WASHINGTON — As vaccination rates rise and the country emerges from the Covid-19 pandemic, there are a lot of questions about what "normal" is going to look like.

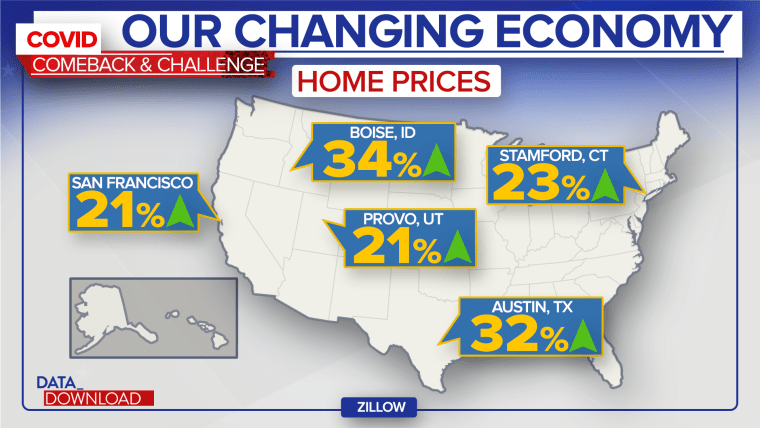

Social distancing and masking will wane and "days at the office" will become more common again, but sliding back into old routines and patterns might be a bit more complicated. Data around housing and transportation suggest that our everyday lives may be affected in more long-term, meaningful ways, such as the choices in where people live. Comparing home sale prices in April of 2021 to April of 2020 shows some clear winners.

The top five metro areas from price growth suggest a desire for more open space, or at least smaller cities. Boise, Idaho and Austin, Texas both saw growth of more than 30 percent. Stamford, Connecticut, outside of New York City, saw 23 percent growth and Provo, Utah grew by more than 20 percent.

But No. 5 on that list, greater San Francisco, suggests that all the talk of American cities emptying out may have been a bit overstated. The nation's big cities aren't going to be shriveling up anytime soon; people just seem to be reaching beyond them as well, and in some cases far beyond.

And all those population moves suggest bigger impacts beyond housing prices in how we live. More than a year of social distancing concerns may change how people feel about standing shoulder-to-shoulder on the morning train.

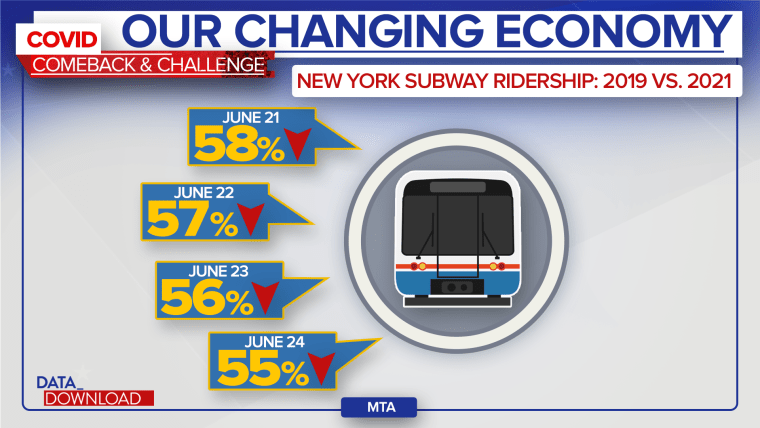

The nation's most used mass transit system, the New York City subway, is still far below where it was for pre-pandemic ridership.

On most days, ridership on the subway is less than half of what it was on the equivalent pre-pandemic day. A lot of that decline is likely due to people not going into the office for work. Currently, weekend ridership numbers are closer to where they were before Covid-19, but even those figures are down sharply, more than 40 percent, from pre-pandemic levels.

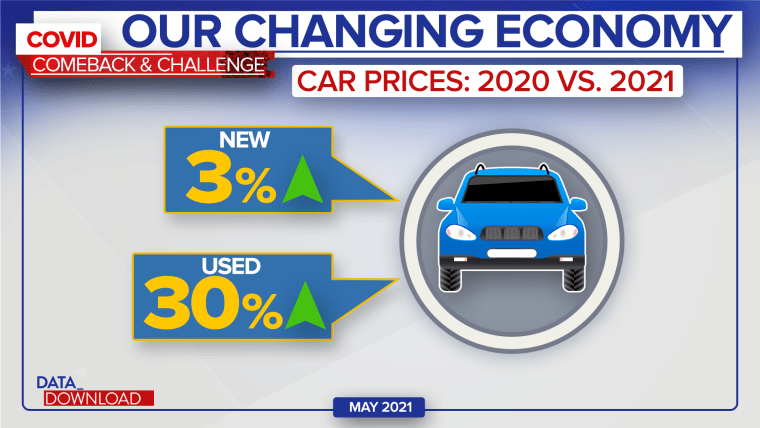

In another sign that having one's own personal space is very desirable post-pandemic, people are interested in buying cars again. Comparing the first quarter of 2021 to the first quarter of 2020, new car sales are up by almost 9 percent.

Hyundai and Toyota have led the way, with 28 and 22 percent increases over 2020 numbers, but all the major carmakers have seen a bump. And those numbers might be higher, but for supply chain problems for many automakers, particularly a shortage of the computer chips that are essential to manufacturing modern cars.

When the pandemic first hit, many automakers greatly decreased their production, expecting a collapse in new car sales. They also canceled orders for the parts. Now that car sales are up, they are playing catch-up. The message is hard to miss, however, as the economy heats up, Americans are discovering they want or need vehicles.

Another way of seeing that desire for wheels is an intense interest in buying used cars, made obvious by a massive spike in those prices.

In the last 12 months, the consumer price index for used vehicles jumped by nearly 30 percent. It surged by 7 percent in the last month alone.

Those are massive increases and there are several possible reasons behind them. It may be the shortage in available new cars pushed people into the used vehicle market. It could also be that, with the country slowly returning to normal and trips to the office looming, households have decided they need a car, particularly if people are leery about mass transit.

Regardless of the reason, however, inflation in used vehicles is driving a lot of the broader inflationary pressures in the economy as a whole. That’s probably a short-term blip, but other impacts will stretch further into the future.

The true nature of post-pandemic America is unknowable, of course. Beyond health concerns, the real impact of Covid-19 was the way it shook up the world. Just think of the different place the United States was in last July 4.

But these numbers — along with others from a long list of industries such as food service — suggest that people aren't expecting things to simply go back to the way they were. There were a lot of dramatic changes over the last 15 months and at the very least a lot of Americans seem to think they'll be living differently in the months ahead.