Later this week, Apple Pay is expected to make its debut, joining Square, Coin, Venmo and other products looking to put paper currency out to pasture. Cash, the headlines suggest, is going the way of the Dodo.

Don't tell that to Kenneth “Cat Daddy” Pogson, one of the guys behind the Voodoo Doughnuts mini-empire. Customers could only pay for a bacon maple doughnut with cash when the first location opened in Portland, Oregon, in 2003, and that's still the only payment accepted at the company's four locations today.

"At this point, it's like 'This is the way we have been doing it, it's working great, why should we change it?'" Pogson told NBC News.

One major reason business owners — especially at bars, restaurants and coffee shops — decide to go cash-only is because of processing fees that can eat away as much as 3 percent of already small profit margins.

"It really does put pressure on businesses," Kenneth Nye, owner of Ninth Street Espresso in New York City, told NBC News. "You are selling something that costs $3 and the credit card companies want to take 3 percent of it and often a flat fee on top of that. At that point, we have lost our profit margin."

Nye's business has remained cash-only even as it expanded from one location in 2001 to four spread throughout New York City today, with another due to open in Brooklyn soon.

He doesn't like the idea of handing money over to credit card companies and he said that payment processing software that relies on the Internet can slow down transactions when the connection slows or goes out completely — a problem that comes up at least four times a year, he said.

Pogson originally decided to go cash-only to protect the slim profit margins made on his doughnuts. Now, thanks partly to appearances on shows like "Portlandia" and "Anthony Bourdain: No Reservations," money isn't the primary concern. During the peak of the busy July tourist season, he said, his flagship location can move as many as 20,000 doughnuts in a single day.

Accepting only cash, he said, adds to the "cool factor" of Voodoo Doughnuts and helps take a stand when the average American household has nearly $7,000 in credit card debt.

"When I was young in college I had too many credit cards, and I paid the price, heavily," Pogson said. Taking cash these days, he said, is "definitely more idealistic than an economic decision."

Cash rules everything around me

The iPhone 6 and Apple Watch were not the only big revelations in Cupertino last month. Apple's CEO also unveiled the company's long-awaited near-field communication (NFC) payment system, which will let people pay for stuff by simply waving their phones at a compatible payment terminal.

"In many ways, Apple Pay is nothing new," Nick Holland, senior payments analyst at Javelin Strategy & Research, told NBC News. He pointed to Google Wallet, which let people do the same thing three years ago.

"But Apple could normalize mobile payments and bring it into the mainstream," he said.

Before you throw your wallet into the trash can, know that even stratospheric growth means a very tiny percentage of people will be paying with their phones.

In 2019, Javelin predicts, Americans will spend $53.1 billion with their phones — a huge jump from the $0.4 billion they spent in 2012. But as a piece of the whole pie, $53.1 billion is still only 1.24 percent of point-of-purchase sales.

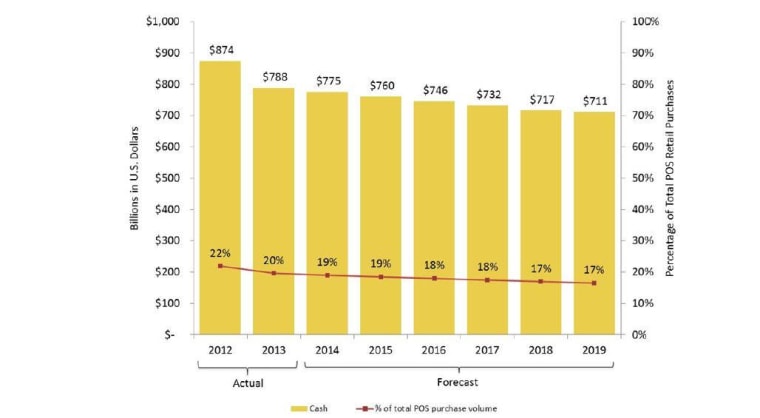

Compare that to cash, which is predicted to lose $100 billion in point-of-sales volume by 2019. Even with that dramatic drop, it will still comprise 17 percent of sales.

"Cash is declining, but after debit and credit, cash is the primary way people pay at checkout," Holland said. "Cash is still a good chunk of retail transactions and will remain so for the foreseeable future, even with Apple Pay."

For merchants, cash comes with no extra fees, plus they don't have to deal with credit card companies when a stolen card is used in their store. Bloomberg reports that Apple Pay will make money by taking a cut from the banks.

NBC News reached out to Apple to confirm the launch date of Apple Pay and ask how the service would make a profit, but the company did not respond.

Consumers, the numbers suggest, prefer the convenience of credit and debit cards. On Yelp, some users seem downright hostile to restaurants that only take cash.

Nye has had people accuse him at the counter of trying to avoid the IRS when they are told that they can't pay with a credit card.

"A lot of people have a negative association with businesses owners who only take cash, as if they're trying to be crooked or shady and that always drives me crazy," he said.

"You hear all of these horrible, snide comments coming from people, but you are paying for this somewhere — that 3 percent is going to come out of your pocket at some point, and you are just feeding Amex or MasterCard or someone else a lot of money."

Not that every customer minds carrying cash. Kirsten Smith, 34, of Lafayette, Indiana, started her own Etsy shop filled with "Zippy!" organizational wallets, which she originally designed so she could parcel out cash from her monthly budget in categories like "groceries" and "gas money."

"It keeps you from overspending," she said. "Sometimes it's a little too convenient to pull out your debit card."

How businesses will make it easier than ever to spend

In the future, even Apple Pay might seem like an inconvenience. On the streets of Manhattan, there are still plenty of coffee carts that deal mostly with the crumpled dollar bills and loose change of midtown commuters. Blue Bottle Coffee has gone in the exact opposite direction thanks to a partnership with Square.

Now, whenever someone in New York City or San Francisco is craving a chicory-kissed New Orleans-style iced coffee, they can simply open the Square app and order. Baristas get alerts when someone who has ordered is walking towards the store.

From the customer’s point of view, they simply walk into a Blue Bottle with an iced coffee waiting for them and walk out without swiping a card or handing over cash — they are automatically charged once they leave the café.

"Increasingly, you will start to see payments move to the background, while the focus is more about the actual retail experience," said Holland, the Javelin Strategy & Research analyst.

He cited Uber, the ride-sharing app that charges people for rides after they leave the car. Cover provides a similar experience for paying restaurant bills.

Even in that brave new future, many consumers and businesses will rely on a a tried-and-true payment method: paper money. It certainly has served Pogson and Voodoo Doughnuts well.

Yes, multiple studies have shown that people spend more money in stores when paying with a debit or credit card. But with a thriving business and a few handy ATMs, Pogson feels good about his decision.

"We have stuck to our guns this long," he said. "Yes, it annoys some people, but it's like, 'Sorry, we can't help you ... next?'"