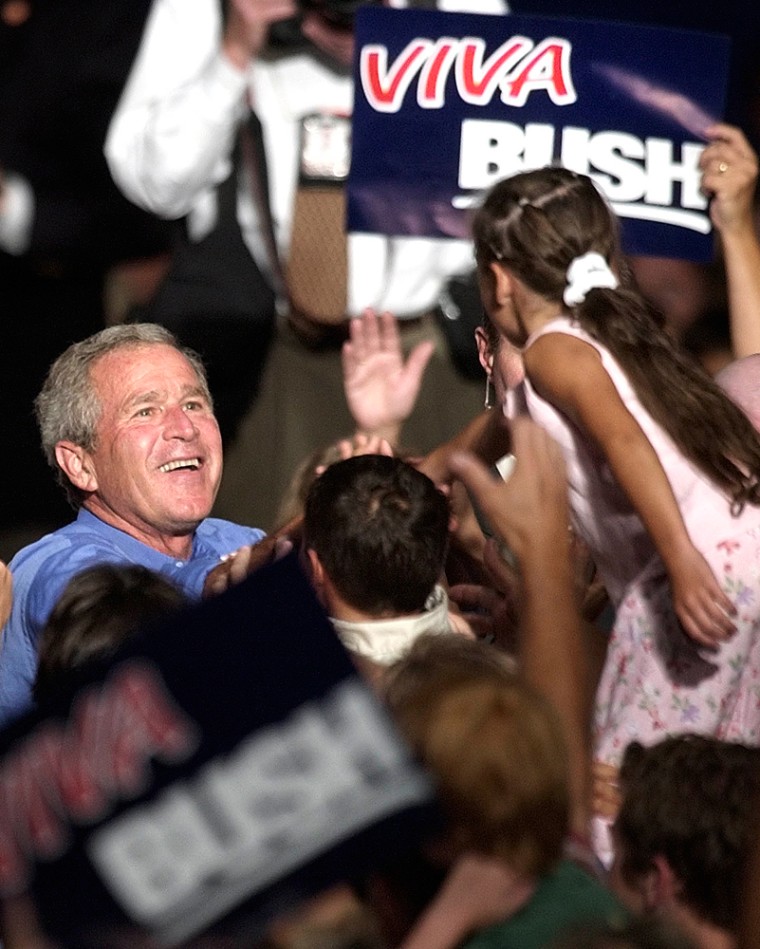

That number —366 votes — more than anything else has inspired Bush and Vice President Dick Cheney to spend time campaigning in the state, resulting in an Albuquerque Journal poll released Sunday that shows Bush with a slight lead over John Kerry in the state, 45 percent to 42 percent, with a margin of error of plus or minus three points.

So why as of Thursday, could one purchase ten “Bush carries New Mexico” contracts with a nominal value of $100 for only $35?

Chance to profit

If Bush fails to carry New Mexico, the trader gets nothing; if Bush does carry New Mexico the trader in this case would net a profit of $65, minus commission.

If ten “Bush wins New Mexico” contracts are valued at $35, traders in the Intrade universe think that Bush now has roughly a 35 percent probability of winning the state.

Given the closeness of his margin of defeat last time and his investment of time in the state, Bush’s chances in New Mexico seem more like a 50-50 proposition.

A trader could buy ten New Mexico contracts this week at $35 and sell in mid-October in the high 40s, but only if the current trends keep pushing Bush up in the state.

As the clock keeps ticking and we get closer to Election Day, if Bush continues to perform strongly in New Mexico polls and keeps visiting the state, the price of the futures contract will rise to reflect the increasing possibility that he’ll win the state.

Intrade spokesman Mike Knesevitch explained that futures contracts, whether for crude oil or for Bush’s potential victory in New Mexico, always factor in some amount of uncertainty over the remaining life of the contract.

Changing the probabilities

Dramatic events, such as the capture of Osama bin Laden, a new Abu Ghraib-type abuse scandal, a gaffe by Kerry or Bush during one of the debates, could throw the election into upheaval.

Such an event would alter investor expectations in the overall Intrade Bush re-election contract, which now gives the president roughly a 59 percent chance to win a second term in the White House. A market-moving event would also shake the more thinly traded individual state contracts.

“The risk is being factored out as time marches on,” said Knesevitch. “As time marches on, there’s less and less risk that some extraneous event will swing California, for instance, so California will keep dropping and dropping.”

Ten “Bush wins California” contracts are currently trading at less than $10.

What makes an election futures market potentially more valuable than the usual wise-guy chatter among Washington consultants is that traders back their judgments with real money, based on their assessment of Bush’s or Kerry’s current likelihood of winning the election or of carrying a particular state.

In theory, at least, traders do not allow sentiment or wishful thinking to cloud their rational assessments.

And the futures market can react quickly to spectacular events: in the January trading on who’d win the Democratic nomination, even in the initial minutes after it was known that Howard Dean had lost the Iowa caucuses, he was still trading at about a 40 percent probability he’d ultimately win the nomination.

But then, only minutes after his televised “scream” in his concession speech, his contract had fallen to only a 9 percent probability.

Effect of a gaffe

Had there been an electoral vote futures market in 1976, the “Gerald Ford wins” contract would have dropped like a granite slab on the night of Oct. 6, 1976, when Ford said in a televised debate with Jimmy Carter, “There is no Soviet domination of Eastern Europe.” Even Ford admitted within a few days that he had blundered.

For a political junkie who is not a trader, Intrade offers an alternate universe where some potential anomalies jump out.

Take Minnesota, for instance. As of Thursday, Intrade traders gauged Bush’s chances of carrying the state at only about 38 percent.

The state has been trending Republican since 2000, with Republican Norm Coleman winning the Senate race in 2002 and Republican Tim Pawlenty winning the governor’s race, albeit with only 44 percent of the vote.

In 2000, Bush came within 2.4 percentage points of beating Al Gore in the state, which hasn’t voted Republican in a presidential election since Richard Nixon’s landslide of 1972.

Irrational exuberance?

Conversely, ten contracts for Bush to win Missouri, now priced at about $67, seem a slight case of irrational exuberance.

If Kerry makes any kind of race of it nationally, he’ll do at least as well as Gore did in Missouri four years ago: 47 percent. And Ralph Nader will not be on the ballot in Missouri in November, potentially giving Kerry at least a small boost.

And keep in mind that Kerry would need only one more vote than Bush in Missouri to carry the state. So one could argue that Kerry has at least a better than a one-in-three chance of getting that one more vote.

On the other hand, Missouri voters showed just how conservative they are last month by giving landslide 71 percent approval to a ballot measure restricting marriage to the traditional one man-one woman marriage.

And a new Gallup poll of Missouri voters, released Wednesday night, showed Bush ahead of Kerry by 55 percent to 41 percent among likely voters.

But traders know all this already — or do they?

Knesevitch said Intrade traders do "pay a lot of attention” to ad buys, polling data and to candidate visits to states. “Traders are very intuitively oriented, they watch the news, they read, they trade on gut instincts a lot, but they also look at probabilities.”