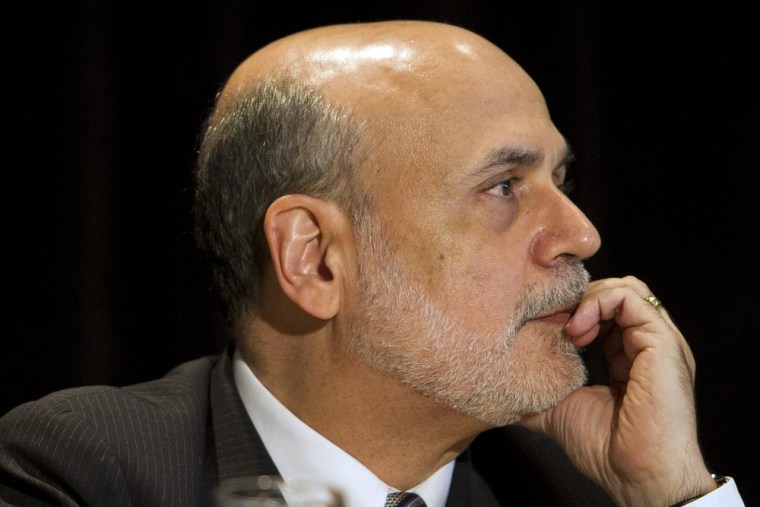

Federal Reserve Chairman Ben Bernanke said the central bank could begin tapering bond purchases aimed at boosting the economy later this year. But he stressed that could change, depending on how the economy performs.

In prepared remarks for his semiannual monetary report before the House financial services committee, the Fed chairman said, "With unemployment still high and declining only gradually, and with inflation running below the Committee's longer-run objective, a highly accommodative monetary policy will remain appropriate for the foreseeable future."

Bernanke said that if the incoming economic data confirms a strengthening labor market and inflation moving back toward the central bank's 2 percent target, "We anticipated that it would be appropriate to begin to moderate the monthly pace of purchases later this year."

But he emphasized that this plan is not a "preset course."

He also reiterated previous remarks that the central bank could continue to reduce the pace of asset purchases through the first half of next year, ending them around midyear so long as the economy continues to improve and inflation normalizes.

Bernanke also sought to draw the distinction between reducing asset purchases and providing accommodative monetary policy, saying "We are relying on near-zero short-term interest rates, together with our forward guidance that rates will continue to be exceptionally low—our second tool—to help maintain a high degree of monetary accommodation for an extended period after asset purchases end, even as the economic recovery strengthens and unemployment declines toward more-normal levels."

(Read more: Bernanke: Highly accommodative policy needed for 'foreseeable future')

According to the Fed's forecasts from the June meeting, unemployment is expected to be about 7.2 percent to 7.3 percent by the end of 2013 and 6.5 percent to 6.8 percent by the end of 2014.

GDP growth is also expected to be 2.3 percent to 2.6 percent this year before accelerating to 3.0 percent to 3.5 percent next year.

In May, Bernanke spooked markets when he told Congress that the central bank could start to reduce its $85 billion per month in bond purchase within in the next few meetings, leading markets to anticipate a reduction in bond buying as early as September. He later said that the bond-buying could eventually end by mid-2014.

Fears that the Fed would start paring back its bond purchases in coming months had sent Treasurys falling with yields rising as high as 2.76 percent earlier this month. But following the release of the testimony, Treasurys yields fell back below 2.5 percent as investors were relieved that the central bank expects to remain accommodative.

Bernanke will deliver his testimony at 10 am, with investors likely to focus more intently on the question and answer session that will follow.

CNBC.com will be streaming the entire testimony and question and answer session.

—By CNBC's Justin Menza. Follow him on Twitter @JustinMenza.

More business news:

- McDonald's finance guide 'insulting' to low-wage workers

- Congress debates food stamp cuts as moms fret about feeding kids

Follow NBCNews.com business on Twitter and Facebook