AT&T promises "more bars in more places" — but which places? Verizon Wireless proclaims "it's the network" — but does the network cover you well in the places you live, work and travel?

Until now, cell phone users have had no detailed and impartial way to assess and compare which network offers the best data and voice service where they use their phones.

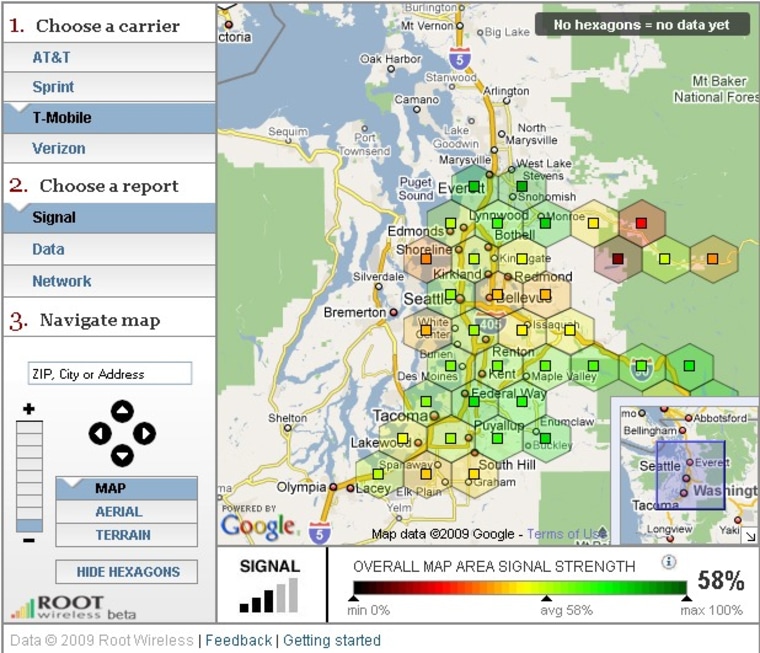

Root Wireless Inc., a Bellevue, Wash., startup, aims to change that. Root's colorful online map, which debuted last week on CNET.com and is currently usable only by consumers living in the eight U.S. markets analyzed so far, shows voice and data signal strength for each of the four major U.S. carriers. An intriguing plan calls for building out map coverage through 200,000 volunteers nationwide, all armed with a data-gathering app on their smartphones.

"This definitely has the benefit of being an objective source," said Charles Golvin, an analyst with Forrester Research. "It seems like a valuable service, potentially."

Consumers Union policy analyst Joel Kelsey, who has seen Root's map, said, "It seems to me to be much more accurate than a theoretical coverage map based on where towers are sited. And it's good for consumers to be able to compare using impartial data."

The Roots map can sequentially show the same region's voice and data coverage from the four major U.S. cellular providers, Verizon, AT&T, Sprint and T-Mobile. The map can be clicked to display a conventional, aerial or terrain view, the latter useful for seeing "shadows" where coverage is blocked.

In each hexagonal cell, measuring several square blocks, Root ranks and color-codes voice-signal strength, from 0 to 100 percent. Clicking the colored square within each hexagon shows the average percentage of optimal voice-signal strength there.

For example, at an intersection near my Seattle-area house, the map showed Verizon offered 30 percent, AT&T 75 percent, Sprint 87 percent and T-Mobile 46 percent. A single click switched the view to data coverage, showing no mapping yet for Verizon's data service but 3G coverage from AT&T of 226 kbps downloads and 147 kbps uploads.

A static table at the bottom of the screen provided interpretive numbers: the minimum, maximum and average speeds produced by each carrier's data network.

Clicking on the Network tab revealed nearby areas that showed zero signal-strength bars, failures to access the network despite signal strength, or "hot zones" that have various service problems.

Initially, the Root map is accessible only through CNET.com, as part of its library of cell phone reviews. CNET isn't promoting the map, but it's available by clicking "check coverage" directly under the reviewed phone's name. Checking it out is difficult, because it is currently available only within selected cell-phone reviews, and only to CNET visitors in the eight markets — Chicago, Dallas, Los Angeles, New York, Orange County, San Francisco, Seattle and Washington, D.C. — where Root has done its own mapping.

Another 12 markets are slated to be mapped by year-end: Atlanta, Baltimore, Boston, Denver, Houston, Miami/Ft. Lauderdale, Minneapolis, Philadelphia, Phoenix, San Diego, St. Louis and Tampa/St. Petersburg.

CNET says that while the Root program is in beta, visitors can increase their odds of seeing the map by clicking on reviews of smartphones, not conventional models. The site promises access to the map from all its cell phone reviews once the beta period ends, probably in January.

Perhaps the most innovative aspect of Root's offering is its expansion plan. The company is looking for 4,000 volunteers — 1,000 per carrier — in each major market, and fewer in smaller markets. They will download a small application, available in about a month, onto their Android, RIM or Windows phone. An iPhone version is problematic, because that phone doesn't run background apps, said Root co-founder and chief executive Paul Griff.

The app will run in the background, periodically sending information on signal strength to Root's servers. Eventually, Root would like a cadre of 200,000 volunteers constantly monitoring the networks nationwide.

Putting a network-testing app on a smartphone and giving it to people who hike in the back country as well as driving down the Interstate will help build coverage maps in rural areas. That's something the cellular carriers have had a hard time doing, because their testing equipment is so bulky it usually has to be driven, noted Bryan Darr, president of network-data compiler American Roamer.

But Root's plan raises a lot of questions. First, what about privacy? Submitting data on network performance necessarily requires identifying the location of each phone making submissions. Essentially, each volunteer's whereabouts would be constantly monitored.

Griff said personal information will be stripped from the submitted data. "We've been through numerous privacy audits," he said. But that may not provide enough reassurance for some.

Then there's power consumption. The GPS chipset essential to the app's function is a notorious power hog. But Griff said the app will consume less than 5 percent of the battery's power and normally will use only 1 percent.

What about bandwidth consumption? Most data plans are unlimited, so that's less of a problem, Griff said. The app sends small data packets and advises of its consumption rate. And the more volunteers come forward, the lower the demand will be on each person's bandwidth.

What's in it for the volunteers? They'll get access to a personalized Web site showing the data they contribute. They'll see actual network performance displayed on their phones, which can be compared to the bars displayed by the carrier. And they'll get the ability to instantly file complaints about data hangs or dropped calls and to point out problem spots they encounter.

"We think these features will be useful and attractive to tech enthusiasts," Griff said.

Crowdsourcing will not only build out the map. It will also allow adding the element of time, showing which hours in which locations provide the best and worst coverage, Griff said. It will also allow mapping coverage of providers aside from the largest four.

Root Wireless doesn't face a lot of competition. Consumers Union, which publishes Consumer Reports, prints an annual article scoring network quality in about 20 markets, based on between 60,000 and 100,000 survey responses from cell phone users, said Kelsey, the Consumer Union analyst. But that's not the same as impartial, quantitative assessments accurate down to the street address, he acknowledged.

Deadcellzones.com has mapped reports of problem areas from about 100,000 consumers, while signalmap.com (bearing the subtitle "Beta is an understatement") has mapped a few known trouble spots.

Aside from those sources, consumers seeking coverage information must rely on online maps from the major carriers. Verizon Wireless used its coverage map last week in a new ad aimed at showing its 3G data coverage exceeds that of AT&T.

Most of the providers' maps assess voice signal strength and the level of data service available, though not always in fine gradations and not based exclusively on actual testing. Granted, their availability is a huge step forward from earlier days of cellular communications. Even in the 1990s, it was impossible to get coverage data from the carriers, even for reporters. They had it but wouldn't share it.

But their maps shows far less than Root's and aren't based on exclusively on impartial, in-the-field data.

Root plans initially to make money from its map by sharing ad revenue with CNET.com. Its second market will be an as-yet undisclosed major retailer of cell phones and service plans, which will use it to optimally match handsets to customers based on where they'll be using their phones.

A study shows that idea would be well received. CNET recently did an online poll of 2,300 visitors showing that 26 percent of respondents have returned a cell phone phones because of poor service, and that 46 percent think there's not enough information on service quality when buying a handset. Nearly half said they'd be very or somewhat likely to switch providers with their next handset.

How about selling the service to the providers themselves? It's not in the plans right now, said Griff. But "it's possible that a carrier might take the position that 'we'll tell you if we think someone else would offer better service for where you use your phone,'" said Forrester's Golvin. "I think carriers realize the more detailed information they provide, the more likely it is the customers they win will stay."