When it comes to having student debt, Latinos fare far better than their black and white peers. But that might not be as good as it seems, according to a new report out today connecting debt to the wealth gap between whites and people of color.

Only 21 percent of Latino households have student debt, according to a new report, “Less Debt, More Equity: Lowering Student Debt while Closing the Black-White Wealth Gap,” released Wednesday by the New York-based public policy organization Demos.

But the figure is likely due to Latinos attending and graduating from college at lower rates than both black and white households and to Latino households having much lower wealth levels than white families, the study finds. Previous research also suggests Latinos may be more averse to taking on student loans even as they face substantial financial needs for school.

Attaining a higher education in the U.S. has long been seen as the great equalizer. “We see education as a way to level the playing field among low-income families, low-income communities and communities of color,” Mark Huelsman, the report’s lead author, told NBC News.

But the current education system is rife with racial and class disparities contributing to an expanding wealth gap between whites and people of color, according to the “Less Debt, More Equity” report. The study assesses the impact of public policy on the wealth gap.

“In an age where inequality is becoming maybe the biggest public policy item to deal with, it’s important to note what communities are dealing with and where the wealth gains we do see are going,” Huelsman told NBC.

“The more we require borrowing for college for certain families and the more we require certain students to go in to debt, not only do we risk people not going and people not completing, but we also put some communities further behind in trying to have the same financial security that primarily white families and higher-income families have now.”

For black students in particular, going to college usually means taking on debt to get a post-secondary degree, while white households borrow less often and in smaller amounts. Despite lower rates of college completion, 54 percent of young black households have student debt, compared to 39 percent of all young white households.

According to the report, the top 1 percent of U.S. households controls 42 percent of the nation’s wealth, and nearly half of the wealth accumulated over the past 30 years has gone to the top 0.1 percent. At the same time, wealth held by the bottom 90 percent of U.S. households continues to shrink, as people of color are a growing percentage of the U.S. population.

Those trends, the report says, have converged to produce a wealth divide by race and class. The average white family owns $13 for every $1 owned by a typical black family, and $10 for every $1 owned by the typical Latino family, according to the report.

Forgiving all student debt regardless of income is not the answer, Huelsman said.

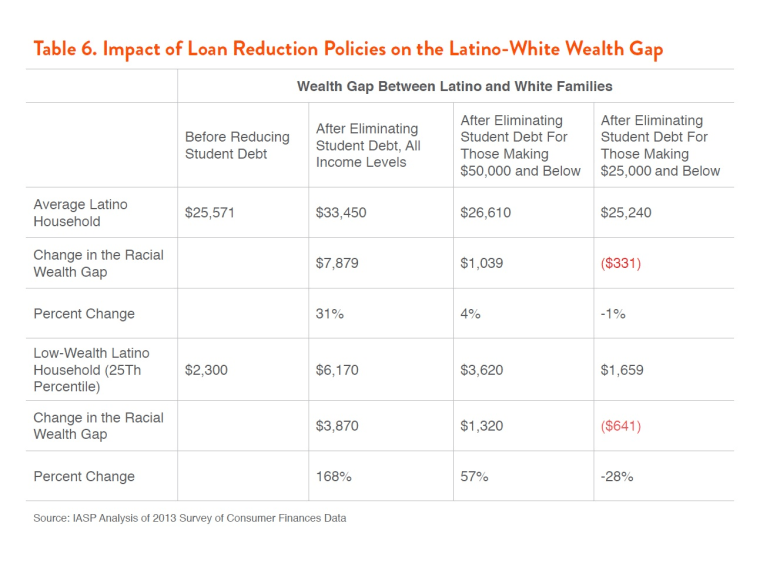

“The most interesting thing we found,” said Huelsman, “is that if you forgive all student debt you’d actually see a big increase in the (wealth) gap and that’s because unlike other forms of debt, the amount of student debt you have does not necessarily predict the likelihood you’re going to struggle to pay that off.”

Huelsman said people who take on lots of debt for graduate school or law school, for example, can also have very high wealth.

The report recommends instead that policymakers consider a debt-elimination policy that targets low-income households because it might dramatically reduce the wealth divide between white and Latino and black families, both among median as well as low-wealth households.

The report’s main findings also include:

--- Among typical households age 25-40, whites have 10 times the wealth of blacks.

--- Black student borrowers are more likely to drop out with debt than white students.

--- Higher earnings often come with a degree. Still, nearly 36 percent of young black households making $50,000 a year or below have student debt, compared to 15.5 percent of young white households.