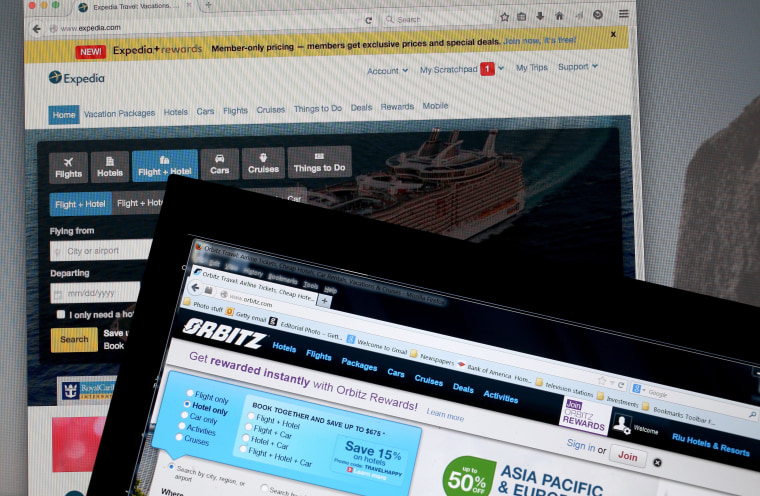

Expedia’s blockbuster purchase of Orbitz may not significantly change the competitive landscape for consumers but it still represents a dramatic move in the larger, ongoing battle for travelers’ clicks, dollars and long-term loyalty.

“I don’t see this as meaning less choice for consumers,” said Douglas Quinby, vice president of research for PhoCusWright. For one thing, he says, Expedia will maintain the Orbitz brand (as well as Travelocity, which the Bellevue, Wash.-based company also bought recently). For another, even with its new acquisitions, Expedia still faces plenty of competition from other industry giants like Priceline, smaller niche players and travel suppliers such as airlines and hotels.

As Quinby explains, the newly enlarged Expedia will essentially control 75 percent of the U.S. online travel agency (OTA) market, based on 2013 figures. However, OTAs handle just 16 percent of total bookings, meaning the company’s total is closer to 12 percent, hardly a monopolistic scenario.

Nevertheless, some analysts still believe Expedia’s moves will reduce consumer choice. “While Orbitz’s name will remain, the back-end content will essentially be the same as Expedia’s,” said Henry Harteveldt, travel industry analyst for Atmosphere Research. Factoring in Travelocity, “It’s like walking into three storefronts in a shopping mall that are really the same store — you lose the competition for promotional content, deals from suppliers and prices.”

What Expedia gains, on the other hand, is leverage with those suppliers. For several years, the OTAs and other third-party sites have been locked in a battle with direct suppliers over where consumers book their travel. To counter the comparison shopping that powers the OTAs’ business model — and to reduce the commissions they pay — the airlines and hotels have been offering incentives and discounts to travelers who book directly from their websites.

“[Expedia buying Orbitz] strengthens the distribution network and preserves the ability to comparison shop in the future,” said Charlie Leocha, chairman and president of consumer-advocacy group Travelers United. “It counters the monopoly power of the airlines.”

Unfortunately, says Harteveldt, that increased negotiating power probably won’t translate into better deals for travelers: “Expedia will have a lot more power in terms of their negotiating clout with travel suppliers,” he said. “That may mean that they can negotiate better prices but it’s more likely that they will use it to negotiate higher commissions.”

Ultimately, Expedia’s recent moves are an acknowledgment that, in travel, size matters. “This industry is fundamentally about scale,” said Quinby. “In order to compete, you have to have scale in terms of technology, marketing, inventory...”

In that light, Expedia’s growing stable of companies can be viewed as circling the wagons against a variety of other challengers, both large and small. Among them: Priceline, which owns Kayak, Booking.com and others; Amazon and Google, both of which have launched travel products in recent years, and newer, smaller companies, such as Hipmunk and HotelTonight.

At this point, the latter are essentially minnows nibbling around the edges of the industry’s leviathans; nevertheless, they may also provide a taste of things to come. With the likes of Amazon and Google testing the waters, “the smaller groups could become more attractive or worth more to an Expedia or a Priceline,” said Leocha. “There could be more acquisitions in the future.”