The Federal Reserve released its regular “Economic Well-Being of U.S. Households” report for 2021, which surveys Americans on how they’re doing on everything from income to personal happiness.

The report, which is based on data gathered in late October and early November, noted there was a large split between how Americans viewed their personal finances versus the overall economy.

78% of adults reported they were doing at least “okay” financially, which is not only up 3 points from 2020, when COVID was still peaking, but higher than it was before the pandemic.

Vaccines, a strong jobs market, and government aid all likely played a part. The report noted a particularly large burst of good vibes among parents, which it suggested may be linked to the now-expired monthly Child Tax Credit.

But when it came to the national economy, the same adults were far more pessimistic. Just 24% of adults rated it “good” or “excellent,” down 2 points from 2020 and a whopping 26 points from 2019. The picture was a little brighter at the local level, where 48% rated their area’s economy as “good” or “excellent,” but still well off pre-pandemic highs.

This split between personal and national economic ratings isn’t entirely new. National economic questions tend to be heavily influenced by partisanship, with huge swings in responses between Democrats and Republicans whenever the other side retakes the White House.

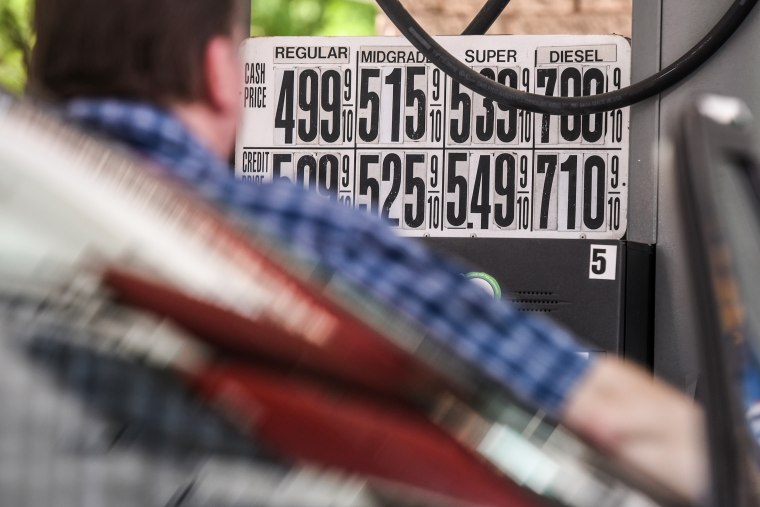

But even by that standard, it’s a big split and it could be that national concerns are a leading indicator of deeper issues. Some recent polls have found households are becoming more worried about their personal finances amid spiking gas prices related to the war in Ukraine, continued inflation, a stock market correction, and speculation about a recession. Trillions of dollars in pandemic stimulus measures are also drying up, which may help bring down inflation, but also leaves Americans with a skinnier financial cushion in uncertain times.