For many years, Araceli Almeida’s husband has hung high in the sky, sand blasting and painting water tanks for good earnings, from which he’s paid thousands in taxes.

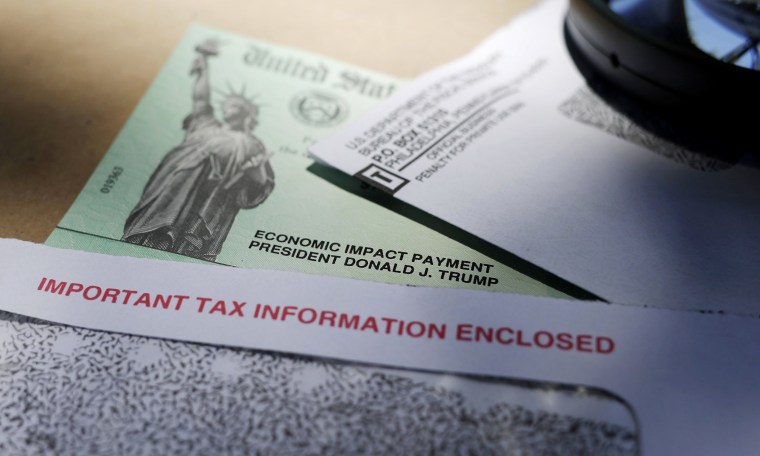

Nonetheless, Almeida has been deemed ineligible for the assistance checks sent to other Americans to help them weather the coronavirus crisis.

The reasons: Almeida's husband is not a U.S. citizen and does not have a Social Security number. The couple files their taxes jointly, which many married couples do for tax discounts.

But under the law, coronavirus relief money can only go to people who have a Social Security number. The law excludes immigrants who pay taxes with an Individual Tax Identification Number — used by many unauthorized immigrants — and anyone in their households.

As Congress considers another round of coronavirus relief, one of the sticking points is the provision that denies millions of American citizens the “stimulus checks”.

“I feel violated,” said Almeida, who is a plaintiff in a lawsuit filed in Illinois to force the government to allow her and others like her to get coronavirus relief money.

Democrats want the next coronavirus relief package to allow people like Almeida and those who pay taxes with an Individual Tax Identification Number to receive a check. Senate Minority Leader Chuck Schumer, D-N.Y., and House Speaker Nancy Pelosi, D-Calif., joined members of the Congressional Hispanic Caucus in support of getting checks to the citizens and people who pay taxes, regardless of immigration status.

But Rep. Sylvia Garcia, D-Texas, told reporters Monday that “regretfully this is a nonstarter over on the Republican side, from what I can glean from House Speaker Nancy Pelosi’s comments” in a phone call with House members. García said that “(Senate Majority Leader Mitch) McConnell, himself and the Republicans don’t want to see any money going to immigrants of any sort.”

Many couples have already filed taxes for this year or did so last year, not knowing it would keep them from getting the coronavirus assistance.

Republicans have said the provision was included to prevent immigrants without legal status from getting money from a U.S. taxpayer funded program, although many immigrants pay federal taxes.

Democrats and lawyers in the Illinois class-action suit and the Mexican American Legal Defense and Educational Fund, which has filed a separate lawsuit, counter that by targeting undocumented immigrants, the provision punishes U.S. citizens and deprives them of fundamental constitutional rights.

Sen. Marco Rubio, R-Florida, said as much last week when he told Telemundo he was unaware that U.S. citizens married to undocumented immigrants were denied assistance. He said that “a person doesn’t lose their rights as a U.S. citizen because they are married to someone who is not documented” and if that was the case, he’d intervene.

Rep. Jesus "Chuy' García, D-Ill., said in a news conference Tuesday, "imagine being denied financial stimulus assistance simply because of the status of your spouse. Imagine U.S. children denied assistance because the parents are undocumented, all of them more likely to have a tough financial situation."

"These exclusions are a slap in the face for many immigrants and their families," García said.

An estimated 9.9 million immigrants are living in the U.S. without work authorization, according to calculations by the Migration Policy Institute. They live with about 3.744 million children and 1.746 million spouses who are U.S. citizens or legal permanent residents, according to the analysis by Julia Gelatt, a senior policy analyst at the institute.

Most of those children and spouses live in California and Texas and other states with high immigrant and Latino populations. But they also include 22,000 in Iowa, the home of Republican Senator Chuck Grassley—a co-author of the coronavirus relief law—and 22,000 in Kentucky, McConnell’s home state, the MPI's state-by-state breakdown shows.

MPI estimated 228,000 citizen and legal resident spouses and children of unauthorized immigrants are living in Florida, Rubio’s home state.

The numbers don’t reflect how many married couples filed their taxes individually versus jointly.

"An issue of basic fairness"

“What this does is punish the citizen as well as the citizen kids and that’s a problem,” said Thomas Saenz, president and general counsel of MALDEF. “This is an issue of basic fairness and the Constitution supports basic fairness when it comes to issues of family and marriage.”

In its lawsuit, MALDEF argues that the provision violates the fundamental right to marry. He said the Supreme Court also has long ago recognized individuals' fundamental right to define their family as they see fit, noting a case in which a grandmother and her grandson were allowed to define themselves as a family to live together in public housing.

By filing together, the families are making statements about their marriage and life partner and that is protected First Amendment expression, Saenz said.

The federal government has clearly stated that it is punishing families for their “expression” on their marriage by allowing the check to go to citizens married to immigrants who filed taxes separately, Saenz said. Congress recognized the provision could be a burden to some families. It exempted active duty military in similar families.

Michael Zona, spokesman for Grassley, told NBC News the provision is modeled on the 2008 Great Recession rebates that also were restricted to people with Social Security numbers and that the standard is also used for the Earned Income Tax Credit and Child Tax Credit.

The provision was included in the 2008 rebate legislation after lobbying by anti-immigrant groups including the Federation for American Immigration Reform, which has been designated as a hate group by the Southern Poverty Law Center.

"Never in my life have I received so many phone calls"

Zona said filings of joint tax returns by such families are relatively rare.

But Vivian Khalaf, one of the attorneys in the Illinois lawsuit, said "never in my life have I received so many phone calls from distressed clients begging to understand why they have not received their stimulus checks when others in their situation have."

Almeida said she has met other spouses of immigrants who filed separately and have received a stimulus check. She and her husband file jointly, as do other immigrants, to show their marriage is legitimate, important for her husband if he is ever to become a legal permanent resident.

“I pay taxes and I work, and I work very hard for my money and I’m going through the same hardship every single person is if you take seriously this pandemic,” Almeida said.

Though Almeida’s husband's work is considered essential, he did not work for almost seven weeks in order to protect their 28-year-old daughter; she has a rare genetic disease that causes connective tissue to turn to bone. Even before the coronavirus outbreak, exposure to germs and illness was dangerous for her. Coronavirus would kill her, her mother said.

Celina Villanueva, a Democratic Illinois state senator, called the exclusion of families "repugnant and cruel" particularly in a pandemic that is affecting many African American and Latino communities.

"We are talking about people who pay billions of dollars in taxes on a yearly basis," she said, adding that the administration has no problem spending the money while "cruelly and unjustly discriminating against those same families."

Follow NBC Latino on Facebook, Twitter and Instagram.