The first time I got one of my now-many student loan debt collection calls, I was mortified. Me? Behind on a payment? No, no, no. I was not going to be one of those. That is not a diss to people who fall behind on payments — millions upon millions of people living in America (and counting). Life happens; that I get. But I didn’t want it to become a regular thing for me.

It would mean that I was losing my fight to stay ahead of this debt. That would then mean that it was having an impact on my credit. And if it was having an impact on my credit, it would hurt me if I wanted to get a car, a house, one of those credit cards that can lead to racking up points so that I could take a damn vacation somewhere nice without having to come out of pocket as much. Beyond all of this, not being hounded by creditors was just its own peace of mind. I was determined not to lose mine.

Whatever needed to be done, whatever needed to be sacrificed, to make sure those payments were made on time was done. I operated this strictly for a significantly long time. As I said, I was determined.

Then things became harder than they needed to be. One employer owed me so much money during the summer of 2014 — well over $5,000 — and that spilled into the fall. Whatever else I brought in had to go to necessities. I was living check to check and constantly trying to collect as many of them as possible. And when your financial state is stuck in quicksand, it’s easy to slip and bust your ass on the ground. So here I was.

It got a little better, but it was so easy to fall back behind. The system was designed this way. I hated to feel like a statistic, some sob story. But life became more about mere survival than appeasing the people making my life a never-ending financial nightmare. Or, when I miraculously had the chance, helping other people through their own financial distress. My loans may have been devastating to me, but I had grown up seeing far worse devastation. So I helped when I could.

It has become easier to ignore my student loan oppressors over time because there are only so few people I ever actually speak to on the phone. That, and the robocalls are endless; I let the ignore and silent options on my iPhone serve their purpose. I assume no one means to call me unless the conversation has been previously scheduled or a blood relative over the age of 40 needs to voice their distress.

But eventually — unfortunately — I do have to make contact. So when I am good and ready, as my pops would say, albeit in a more financially solvent context, I dial that number. By good and ready, I mean when I am either prepared to make good on how much I owe in back payments, or if too many media entities owe me paychecks at once, I want to find out the bare minimum I need to pay to avoid defaulting on any of my loans. It’s not that big of a choice for me in the end: Settle up or snuggle up with your nightmare scenario.

They call my mother, too. She did cosign these loans— against her better judgment. In fact, they call her as much they call me. She’s become immune to this; she’s learned to ignore them. I hate that I have put her in the position to be harassed in that way. Every so often she will send me a text saying she picked up the phone and gave them some amount of money. She says not to worry about it. I tell her thank you, but that I wish she hadn’t given them anything. After all, she brought me up in Catholicism, so she should know that I can’t shake off guilt easily.

Yes, we could change our numbers, but that really doesn’t solve the underlying problem, now does it, beloveds? The debt is still the debt. Besides, to completely ignore a major financial institution to which you owe a large debt would be inciting the wrath of a major financial institution. I’d rather not.

Once I engage any of these people on the other end of the line, I get right to it. I give them my name and my Social Security number. They ask me to wait a moment for their computers to update. Then they ask would I like to pay the total outstanding balance?

I try not to laugh. Do you think I called to give you that much? If I did, I would have paid online, fool. No, this call is to perform damage control with what I have to offer. But cute of you to be that optimistic given your line of work.

I give just enough to avoid default. Just enough means, at minimum, $800 or so. But there are the times when the loan companies hear me say the word “no,” and their voices shift to a disappointed tone.

If they are genuinely nice people or new to their jobs, they will ask if I would like to explore the options available to me during times of financial hardship. I assume when my name appears on their computer screen, there is some indication that no such options exist; I have to inform them that no such options exist. Sometimes, they’ll offer to check just in case. They then return and confirm what I already knew to be true.

Then I get asked why I have fallen behind on payments. The question enrages me every single time, but I have to maintain my composure.

On second thought, no, I often do not, but I try not to be rude to people who haven’t been rude to me. It’s not because I fear they will hear the Lawry’s Seasoning in my voice and fall into stereotypes about Black people; I couldn’t give any less of a f--- about that. If they want to believe the worst, white people will think whatever they want about Black people no matter the setting, income, credit score or debt ratio. So it’s not that at all. I just try not to be rude.

It’s the southerner in me. My problems are not the fault of any of them—something I tend to say when trying to answer their frustrating line of questioning in an effort to get to the point and go on about my day.

Freelance writing and my various other hustles, which all fall under the scope of contract work, don’t make my life easier, but at the same time, I’ve come to realize that, even if I was earning an obscene amount of money, life wouldn’t necessarily be any better for me. It is a pain to be paid late and to have to essentially threaten to run up on somebody (legally or physically) to get paid, but with experience, you learn to better bob and weave with those companies that take longer than they should. The underlying issue is that I am required to pay an enormous sum of money per month by most American workers’ standards — all while simultaneously trying to eat regularly and not be homeless.

So, that’s why I’m late, and while I understand that none of the people who answer the phone are in control of their employers’ policies, they should all acknowledge that, by not offering to negotiate repayment terms under any circumstances, the whole system makes the situation all the more difficult. For them and for me.

I did try to refinance once. Very early on, actually. What ended this me was noticing that, at the time, most of those companies offering refinancing were trying to f--- me over even worse. One company in particular made an offer to somehow expand my debt from a 12-year repayment structure to a 30-year one without decreasing the monthly payments by any significant figure.

I stuck with the devil I had come to know.

What kills me about each and every one of the customer service reps is that they are keenly aware of how screwed I am in the situation. You want me to pay $800 a month on a 12-year plan with only two deferments? This sum on top of other bills — including some other student loans that covered expenses these other loans did not? In the United States of America? And not as a millionaire?

That’s what makes their repeated inquiries so frustrating. But their questions end up asked and answered.

Once I wrap my remarks, the people on the phone proceed to stop pretending they can be helpful and accept my payment. They know that there is no additional deferment available unless there is a natural disaster that significantly affects where you live. Likewise, they are fully aware that their employer, my lender and oppressor, will not lower my payments in favor of an extended repayment period.

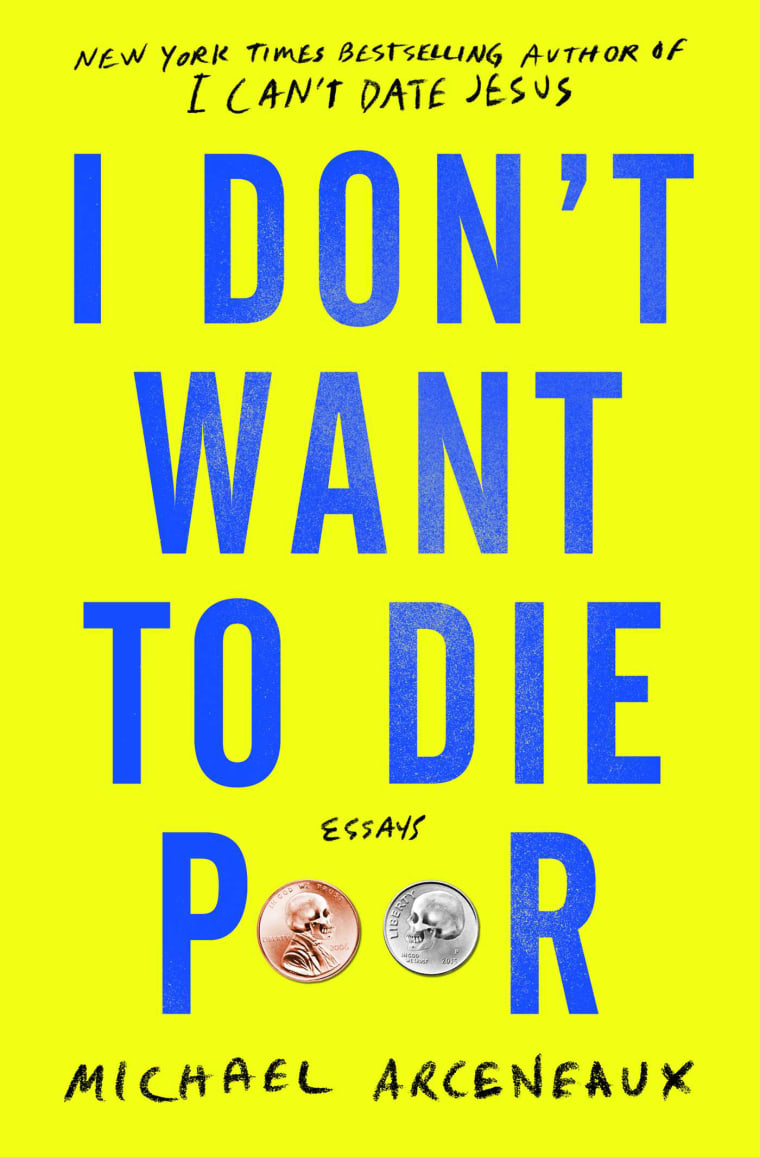

Excerpted from "I Don't Want to Die Poor" published by Atria Books, a division of Simon & Schuster, Inc. Copyright © 2020 by Michael Arceneaux