WASHINGTON — The U.S. government has awarded coronavirus relief loans to several subsidiaries of Chinese companies, including one linked to the Chinese military that drew scrutiny from Congress, according to data released by the Treasury Department.

Designed to help businesses hit hard by the pandemic's stay-at-home orders, the Paycheck Protection Program bailout loans included $5 million to $10 million for Continental Aerospace Technologies Inc., an aircraft engine manufacturer under the control of the Chinese defense giant Aviation Industry Corp. of China, or AVIC, according to data from the Treasury Department.

A joint venture of the same Chinese aviation company, called Aviage Systems, based in Arizona, received between $150,00 and $350,000, the data showed. Aviage is a joint venture between China's AVIC and General Electric Co. that produces avionics equipment.

The U.S. government also gave between $350,000 and $1 million to HNA Group North America LLC and HNA Training Center NY LLC, affiliates of the Chinese conglomerate HNA Group Co., according to the data. The Chinese conglomerate has businesses in airport services, transportation, real estate, financial services, leasing, tourism, hotels, and logistics.

Bloomberg first reported on the loans to the subsidiaries of AVIC and HNA.

AVIC, the Chinese aviation company that controls Continental Aerospace Technologies, appeared on a list last month from the Defense Department of 20 Chinese firms considered to be owned or tied to the Chinese military.

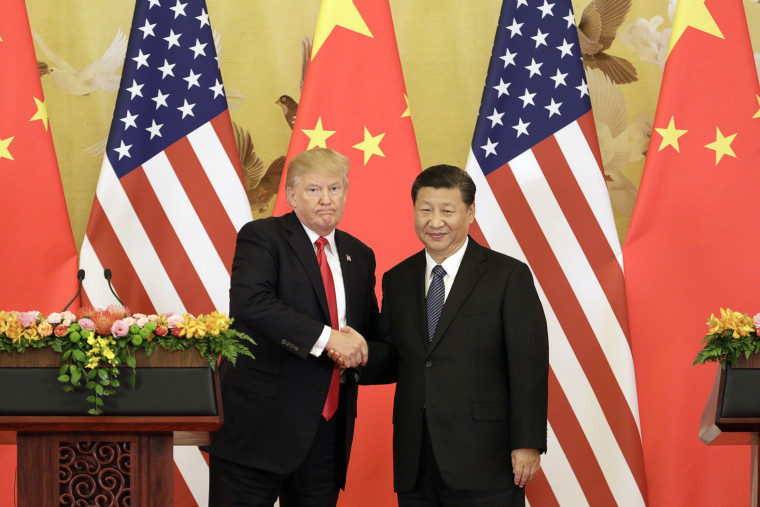

Last month, a bipartisan group of lawmakers called on President Donald Trump to impose economic penalties on the companies appearing on the list.

In a letter, the lawmakers, led by Republicans Sen. Tom Cotton of Arkansas and Rep. Mike Gallagher of Wisconsin, praised the Pentagon for releasing the list and said the U.S. needed to counter China's "parasitic technology transfer efforts."

When asked about the loans, the Treasury Department and the Small Business Administration did not comment specifically on the Chinese subsidiaries and pointed to the general parameters of the PPP loan program. But the Treasury Department spokesperson said the government can direct a lender to deny forgiveness of a loan.

The State Department referred queries to the Treasury Department. The White House national security council did not respond to requests for comment.

The loan disclosures come amid growing tensions between China and the Trump administration, which has accused Beijing of initially trying to conceal the extent of the coronavirus outbreak, attempting to hack U.S. research on a COVID-19 vaccine, stealing intellectual property and committing egregious human rights violations in Hong Kong and against Uighurs in the country's west. China denies the allegations.

The rivalry has played out over technology, with the White House lobbying allies to rebuff offers from Huawei Technologies Co to provide 5G networks.

The Paycheck Protection Program, established by the CARES act and overseen by the Small Business Administration, has provided more than 4.9 million loans worth more than $517 billion as of July 9. Critics, and some lawmakers, have faulted the program for providing loans to larger companies that do not need help. The Trump administration has said the program has been a major success.

The program does not appear to explicitly prohibit U.S. subsidiaries of foreign companies from receiving loans. According to guidance from the Treasury Department and the Small Business Administration, companies whose principal place of residence is in the United States can qualify for loans.

Some law firms have issued advice online that U.S. companies with foreign ownership may be eligible for government assistance.

A U.S. subsidiary of another Chinese company that has raised concerns among U.S. officials, BGI Group, also received a loan from the program.

BGI Americas Corporation got a loan of between $350,000 and $1 million, according to Treasury Department data. The parent company is building a vast genetics database of China's population.

Axios first reported on the BGI loan.

A U.S. startup in Irvine, California, CloudMinds Technology Inc., which provides cloud-based "brain systems" for robots, got a loan of $1 million to 2 million, according to Treasury data. Reuters first reported on the loan.

In May, the Commerce Department cited several CloudMinds entities among a "debarred list" of organizations "engaging in activities contrary to the national security or foreign policy interests of the United States."

In a statement posted on its website in May, CloudMinds Technology Inc. acknowledged that though some CloudMinds affiliates had been added to the list, the list did not include the California-based company.