IE 11 is not supported. For an optimal experience visit our site on another browser.

UP NEXT

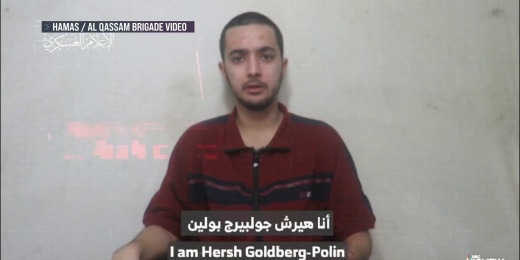

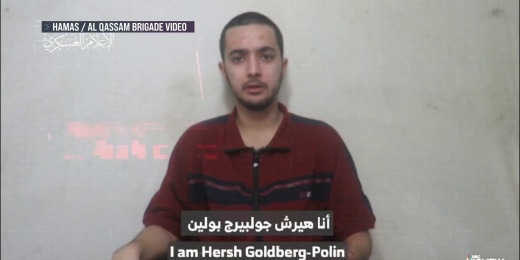

Hamas releases video of hostage Hersh Goldberg-Polin 01:47

Insurers scale back reimbursements for drugs used for weight loss 02:44

Biden signs foreign aid bill to provide new funding to Ukraine, Israel and Taiwan 01:35

New pro-Palestinian protests on campuses across the country 03:28

Supreme Court hears arguments on highly restrictive Idaho abortion law 03:49

Biden Administration announces new rules to speed refunds for passengers whose flights are disrupted 01:34

Heartbreak and hope as Gaza baby is delivered 01:39

Tennessee lawmakers approve bill that would allow teachers to carry guns in school 01:26

Campus protests spread around the country 02:44

FBI director warns of TikTok's danger 04:42

Senate poised to vote on potential TikTok ban 02:04

Former National Enquirer publisher testifies about how he helped Trump 02:32

Threats of violence to colleges on FBI's radar amid heated campus environment 00:54

FBI director warns of three-part TikTok threat as Senate considers ban 01:36

Prosecution, defense paint competing visions of Trump as trial begins 03:26

Surge of Chinese migrants crossing Southern border into the U.S. 02:42

Dozens of pro-Palestinian protesters arrested at Yale 02:52

Volkswagen workers vote to unionize in Tennessee assembly plant 01:32

Barry Manilow makes history with Radio City performance 01:45

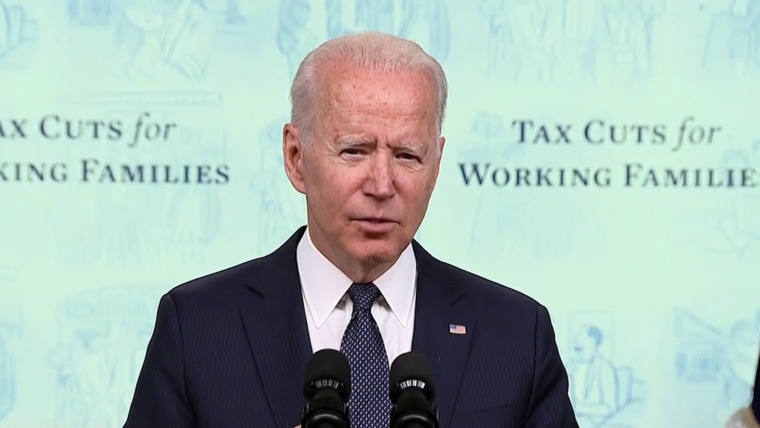

Child tax credit checks begin hitting bank accounts 01:23 The new program expands on the existing child tax credit, and was added as part of the Covid relief package earlier this year. It applies to single parents earning as much as $112,000 a year, and couples making up to $150,000. July 15, 2021

Read More UP NEXT

Hamas releases video of hostage Hersh Goldberg-Polin 01:47

Insurers scale back reimbursements for drugs used for weight loss 02:44

Biden signs foreign aid bill to provide new funding to Ukraine, Israel and Taiwan 01:35

New pro-Palestinian protests on campuses across the country 03:28

Supreme Court hears arguments on highly restrictive Idaho abortion law 03:49

Biden Administration announces new rules to speed refunds for passengers whose flights are disrupted 01:34