First Read is your briefing from Meet the Press and the NBC Political Unit on the day's most important political stories and why they matter.

GOP wrestles with tax politics — but what about the policy?

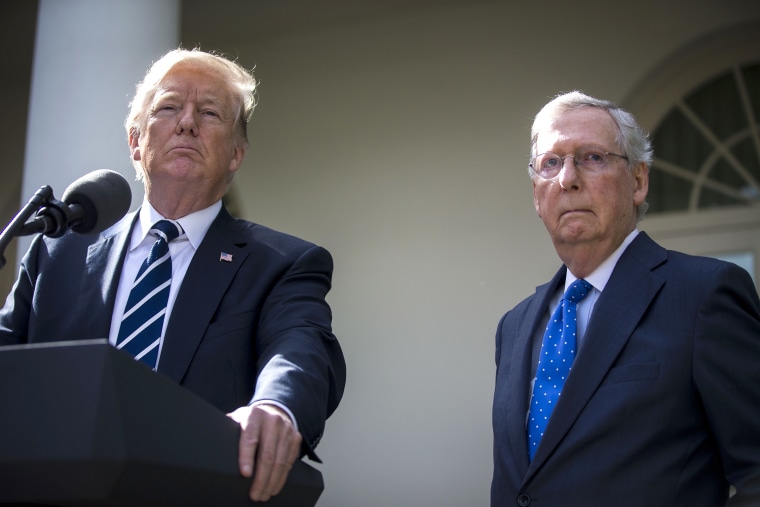

WASHINGTON — On a conference call Sunday afternoon with House Republicans, NBC’s Kasie Hunt reports, President Trump issued this warning: The GOP needs to pass his tax plan or it will lose in the 2018 midterms.

Failure, he said, would be “really bad” for the party in next year’s elections, while success would be “like skating on ice.”

But that focus on the tax plan’s electoral politics — when the midterm cake is already being baked — ignores the more important policy questions right now.

- Will the GOP tax plan really RAISE taxes on middle-class and upper-middle-class Americans? Given that the initial plan eliminates personal exemptions (replaced by a larger standard deduction), the nonpartisan Tax Policy Center said one-quarter of American taxpayers would pay higher taxes by 2027, including 30 percent with incomes between $50,000 and $150,000 and 60 percent of those making between $150,000 and $300,000.

- How much will the plan add to the deficit? The Treasury Department announced Friday that the federal budget deficit increased to $666 billion in the just-completed fiscal year – up from $585 billion last year. And that’s significant, because the Tax Policy Center says the GOP tax plan would reduce revenues by $2.4 trillion over the first 10 years (or $240 billion per year).

- How much will the wealthy benefit vs. everyone else? Since the GOP proposal, among other things, eliminates the estate tax and lowers taxes for “pass-through” businesses, the same Tax Policy Center says that more than half of the benefits in the first year go to the Top 1 percent of taxpayers, while 30 percent of the benefits will go to the Top 0.1 percent.

- Are Republicans really going to tax 401k accounts? That has been one of the trial balloons that Republicans have released. “The proposals under discussion would potentially cap the annual amount workers can set aside to as low as $2,400 for 401(k) accounts, several lobbyists and consultants said on Friday,” the New York Times wrote. “Workers may currently put up to $18,000 a year in 401(k) accounts without paying taxes upfront on that money.” But before 8:00 am ET this morning, Trump popped this trial balloon. “There will be NO change to your 401(k). This has always been a great and popular middle class tax break that works, and it stays!” he tweeted.

- Do tax cuts always lead to economic prosperity? The basic rationale for cutting taxes is that more money in people’s pockets leads to economic growth. But do Americans, including the wealthiest, always spend that money? And how do lower tax revenues impact the budget? As NBC’s Benjy Sarlin writes, the lesson of Kansas’ tax cuts have become “Exhibit A” for Democrats “in their prosecution” of Trump’s tax plan. “It's routinely cited as evidence the new GOP proposal won’t grow the economy or pay for itself, and that proposed business tax reduction similar to [Gov. Sam] Brownback’s will create a new loophole for wealthy individuals to exploit.”

So as Trump tells Republicans that passing their tax plan would be good midterm politics for the party, the questions become: Is it good politics to raise taxes on the middle class and upper middle class? Is it a good idea to further increase the deficit (especially when the economy isn’t in recession)? And do the tax cuts benefit the wealthiest of Americans (including President Trump and member of his cabinet) more than everyone else? Because, if so, you could make a good argument that passing such a plan would hurt the GOP as much as it helps.

Democratic House challengers are starting to outraise GOP incumbents

As for the overall 2018 midterm environment, National Journal’s Josh Kraushaar makes an important observation: Democratic challengers are starting to outraise GOP incumbents. “Of the 53 House Republicans facing competitive races, according to Cook Political Report ratings, a whopping 21 have been outraised by at least one Democratic opponent in the just-completed fundraising quarter. That’s a stunningly high number this early in the cycle, one that illustrates just how favorable the political environment is for House Democrats,” he writes.

Now Nathan Gonzales, editor and publisher of Inside Elections, says that a better metric is comparing “cash on hand” between incumbents and challengers, since any challenger can have one big fundraising quarter. But if Democratic challengers keep up the pace, that could erase one of the big advantages of being an incumbent — money.

McCain’s not-so-subtle dig at Trump: It was wrong for wealthy Americans to avoid Vietnam over a “bone spur”

Today, President Trump meets with Singapore Prime Minister Lee, and he presents the Medal of Honor at 3:00 pm ET. But that Medal of Honor event now has THIS John McCain comment hovering over it: “One aspect of the (Vietnam) conflict by the way that I will never ever countenance is that we drafted the lowest income level of America and the highest income level found a doctor that would say that they had a bone spur. That is wrong. That is wrong. If we are going to ask every American to serve, every American should serve.”

Of course, Trump received a draft deferment for bone spurs. “Trump received five deferments during Vietnam: four for his studies in college, and one for — you guessed it — bone spurs in his heel,” the Washington Post writes.

Two counties defining the battle lines in the GOP’s civil war

Finally, don’t miss this dispatch from our colleague Dante Chinni: “On the struggling streets and in the crowded pews of Wilkesboro, N.C., voters sense that a conservative revolution has arrived, and Republicans here relish the thought of overthrowing the Washington establishment and remaking the party in their own faith-driven image. Sitting in a local diner recently, James Jones, 59, who voted for and supports President Donald Trump, smiled at the possibilities. ‘I think Trump is busting up the GOP, and I am so glad. I love it,’ he said. ‘We need a real party. We might keep the name Republican, but we need change.’”

Meanwhile, in wealthy exurban Columbus, Ohio, there is hope that Republicans will do what they always do, fall back in line for the good of the party, leaving plenty of room for the country club set that has long dominated its upper echelons. But there is also uncertainty. Jai Chabria, who once worked for Gov. John Kasich, a Trump critic and Republican establishment favorite, sees changes ahead. ‘I don’t think I can sit here and tell you what it is going to look like in 10 years, but it’s going to look radically different that it did before,’ he said.”