A second straight month of lackluster hiring by American businesses is sapping strength from the economic rebound.

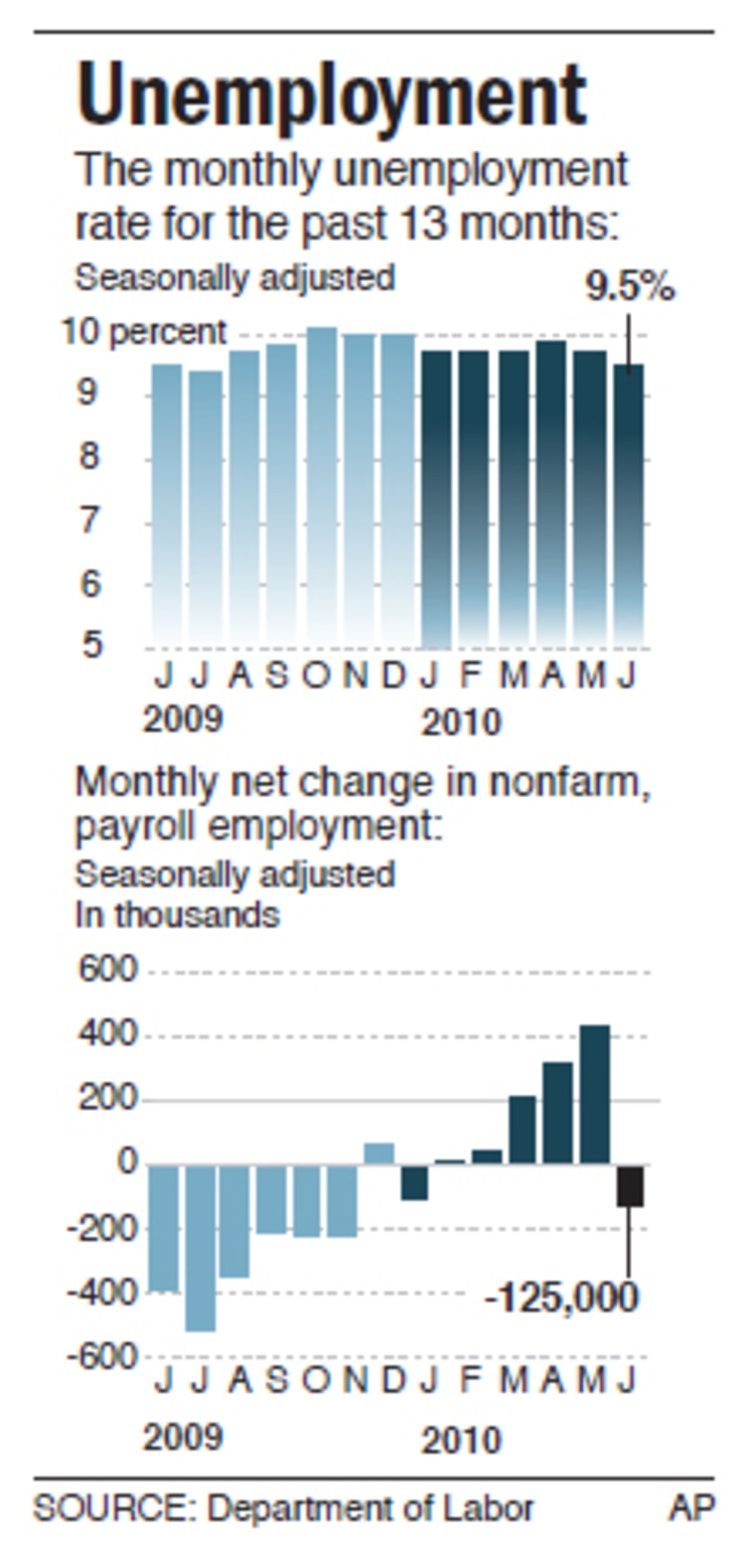

The jobless rate fell to 9.5 percent in June, still far too high to signal a healthy economy. It came in slightly lower than the month before only because more than a half-million people gave up looking for work and were no longer counted as unemployed.

The private sector added just 83,000 jobs for the month. Looked at from that angle or almost any other, from a teetering housing market to falling factory orders, the recovery is limping along as it enters the year's second half. And that is when the benefits of most of the government's stimulus spending will begin to wear off.

The fate of the economy will hinge on whether it can stand on its own. President Barack Obama acknowledged the slow pace of the recovery and used the new jobs figures to argue for more stimulus spending and extended unemployment benefits.

"We're not headed there fast enough for a lot of Americans," the president said. "We're not headed there fast enough for me, either."

Overall, the nation's total payroll actually shrank last month by 125,000, the first decline in six months, the Labor Department said Friday. The loss reflected the end of 225,000 temporary jobs helping the U.S. Census Bureau complete its 10-year head count.

Readers: We want to hear from you about Millennial job discrimination

The 83,000 jobs added by the private sector was a better performance than in May, when private job creation nearly stalled. But it fell far short of what the economy needs — at least 200,000 jobs a month — to bring down the unemployment rate.

Nobody, from Obama to Federal Reserve Chairman Ben Bernanke to private economists, expects that anytime soon. And the government has mostly exhausted its realistic options for nudging the economy along faster.

Benchmark interest rates, which at low levels can encourage borrowing to spur economic growth, are already near zero. Republicans in Congress object to additional stimulus spending.

Unemployment is expected to stay above 9 percent through the midterm elections in November. And the Fed predicts joblessness could still be as high as 7.5 percent two years from now. Normal is considered closer to 6 percent, and economists say it will probably take until the middle of this decade to achieve that.

The jobless rate did come down in June from 9.7 percent the month before. But that was mainly because 652,000 people abandoned their job searches.

Even among Americans with secure jobs, confidence is fading. One gauge of consumer confidence fell in June to about 53, down nearly 10 points in a single month. And it's well below the reading of 90 typically seen in a healthy economy.

Add to that jitters over Europe's debts, an edgy stock market and cautious consumer spending, and the result is an economy essentially moving sideways. It's no surprise that businesses are reviewing their orders and seeing no reason to add to payrolls.

Few big companies say they plan to step up hiring in the second half of the year. Most auto, airline and railroad companies, for example, say they expect little or no job growth, blaming weak demand.

One that does plan to hire, Chrysler Group LLC, expects to add engineers and other workers as it updates its aging line of cars and trucks. The company has announced 1,000 factory jobs in Detroit to meet demand for the new Jeep Grand Cherokee SUV.

But other companies, like American Airlines, have no plans to significantly boost hiring this year. And major railroads, which have furloughed thousands since the recession, say they have no plans to add employees in the coming months.

In June, manufacturers, the leisure and hospitality industries, temporary staffing agencies, and education and health services providers all added jobs. Retailers, construction firms and financial service providers cut payrolls. So did state and local governments, which are wrestling with budget shortfalls.

On Wall Street, stocks sagged yet again on the news. The Dow Jones industrial average finished down 46 points, its seventh consecutive losing session. The Dow lost more than 10 percent of its value in the second quarter.

Trying to put a positive outlook on the report, Obama said it showed that "we are headed in the right direction." At the same time, he acknowledged there is a "great deal of work to do to repair the economy and get the American people back to work."

His options are limited. Senate Republicans concerned about record budget deficits this week blocked his efforts to extend unemployment benefits for millions of out-of-work Americans.

"The two things that are growing fastest in this Democrat economy are the size of the federal government and the crushing burden of the national debt," said Senate Republican leader Mitch McConnell of Kentucky, who led opposition to the extension.

All told, 14.6 million people were unemployed in June. An additional 11.2 million have given up their job searches or are working part-time but would prefer full-time work. That adds up to nearly 26 million Americans, and an "underemployment" rate of 16.5 percent.

Eric Model, co-owner of Seal & Co., a shop in Summit, N.J., that sells accessories and toys, said he has not replaced the two back-office workers he let go two years ago. Not including a summer hire, Model has four employees, plus himself.

"It would be nice to get some support," Model said. "But I don't want to go out on a limb and hire somebody, anticipating things will improve. I would rather run with low expenses."

Those Americans who still have jobs drew smaller paychecks last month. Average hourly wages fell 2 cents to $22.53. Workers' hours were cut, too. Those factors could dampen consumer spending in the months ahead and further weaken the recovery.

It all threatens to perpetuate a vicious cycle for the economy.

"It is a Catch-22 situation," said Sung Won Sohn, professor at California State University, Channel Islands. "Businesses are reluctant to hire for fear of a 'double-dip' recession. Without jobs, people are watchful of their spending, a danger to the recovery."

AP Business Writers Tom Krisher in Detroit, Harry Weber in Houston, Joshua Freed in Minneapolis, Christopher Leonard in St. Louis and Samantha Bomkamp and Anne D'Innocenzio in New York contributed to this report.