According to F. Scott Fitzgerald, the rich are different than you and me. And when it comes to paying taxes, he’s absolutely correct. As Internal Revenue Service Commissioner Charles Rettig recently testified before Congress, the IRS may be losing $1 trillion in unpaid taxes every year. And, as a recent working paper co-authored by IRS researchers found, the vast majority of unpaid taxes is owed by rich people. The Treasury Inspector General for Tax Administration in a study looking at the tax years 2014 to 2016 has detailed how hundreds of thousands of wealthy taxpayers have brazenly failed to file any tax returns at all.

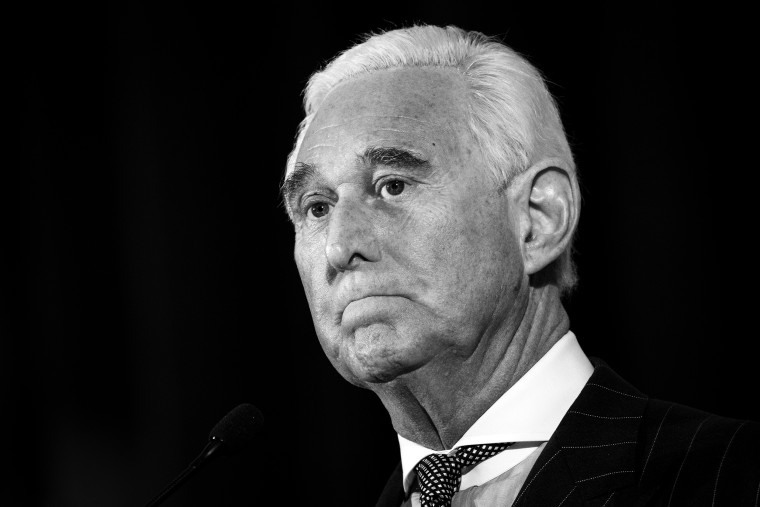

Roger Stone is a perfect example of this phenomenon. On April 16, the United States filed suit to collect over $1.5 million in federal income taxes, interest and penalties it says Stone and his family owe, dating back to 2007. (Stone vowed to fight the complaint, calling it “yet another example of the Democrats weaponizing the Justice Department.”)

There are myriad strategies to avoid paying taxes that cut out the employer middleman — if you know where to find them.

Those of us who work have employers who subtract a portion of our income tax bill from each paycheck and send it to the IRS throughout the year. But there are myriad strategies to avoid paying taxes that cut out the employer middleman — if you know where to find them.

The IRS alleges the Stones filed their tax returns late, failed to make estimated tax payments and did not pay the balances shown on their returns when they filed them, the lawsuit says, and when the IRS sent a notice and demand for payment, as required by law, the Stones more or less ignored the government. Using programs Congress meant for people with lesser means, they requested that the IRS accept a settlement for their unpaid taxes (called an offer in compromise, in tax jargon) or be allowed to pay the amounts due by way of a payment plan (called an installment agreement), the complaint says.

At the same time they were requesting clemency from the United States, the Stones allegedly allowed their unpaid tax bill to grow. When the IRS issues a levy to a bank, which is a way of taking any funds the taxpayer may have in the bank, it asks for accounts in the taxpayers’ names. The Stones allegedly avoided seizure of their bank accounts by simply depositing checks made out to Roger Stone and transferring other personal funds into accounts held by Drake Ventures, a limited liability company on which only members of the Stone family had signature authority. The complaint says this allowed the Stones to continue to use their funds but keep them in bank accounts that did not clearly belong to them.

According to the government complaint, Drake Ventures then paid for a "substantial amount of their personal expenses, including groceries, dentist bills, spas, salons, clothing and restaurant expenses." Drake Ventures also purportedly paid $140,000 as a down payment on the condominium in which the Stones live in Florida. The United States alleges in its lawsuit that Drake Ventures exists solely as a way for the Stones to disguise how they are paying for personal expenses.

In 2017, the Stones entered into an installment agreement with the IRS in which they agreed to pay almost $20,000 a month toward their unpaid taxes, with the payments allegedly being made from a Drake Ventures bank account. Pursuant to the allegations made by the United States, in 2019, after Roger Stone was indicted for lying to Congress concerning possible collusion between former President Donald Trump's campaign and Russia, his wife, Nydia, transferred their residence to the Bertran Family Revocable Trust, of which their children were the beneficiaries. This strategy, commonly referred to as a “fraudulent conveyance,” is a way that people keep assets away from their creditors, including the IRS. The complaint alleges that the day after this transfer was made, the Stones stopped making the installment agreement payments.

Stone is not the only high-profile taxpayer who seems to believe taxes are optional. In a 2008 New Yorker profile, “The Dirty Trickster,” Stone cited Roy Cohn, the New York political operative, whose "absolute goal was to die completely broke and owing millions to the I.R.S," Stone said. "He succeeded in that." Stone apparently views Cohn as a role model in more ways than one.

As the complaint shows, the IRS is not without tools to address taxpayers who use schemes — such as those the U.S. says the Stones employed — to avoid paying. Every state has laws to prevent debtors who can pay their debts from avoiding payment by transferring and hiding their assets (these are often referred to as “fraudulent conveyance statutes”). When the United States becomes a creditor of a taxpayer, it has the right to use these state statutes. However, the investigation necessary to build a case to show that a taxpayer has made fraudulent transfers or has put assets in the name of another person or entity to keep them from being seized by the IRS takes time, effort and money.

The loss of experienced collection personnel and budget squeezes has focused the IRS on easier collection actions that show quick results. It is much easier to seize the wages or bank account of a middle-class employee or to take a refund from someone claiming the earned income credit than it is to build a case against someone with means. In many cases, the IRS is now simply outgunned by the wealthy delinquent taxpayer.

But Stone’s purported actions were not sophisticated or well hidden, unlike other well-heeled people who use multiple entities or offshore accounts.

At a recent hearing of the Senate Finance Committee — as evidenced by the opening statements of Sen. Ron Wyden, D-Ore., and Sen. Mike Crapo, R-Idaho — both sides of the political aisle recognized it is time to fund the IRS so it has the resources to deal with wealthy tax cheats. Building up this cadre will take effort and resources.

At the same time, the IRS has to provide better service to the vast majority of compliant taxpayers, who are the backbone of the system. Today far too many cannot get the IRS to answer its phones, read correspondence (some of which is required to be sent in by 1990s-era fax machines) or process tax returns. Failing to rebuild the IRS could have disastrous results.

Knowing Roger Stone, he’s bound to spend the next several months complaining that he’s being persecuted by the government. But he’s no victim. Americans who have made millions but fail to pay their fair share undermine the entire system. The rich are no exception.