Good morning. 📈 Welcome to earnings week. Alphabet, Amazon, AT&T, Comcast, Facebook, Snapchat, Tesla and Twitter all report in the days ahead.

☀️ Sun in the West

⛈️ T-storms in the East

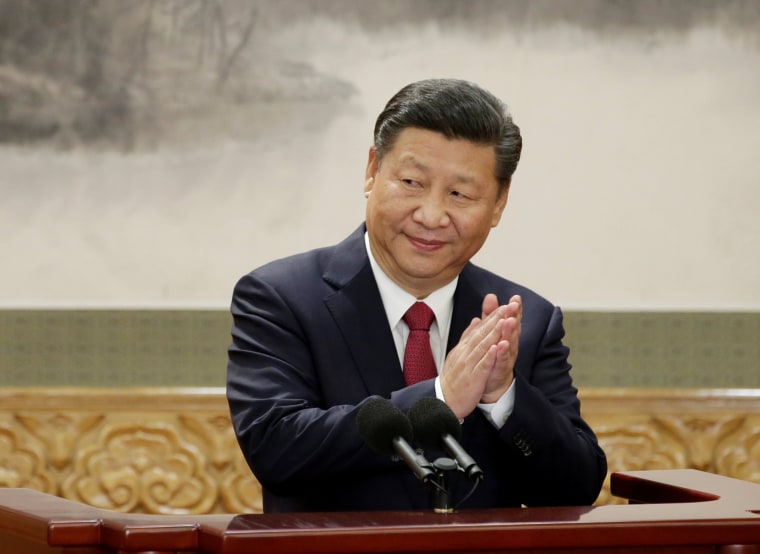

Xi Jinping tests the market

Moving the Market: China has launched a new stock exchange venue focused on tech and science equities in order to spur domestic investment and keep the kingdom's next big tech giants from decamping to foreign markets — and it's already paying off big.

• "Chinese investors greeted the opening of the country’s Nasdaq-style stock market with a frenzied burst of trading on Monday, driving gains in all 25 companies that made their debut," per Bloomberg.

• "The stocks posted an average surge of 166%," while one "little-known semiconductor manufacturer" saw a 521% surge.

The big picture: The Science and Technology Innovation Board, or "STAR Market," is "a pet project of President Xi Jinping, part of Beijing’s effort to revitalize a slowing economy and sharpen its edge in the fight for global tech dominance," WSJ's Shen Hong reports.

• "Beijing has high hopes that the new marketplace eventually could compete with Nasdaq in nurturing innovative startups and tech companies."

What's next: "More than 140 technology and science companies across China have signed up to list their stocks on the new board... aiming to raise a total [of] $18.7 billion," per FT's Hudson Lockett.

China slows on U.S. investment

Trade war watch: "Growing distrust between the United States and China has slowed the once steady flow of Chinese cash into America, with Chinese investment plummeting by nearly 90 percent since President Trump took office," NYT's Alan Rappeport reports.

• "The falloff... is affecting a range of industries including Silicon Valley start-ups, the Manhattan real estate market and state governments."

• It underscores "how the world’s two largest economies are beginning to decouple after years of increasing integration."

The big picture: "Weaker Chinese investment is unlikely to derail the United States economy ... But the decline in investment could hurt areas that are already economically disadvantaged and that have become dependent on Chinese cash."

• What's next: "Even if the two countries reach a trade deal, tepid Chinese investment is expected to continue."

🇺🇸 Talk of the Trail 🇺🇸

Story of the week: Robert Mueller will testify before Congress on Wednesday. House Judiciary Committee Chairman Jerrold Nadler, D-N.Y. says his report "presents very substantial evidence" that President Trump "is guilty of high crimes and misdemeanors."

Joe Simons faces tech test

Big in the Bay, big in the Beltway: "The federal government's struggles to rein in Facebook are driving some Democrats and consumer advocates to a stark conclusion: The agency charged with regulating Silicon Valley is not up to the task," Politico's Nancy Scola and Margaret Harding McGill report.

• "The 105-year-old Federal Trade Commission is a main enforcer of Americans' consumer protections but it has only a small fraction of the money and workforce of the nation's largest tech companies."

• "Some lawmakers and activists [are] calling for an entirely new agency to oversee the online industry."

• "Those calls have only grown [since] the FTC's proposed $5 billion privacy fine for Facebook... [which] many lawmakers called laughably small given the social networking giant's resources."

The big picture: As I wrote last week, the FTC's Facebook fine isn't a sign of new pressure on Silicon Valley so much as a sign of the U.S. government's inability to effectively regulate big tech.

Market Links

• Susan Wojcicki reaches a settlement with FTC (WaPo)

• Joe Ianiello plays hard ball in dispute with AT&T (WSJ)

• Rick Fox nears a sale of his e-sports company (Bloomberg)

• Heather Podesta joins Apple's DC lobbying team (O'Dwyer)

• Graydon Carter talks Vanity Fair and Jeffrey Epstein (NYT)

Jimmy Pitaro firm on policy

Big in Burbank, big in Bristol: ESPN chief Jimmy Pitaro has no plans to change the network’s policy on political discussion after host Dan Le Batard slammed President Trump for instigating "racial division" and called his network "cowardly" for avoiding it.

• Two senior ESPN sources tell me that the company has no plans to change the policy, which advises on-air talent to avoid talking about politics unless it intersects with sports.

The big picture: "Pitaro, who took over in March 2018, has said the network has moved away from covering political angles in sports," my colleague Daniella Silva writes. That's "a departure from the position of the company's previous president, John Skipper."

Kevin Feige talks Marvel plan

Talk at Comic-Con: Kevin Feige has unveiled what's next for Marvel: "a slate of interconnected movies and streaming-service shows that emphasizes diversity on both sides of the camera," per NYT's Brooks Barnes.

• "The lineup includes the first openly L.G.B.T.Q. superhero in a Marvel film, a superhero who is disabled, and a film anchored by an Asian superhero."

• "Scarlett Johansson will headline 'Black Widow' ... Angelina Jolie, Kumail Nanjiani [and] Salma Hayek... will star in 'The Eternals.'"

The big picture: "The films and TV shows will either push Marvel further into the stratosphere or at long last reveal the studio’s limitations."

• "Until now, Feige... has focused almost entirely on movies. But [Disney] is now counting on him to also make must-watch shows for its Disney Plus streaming service, which is scheduled to go live on Nov. 12."

Meanwhile, AT&T's WarnerMedia "is likely to lean on Batman, Wonder Woman, Superman and DC’s other crime fighters" as it challenges Disney, Netflix, et al in the streaming wars, per NYT's Greg Schmidt.

🎞️ What next: Speaking of Marvel, "Avengers: Endgame" has now surpassed "Avatar" as the highest-grossing film of all time.

See you tomorrow.