With consumer confidence at a nine-year low and the stock market stumbling, President Bush faced a daunting task Tuesday as he sought to reassure Americans on the economy while urging Congress to pass his new tax-cutting plan.

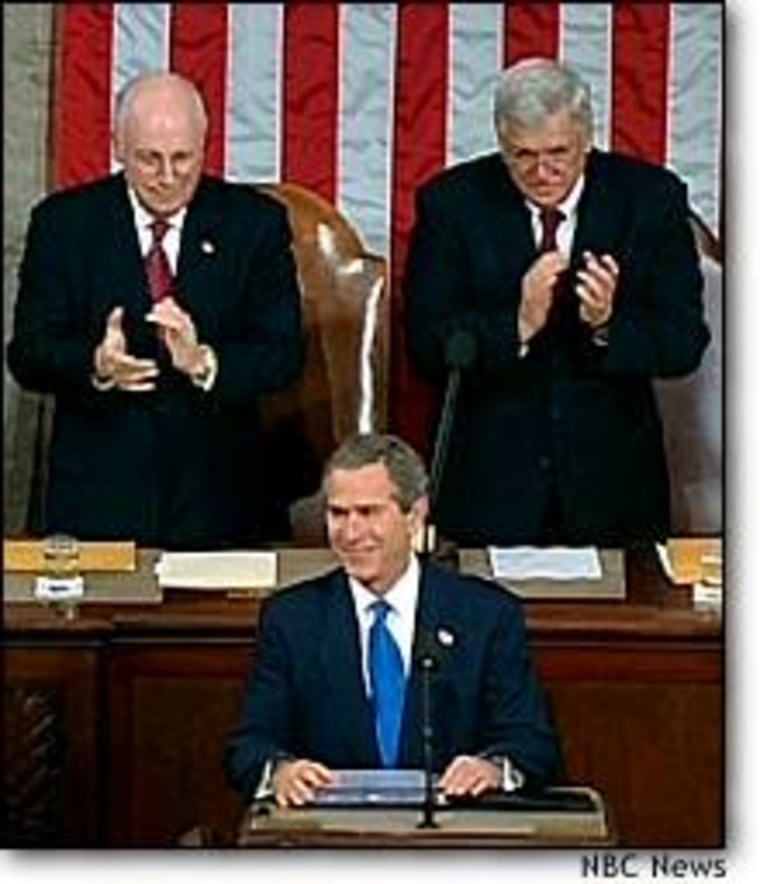

Bush used his State of the Union address to urge congressional passage of his $674 billion economic program, arguing that the proposed tax cuts are the best way to encourage job creation and improve investor sentiment. “Our first goal is clear: We must have an economy that grows fast enough to employ every man and woman who seeks a job,” Bush said. “Our economy is recovering, yet it is not growing fast enough or strongly enough.”

While Bush declared that the economy is no longer in recession, there is no question that the economy could use a boost. By most estimates gross domestic product grew at a minimal rate of less than 1 percent in the fourth quarter, its worst performance in more than a year, and few forecasters expect substantial improvement in the current quarter.

“There is good reason for consumers to be losing confidence,” said Mark Zandi, chief economist of Economy.com, a research firm. “The economy is struggling.”

He and other analysts agree that uncertainty about a possible war in Iraq is the main factor weighing on sentiment among consumers, investors and business executives, leaving war and the economy inextricably linked. But while the parameters of Bush’s economic proposal are clear, any additional clarity on the timing and likelihood of a war could provide at least a modest boost to confidence.

“The president has no magic bullet,” said Lynn Reaser, chief economist at Banc of America Capital Management. “It will be impossible to convince Americans that conditions will improve immediately, because it will take some time. The Iraqi situation will not be solved in a week.”

But she said Bush’s speech, by clarifying the U.S. position on Iraq, “could help bolster the confidence in the righteousness of our current position.”

In his speech, Bush said Iraqi leader Saddam Hussein has shown “his utter contempt” for the United Nations and must be brought to account unless he disarms. He said Secretary of State Colin Powell will go to before the U.N. Security Council next Wednesday to present intelligence about Iraq’s weapons programs.

Reaser stressed that even a quick resolution to the tension over Iraq will hardly be a panacea for an economy that has lost 1.6 million jobs over the past two years. The assumption is that a resolution of the crisis will lead to lower oil prices and a more bullish stock market, sparking a cycle of renewed business investment and hiring, but that theory has yet to be tested.

Bush also used the speech to resurrect a proposal that would partly privatize Social Security, by allowing younger workers to invest in market-based “retirement accounts” that would be under their own control. And he urged Congress to add a prescription drug benefit to Medicare as part of a program to reform the health care system.

While Bush was upbeat about the potential of the economy and the stock market, he could hardly afford to minimize the pain of millions of working poor and unemployed.

For the first time since the Sept. 11 attacks, Bush faced serious questions about his leadership. Most Americans don’t approve of his handling of the economy, according to the latest polls.

Halfway through his term, with one eye on re-election, Bush clearly is mindful of the fate of his father, who lost his 1992 bid for re-election largely because of concerns over a weak economic recovery.

“He’s got to be scared of looking complacent,” said Ethan Harris, chief U.S. economist for Lehman Bros. “He’s got to be scared of repeating his father’s mistakes.”

Harris said it was too soon for Bush to signal that he is ready to compromise on his economic package, which calls for an elimination of the tax on personal dividends and an acceleration of income tax rate reductions. Bush and his top aides have been promoting the plan heavily over the past three weeks, and Congress will begin focusing on it this week in a hearing before a House-Senate joint committee.

Zandi said rapid congressional action is essential if the tax-cut plan is to have any impact at all on the short-term economic outlook.

“If the Bush plan were passed it would be helpful, but it has to be passed soon,” said Zandi. “The economy is struggling now, and it needs some stimulus.”

He said he hoped to see some signals soon that the White House is willing to consider elements of Democratic proposals that include more short-term stimulus, including aid to hard-pressed state and local governments.

In a year when the economy faces the potential fiscal drag of $50 billion or more from state budgetary shortfalls, Democrats signaled the importance of the issue by tapping Washington Gov. Gary Locke to deliver their televised response to Bush’s address.

“People are clearly worried about terrorism and Iraq but those concerns should not overshadow the pressing needs of the people here at home,” Locke said.

He criticized Bush’s economic plan as “upside-down economics. It does too little to stimulate the economy now and does too much to weaken our economic future.”

Despite the drop in consumer confidence reported by the Conference Board Tuesday, analysts noted that consumer spending has been holding up fairly well. New-home sales surged to a record rate in December as consumers hurried to take advantage of low mortgage rates, and sales of existing homes were stronger than expected last month. Auto sales appear likely to exceed year-earlier levels in January, propelled higher by heavy promotions including manufacturer’s rebates of up to $4,000 on some models.

“Iraq is sort of an excuse for whatever ails us,” said Jim Glassman, senior economist at J.P. Morgan Chase. “Housing is still booming. It’s not like the economy just froze.”

He said passage of Bush’s plan on dividends could mean a quick 10 to 15 percent increase in equity values. But he also said the uncertainty over war is keeping the market under pressure.

“Investors would like to get this out of the way,” he said. “It has to clear the air before people are confident.”