President Bush and Vice President Dick Cheney reaped tax benefits last year from the cuts that they pushed through Congress and that Democrats have criticized as a boon to the rich.

The government’s top two executives, both wealthy men, paid smaller shares of their income in federal taxes in 2003 than in the year before, according to returns released Tuesday by the White House.

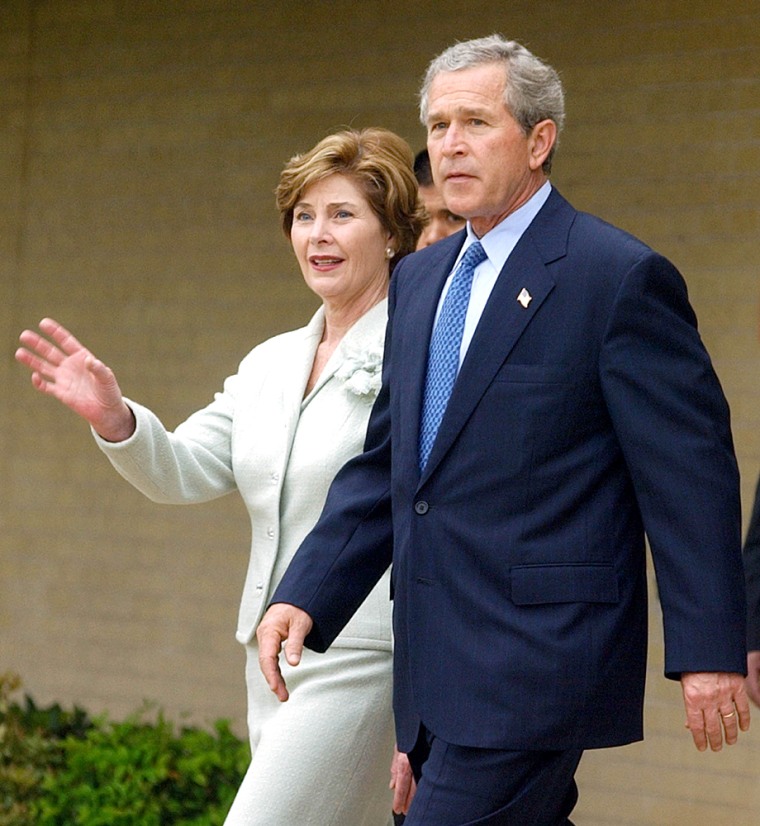

Bush and his wife, Laura, paid $227,490 in federal income taxes — or about 28 percent of their $822,126 in adjusted gross income. For 2002, the Bushes paid about 31 percent of their adjusted gross income — which was slightly higher at $856,056 — in federal taxes, for a total of $268,719.

The difference from one year to the next was even more pronounced for Cheney. He and his wife, Lynne, owed $253,067 in 2003 federal taxes — about 20 percent of their $1.3 million in adjusted gross income. In 2002, the Cheneys earned less but paid more, owing 29 percent — or $341,114 — of their $1.2 million in income.

Benefits from own tax cuts

White House spokeswoman Claire Buchan said the president and vice president join 109 million other Americans also benefiting from the tax cuts.

“And that’s had the effect of spurring economic growth and creating jobs,” she said.

Bob McIntyre, director of Citizens for Tax Justice, a liberal advocacy group whose statistical analyses are respected by mainstream economists, analyzed the returns and found the Bush-backed tax cuts saved the president nearly $31,000 on his 2003 bill over what he would have paid if there had been no cuts.

Cheney saved $11,000, mostly because the alternative minimum tax — designed to curb tax sheltering among high-income taxpayers — took back about three-quarters of the benefit he would have reaped from the cuts, McIntyre said. The Cheneys paid $47,198 in alternative minimum tax.

Among the cuts that were in effect in 2003 but not in effect in 2002 were further decreases in tax rates at all bracket levels, an expansion of the lowest 10 percent bracket and lower taxation of capital gains and dividends.

“What can you say? They’re rich, so you’d expect them to benefit from a tax cut for the rich,” McIntyre said.

Bush: Tax cuts for all

Bush sees the tax cuts passed on his watch much differently. He has traveled the country touting them as the reason the economy is rebounding and urging that they be made permanent. He also likes to say that he believes tax cuts should go to all taxpayers.

“I insisted, on the tax relief, we cut the rates on everybody who pays taxes,” Bush said in El Dorado, Ark., last week. “Some of them howled up in Washington when I did that. See, my attitude is, government ought not to play favorites.”

The White House distributed the Bushes’ and the Cheneys’ federal form 1040s for 2003, along with attached schedules, two days ahead of the April 15 tax filing deadline.

Most of the income for Bush and his wife, Laura, came from the $397,264 he reported earning as president and $401,803 in interest from trusts that hold their assets, plus $23,417 in dividend income.

Cheney and his wife had more varied sources of earnings, including the vice president’s $198,600 government salary; the $178,437 he earned in deferred compensation from Halliburton Co., the Dallas-based energy services firm he headed until Aug. 16, 2000; capital gains of $302,602, Lynne Cheney’s income from work at the American Enterprise Institute, a Washington-based think tank; and compensation from her service on the Reader’s Digest board of directors in 2003.

Book royalties

Lynne Cheney also brought in $327,643 in royalties from her books, “America: A Patriotic Primer,” “A is for Abigail” and soon-to-be-released “Fifty States.” The Cheneys donated almost all of the book proceeds to charity. The couple also earned $627,005 in interest that was exempt from taxes in 2003.

Halliburton has been awarded as much as $6 billion in contracts in postwar Iraq but has been under scrutiny for allegedly overcharging the government. Cheney earned money from the company because he elected in 1998 to recoup over five years a portion of the money he made in 1999 as the company’s chief executive officer.

“The amount of deferred compensation received by the vice president is fixed and is not affected by Halliburton’s current economic performance or earnings in any way,” said a statement released by the vice president’s office.

Cheney’s office has repeatedly stated that the vice president doesn’t have a financial stake in the success of Halliburton nor has had any involvement in defense contracts.

Charitable donations

The Bushes reported itemized deductions of $95,043, bringing their taxable income down to $727,083.

The deductions included $68,360 to churches and charitable organizations, including Evergreen Chapel at Camp David, Md.; Tarrytown United Methodist Church in Austin, Texas; St. John’s Church in Washington, D.C.; the M.D. Anderson Cancer Center in Houston, Texas and the federal government’s Combined Federal Campaign.

The Cheneys reported itemized deductions of $454,649, including Lynne Cheney’s book royalties, making their taxable income $813,266.