Purchasing a home can be a great investment. But for many women, it’s easier said than done.

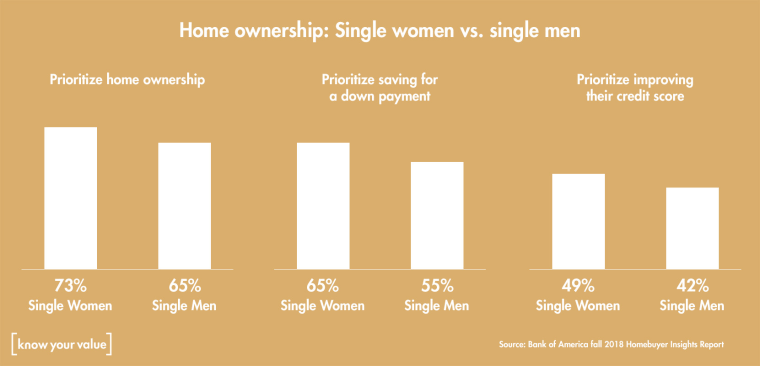

In fact, while 73 percent of single women prioritize homeownership compared to 65 percent of single men, it can take them longer to save for a down payment and buy, largely because they earn less, according to Bank of America data.

That’s unfortunate, because home ownership has always been one of the best investments you can make, Janet Alvarez, executive editor of WiseBread, a financial advice website, told Know Your Value. In addition to building equity, it’s also about building a life. “Women view buying a home as a natural step in securing their financial and personal future,” Alvarez said.

Yet for many women, the journey remains an uphill battle.

How the gender gap hurts

In every state and in nearly every occupation, there is a gender pay gap that widens with age as women reach their prime earning years.

It may not seem like a big deal, but earning less over their career makes it harder for women to save for a down payment, pay off debt, improve their credit score and get a lower interest rate on a mortgage.

“Women, especially those now in their mid-30s and younger, have been severely impacted by the economic downturn and are struggling more than previous generations,” said Alvarez.

Since women earn less than men, it's no surprise it’s harder for them to save for a down payment. According to a Credit Sesame survey, 42 percent of female respondents said struggling to afford a down payment was the top reason they weren't homeowners, compared to 38 percent of men.

Student debt that lingers

Women are also more burdened by student debt.

Women hold almost two-thirds ($890 billion) of the country’s $1.4-trillion student debt, while men hold $490 billion.That’s especially true for women of color. Black women graduate with the most debt — at $30,400 — compared to $22,000 for white women and $19,500 for white men.

“We’ve found that more women are more likely than men to put off home buying because of student debt,” said Kimberly Palmer, a personal finance expert for NerdWallet.

Paying off student loans leaves women with less disposable income, which means having to use more of their available credit to cover expenses. That contributes to lower credit scores.

“Student loans are an unfortunate reality for many women,” said Alvarez. “It makes it harder to qualify for larger mortgages because creditors see that you’re still paying off a certain amount of debt and therefore you may not be able to make your mortgage payments,” she said.

Women pay back their student loans more slowly too.

“They tend to view student loans as “good debt” since a degree will help them land a higher paying job,” said Alvarez. But paying just the minimum each month on their loan means they’ll pay more interest over the life of the loan.

Worth the risk

There's also a female-male risk gap. Women tend to be more conservative with their investments than men, and report having a lower tolerance for risks with their investments.

“The positive is that women tend to have higher investment returns than males,” said Alvarez. “But when it comes to buying a home, they’re also less likely to want to take on large mortgages, even if they could qualify,” she said.

Plus, “hidden costs” of homeownership (like repairing the stove or fridge, having the lawn mowed, HOA fees and paying for cable, phone and internet) dissuades some.

“With only one income, maintenance costs can put a strain on women buyers, especially if they’re very focused on their careers,” said Jenee Murphy, a financial consultant in Henrico, Virginia. To compensate, some women buy homes with partners, family members or friends to split the costs of buying, paying their mortgage and other expenses.

How to improve your odds

Still, there are several steps women can take to increase their readiness to buy a home.

1. Do your research.

There are plenty of resources, both online and through local real estate professionals, to help women learn about finances, investments, and the home buying process. “My real estate agent was really patient and explained things thoroughly, but I had a lot of doubts with all the paperwork. I wanted to make sure I wasn't being taken advantage of,” said Karla Ruiz, 32, a single woman who bought her Lakewood, California, home for $475,000 in 2016.

2. Set realistic goals.

A lot of people put off home buying because they think it’s insurmountable to save “so much money,” said Alvarez. You need to consult with professionals or use online tools to know how much house you can buy and how much to put down, whether it’s 3, 5, 10 or 20 percent. Set realistic goals that are achievable, within your financial capacity and that motivate you, she advised.

3. Automate your savings.

Saving is hard for many of us — who doesn’t want to eat out now and then or splurge on that dress in the window? Don’t tempt yourself. “Have your savings automatically withdrawn each month before you even see that portion,” said Alvarez. “Otherwise you’ll sabotage your progress.”

4. Improve your credit score.

Lenders use your credit score to determine your interest rate — which can have a huge effect in what you’ll pay over the life of a loan. “You’ll want your credit score to be as high as possible, and definitely over 720, so you are offered a favorable interest rate,” said Palmer. She advocated paying bills on time and paying more than the minimum due. Also keep credit utilization rate (the ratio of your outstanding credit card balances to your credit card limits) under 30 percent.

5. Think long-term.

If you’ll need $30,000 for a down payment, you may opt to save $10,000 a year over three years, and then break that down by how much you need to save each month. And instead of looking only at cutbacks to accumulate your savings, consider additions, making money renting a spare room or taking on a part-time job. “For a lot of people that’s much more palatable than cutbacks,” Alvarez said.