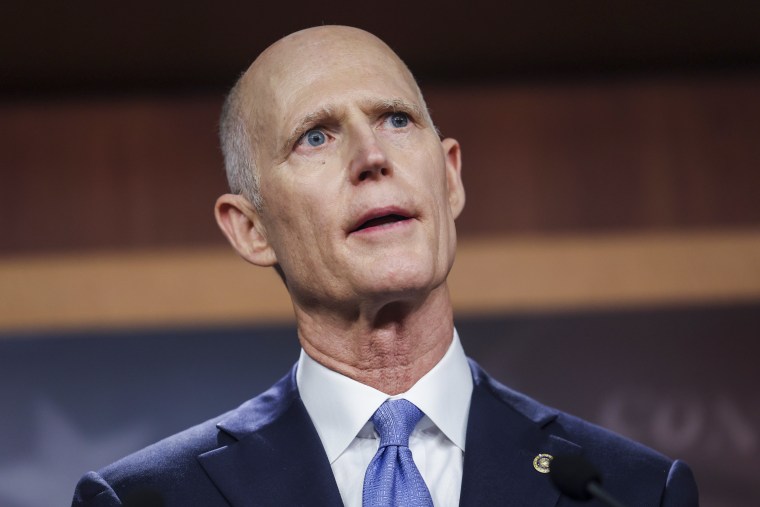

Sen. Rick Scott, a Florida Republican, is one of several lawmakers attempting to misinform the public about the Inflation Reduction Act, or IRA, and the much-needed infusion of cash it will provide to the IRS. In a letter sent on Tuesday, he warned constituents not to apply for positions with the IRS, pledging to “defund” the jobs if Republicans gain control of Congress after the midterms.

The senator’s warning to not apply for a public sector job was unusual. But more concerning was how the letter blatantly misstates facts and attempt to scare the public into thinking that the IRS will use the additional funding provided to hire thousands of armed agents and threaten Americans’ life and liberty.

More concerning was how the letter blatantly misstates facts and attempts to scare the public.

Scott added that “the IRS is making it very clear that you not only need to be ready to audit and investigate your fellow hardworking Americans, your neighbors and friends, you need to be ready and, to use the IRS’s words, willing, to kill them.”

This isn’t just misinformation — this is information that is designed to radicalize. And the consequences, as we’ve already seen, could indeed be disastrous.

Unfortunately, rather than appealing for a common sense of calm, several of Scott’s peers are actually doubling down. Sen. Ted Cruz, the junior senator from Texas, echoed Scott’s sentiments on Twitter, where he claimed the “Democrats are making the IRS bigger than the Pentagon, the Department of State, the FBI, and the Border Patrol COMBINED! Those IRS agents will come after you, not billionaires and big corporations!”

Gov. Ron DeSantis of Florida, quoted in Florida Politics, added, “Of all the things that have come out of Washington that have been outrageous, this has got to be pretty close to the top. I think it was basically just the middle finger to the American public, that this is what they think of you.”

This rhetoric is, quite simply, disconnected from reality. The IRA that Biden signed into law this past Tuesday provides a stable stream of funds over a 10-year period that will enable the IRS to hire replacement and new employees at an agency that has been struggling to perform basic tasks like processing tax returns and answering phones. On top of its current considerable challenges, the IRS has an aging work force, with an estimated 52,000 of its current 83,000 employees past or close to retirement age. Meanwhile, Congress is leaning on the IRS to not only collect revenues but increasingly to deliver benefits like pandemic relief stimulus payments, health care subsidies and refundable credits for things like child care, wage subsidies and electric vehicle purchases.

The IRA funding will enable the IRS to accomplish the basic tasks of tax administration that the American public deserves. But its added resources can also help the agency in a goal Republicans and Democrats should, in a sane world, be celebrating: evening the playing field by taking on the sophisticated and wealthy taxpayers who for years have had way too many opportunities to game the system and avoid paying their fair share.

Scott’s letter specifically referred to a since-removed IRS job posting that discussed hiring criminal investigation special agents, who are authorized to carry firearms. Of the roughly 83,000 IRS employees, only about 2,000 are special agents investigating crimes. And these are the only IRS employees authorized to carry weapons. The IRA does not seek to raise in any significant way the number of special agents, but rather seeks to increase the number of auditors and collectors, as well as IT and phone support.

More broadly speaking, these scare tactics are part of a century-long tradition of attempting to turn governmental agencies and agents into bogeymen. As usual, this mythologizing hinges on claims that Democratic-supported policies are existentially dangerous threats to basic American freedoms.

There are real consequences from these lies. The rhetoric can lead to physical harm for IRS employees. Recall that just over a decade ago, a longtime IRS employee was killed when a disgruntled pilot with an anti-IRS grudge flew a plane into an IRS office. The IRS has long been a target of extremists, and the single largest incident of domestic terror in the U.S. involved an attack on a federal building in Oklahoma, with IRS employees and their children at the building’s day care center among the victims.

Today, there are multiple videos on TikTok calling on citizens to take up arms against IRS employees.

Today, there are multiple videos on TikTok calling on citizens to take up arms against IRS employees.

At a broader level. these lies undermine the fragile trust that is the very foundation of our tax system, which relies on Americans to voluntarily pay their fair share.

To be sure, and as with almost all giant spending bills, there are legitimate concerns about the additional IRS funding. Congress needs to provide oversight for agency spending priorities, such as the pledge from Treasury Secretary Janet Yellen that the IRS will use the resources to target the wealthy and business taxpayers who contribute the most to our tax gap.

No one likes to pay taxes. The percentage of voters who support the additional IRS funding is only 40 percent, according to a Politico/Morning Consult poll, making it the least popular part of the IRA, with Americans having much more favorable views on the law’s caps on drug prices, investments in clean energy and its new corporate minimum tax provisions.

Scott and his ilk must love these polling numbers. And they appear more than happy to exploit them to rile up the base and scare Americans into thinking that the IRS is coming for them. Yet we would all be better served if politicians focused on legitimate concerns — and opportunities. Americans deserve a faster taxpayer service, and they deserve a system that investigates tax enforcement inequality, so that Americans who pay their fair share are not unfairly burdened by those who do not.

This should not be a partisan issue, as some Republicans, like Sen. Rob Portman of Ohio, have long championed.

It is time for politicians to tamp down the rhetoric and focus on improving the IRS. Can our elected officials wean themselves from the polarizing and dangerous demonizing of the IRS? Let’s hope so, before someone else gets killed.