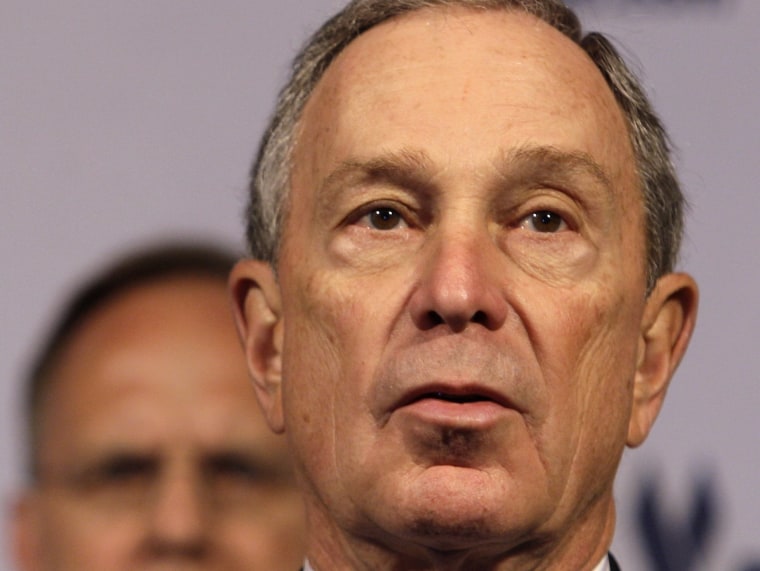

As Congress debates sweeping legislation aimed at guarding against another financial meltdown, Mayor Michael Bloomberg has become Wall Street's spokesman and defender amid a chorus of populist voices.

With President Barack Obama set to visit New York to push for passing financial reform, the billionaire mayor, who got his start on Wall Street in the 1960s and is considered a national expert on financial matters, argues that too much regulation could endanger the economy as much as others say it would protect it.

"The bashing of Wall Street is something that should worry everybody," Bloomberg declared last week.

"We're on their side," he said this week.

The Republican-turned-independent mayor's positions have made him a lone wolf among left-leaning officials in the city. Local lawmakers and others rallied at City Hall on Tuesday in support of financial reform, some holding signs that read "Goldman Suchs."

Bloomberg plans to attend Obama's speech at The Cooper Union college Thursday but demurred when asked whether he was concerned about what the president would say.

"He hasn't run his speech by me yet," Bloomberg quipped Tuesday.

White House press secretary Robert Gibbs said Wednesday that Obama would use the moment to remind the American people what is at stake and to press Congress to pass regulations "so that we don't find ourselves at the mercy of a series of risky decisions as we have in the past."

The U.S. Chamber of Commerce, the nation's largest business lobby, opposes many of the proposed reforms and prepared to run a full-page advertisement in Thursday editions of The New York Times to coincide with Obama's visit. The ad says the legislation is flawed and prominently quotes Bloomberg saying Congress should be doing "what's right for the country, not what is politically popular at the time."

Bloomberg's chief argument in the financial reform debate is that companies will take their business to other countries if the federal government restricts the industry too much and taxes it too high.

Top Obama administration adviser Jared Bernstein said Bloomberg has missed a larger point after a string of actions in the financial markets led to one of the gravest economic crises in decades.

"It would be highly irresponsible of us not to take the necessary steps to keep this from happening again," Bernstein said.

Bloomberg has been most vocal lately about two concepts that aren't even in the legislation being negotiated on Capitol Hill — a tax on bank liabilities and a tax on Wall Street bonuses.

The bank tax would raise an estimated $90 billion over the next decade. Obama proposed the idea separately in January, but New York's Democratic Sen. Charles Schumer has proposed including it in the financial reform bill.

Some lawmakers also have separately called for a tax on bonuses.

Bloomberg, who worked as a salesman on the equities desk at Salomon Brothers in the 1960s and '70s before founding the financial information company Bloomberg LP, says a bonus tax would drive out workers.

"If you want to worry about a few guys that got big bonuses, let me tell you, they will find some place to work in this country or elsewhere," the mayor said last week.

"Those people bring in business," he added. "That's why they get paid those bucks."

The financial industry employs about 8 percent of working New Yorkers and generates 40 percent of the city's business taxes and personal income taxes. For every billion dollars in Wall Street profits, the city reaps $70 million in direct taxes plus indirect benefits from money spent in the city by financial workers.

David Yermack, a finance professor at New York University's Stern School of Business, said Bloomberg's arguments aren't likely to have much effect on the debate in Congress.

"If you're the mayor of a city and it's your largest industry — he's got clear reasons to want to keep it in business and thriving," Yermack said. "But this bill is going to be hashed out in the committee rooms in Washington."

While Bloomberg and Obama disagree on several concepts in the financial reform package, there also is common ground.

Congress is considering provisions that would govern previously unregulated derivatives, create a council of regulators to detect systemwide financial threats and establish a consumer protection agency.

The Bloomberg administration says the mayor backs those concepts, although it's unclear whether he supports the stricter derivatives regulations being pushed by some Senate Democrats.

A provision that gets little attention but is high on Bloomberg's list of concerns is one that would essentially restore states' authority to regulate the activities of national banks.

Bloomberg wants to protect federal pre-emption of state banking laws, and he says the measure would lead to "chaos" because it would allow state attorneys general to go after companies for violating laws in states where the companies don't even do business.

He also doesn't support a rule that would ban deposit-taking banks from proprietary trading operations such as owning hedge funds.

"That's the way they hedge their positions, that's the way they make their money and support their other businesses, and if they can't do it here, they can do it elsewheres," Bloomberg said Tuesday.