Banks are scrambling to beef up their Web sites by adding pie charts, budget calculators and other gizmos designed to help people manage their money.

The effort is aimed at rebuilding relationships with consumers still angry at the financial industry's role in the economic meltdown.

Banks want these tools to help customers get a better picture of their financial health by organizing scattered accounts, credit cards and investments. The thinking is that customers who feel more in control of their finances will see their bank in a better light, and turn there first when they need a new loan or want to open an IRA.

"The more informed customers are about their financial lives," said Michael Upton, a senior vice president at Bank of America, "the better customers they make for us in the long term."

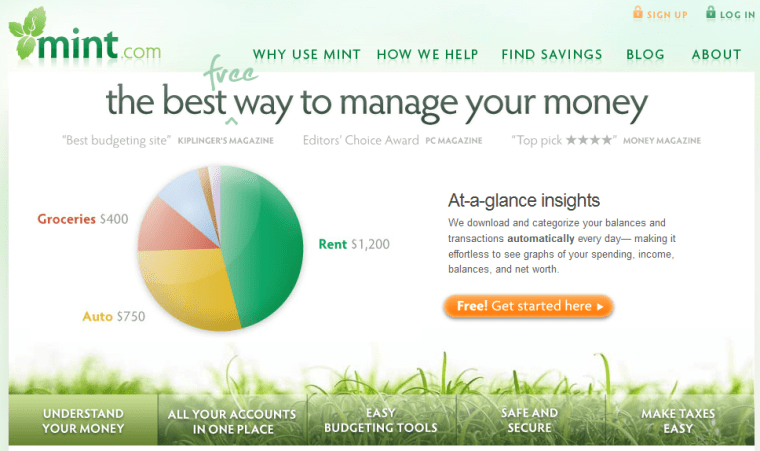

Personal finance add-ons are inspired by the success of independent Web sites. In particular, Mint.com, which launched in late 2007, caught the industry's attention with its ability to combine data from various accounts and present it in a way that gives consumers a clearer picture of their finances.

Industry watchers estimate about 60 million people in the U.S. currently do some banking online. The number of people using online personal finance management tools is much smaller, about 5 percent of that, or 3 million, but it is expected to grow rapidly.

That's one reason Mint.com commanded $170 million when purchased last fall by Intuit Inc., best known for the Quicken personal finance brand and TurboTax. It averages just over 400,000 users each month, according to ComScore, which tracks Web site use. That's a small number, but the technology Mint.com uses to analyze a consumer's data and suggest ways to save money makes it unique. Intuit is folding some of Mint.com's capabilities into FinanceWorks, the personal finance management software sold to banks by its Digital Insight unit. About 400 banks currently use FinanceWorks on their Web sites.

Smaller personal finance startups like Wesabe.com, known for its user forums, Jwaala.com and Geezeo.com are also signing up banks and credit unions, which then add their technology to their Web sites.

Online concerns

Less than half of all U.S. banks offer personal finance management. Smaller banks and credit unions are leading the pack in adopting these tools, said Jacob Jegher, an analyst for the consultant Celent.

Advice forums where customers can chat about their financial concerns are also starting to appear on credit union sites, a handful of which are powered by Wesabe. "They were really interested in that community part, and that's really where we focus with them," said Wesabe CEO Marc Hedlund.

Among big banks, analysts estimate about one-third currently offer some personal finance tools, like spending tracking and budgeting. These institutions will likely be slower to add some of the more elaborate features, like the ability to combine account data from different institutions.

Jegher said several issues are at play for big banks in the adoption of combining data, called aggregation. One is that their technology issues are more complicated, and often involve combining systems from serial mergers.

Concerns about online security and competition are also sticking points.

Wells Fargo has limited personal finance tools. Its "My Spending Plan," categorizes spending and has a budgeting function, but pulls data only from the bank's own accounts, which critics say limits its usefulness.

That's because it is common for people to have a dozen or more accounts with different banks, brokers and credit card companies. "Consumers want to simplify their financial lives," said Mark Schwanhausser, a senior analyst with Javelin Strategy and Research. "There's a screaming need for someone to come through and help them organize, and pull all that account data in one place."

"I would argue that personal finance management without aggregation is a failed model," said Peter Glyman, CEO of Geezeo.com, which sells its technology to small banks and credit unions. "It's that holistic view of your finances that brings the actual value."

One exception among big banks is Bank of America, which has a feature called "My Portfolio" that can aggregate account data from competitors. About 20 percent of the people who use online personal finance management access it through My Portfolio, said Schwanhausser.

Trust in banks

Mint.com, Wesabe.com and other sites like Rudder.com are still adding users. But banks that offer aggregation and can get their sites up to speed quickly will have an advantage. By a 2-to-1 margin, most people still trust their own institution to keep financial information safe, said Schwanhausser.

That sentiment is supported by Celent's Jegher. "For me, it's a natural fit for this type of activity to be done through a bank," he said. Consumers are repeatedly warned against divulging login and password information for their financial accounts, he noted, but they must break those rules to use a third-party site. "It goes against what I would call the best practices for your bank."

A key advantage for banks is their ability to handle transactions. The only non-bank site consumers can currently use to pay bills or transfer money is Yodlee.com's MoneyCenter.

Banks should also start to draw more attention to their personal finance offerings by making them more prominent on their Web sites, said Schwanhausser. Making them landing pages once customers sign on, for instance, will increase interest and use.

After adding these features, the logical next step for banks will be extending them to mobile applications.

Only about 5 percent of banks and credit unions currently have limited apps for smartphones, according to Drew Sievers, CEO of mFoundry, which provides mobile banking technology. It will likely be some time before personal finance tools are widely available through those channels, because it's hard to convert the graphics and other features, he said. "I don't see it in 2010 being a bank priority," he said. "I think there are other things they want to get done first."