Consumers eager to learn about their credit history began asking for free copies of their credit reports Wednesday, but many were having trouble using the Web site built by the nation's three credit bureaus.

Starting Wednesday, consumers in the western United States were entitled to one free credit report each year beginning Dec. 1, using a Web site called AnnualCreditReport.com. Visitors choose which of the three bureaus — Equifax, Experian or Trans Union — they want to obtain their report from, and they are redirected to the individual company's Web site.

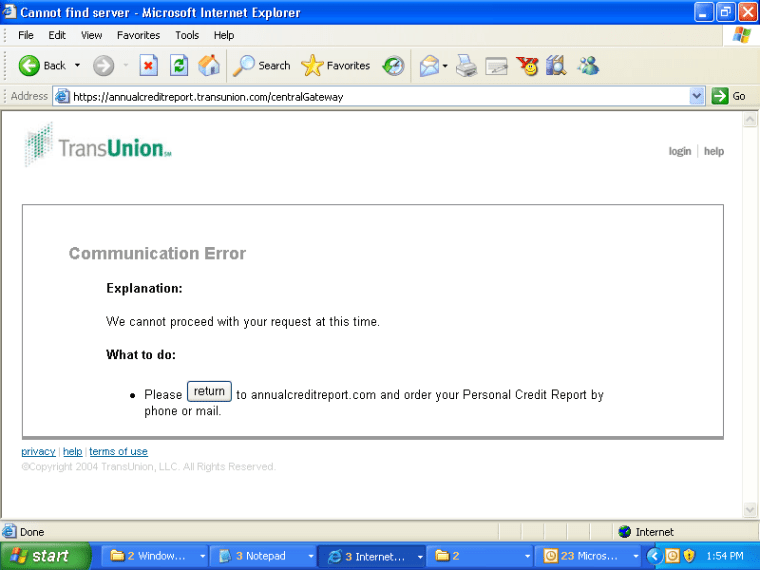

Some consumers told MSNBC.com they received error messages when they were redirected to the individual bureaus' sites. MSNBC.com employees experienced the same trouble attempting to obtain credit reports from Trans Union and Experian. Equifax reports were available.

"As usual, the credit industry is impossible to reach. I tried for more than 30 minutes to get my free report and was unsuccessful. Their error message recommended I mail in for it," wrote one consumer, who asked that his name be withheld. Said another: "So much for new credit report ... this is what I got ... No backend server available for connection: timed out after 10 seconds."

At Experian, after filling out the requisite forms, the firm's Web site repeatedly generated a simple message: "The page cannot be displayed."

At Trans Union, visitors were told to order their credit reports by telephone or regular mail. Trans Union's Colleen Martin confirmed her firm's site was having trouble, and she asked consumers to be patient.

"We are working on it as we speak, adding capacity," Martin said. She also encouraged consumers who didn't need their report right away to wait a few days.

David Rubinger, a spokesman for Equifax, said his firm's site was up and running normally. "We've had no problems," he said. He didn't know how many people had visited the site on Wednesday, but said, "I'm sure volume is high."

Don Girard, a spokesman for Experian, acknowledged his firm's site had first-day difficulties, but said it was functioning well by the end of the day Wednesday.

He also acknowledged a frustration raised by several MSNBC.com users: They got about halfway through the process of getting their Experian report then were booted out of the system, and when they returned they were told they already had received their free report for the year. A message on the Web site then urged them to pay for a fresh copy.

One consumer who went through that Web site trial was livid.

"I spent 20 minutes trying to find a number to Experian where a live person would answer and another 30 minutes trying to get someone to provide me with my free credit report that I was never able to look at," wrote Jeremy Smith of Utah. "I was finally transferred to a very unhelpful woman ... who told me I was out of luck. She also told me that I should just buy the report if I wanted to 'see' it again."

Girard said consumers who encounter this problem should explain the situation and mail in their request to Experian.

"To anybody we've inconvenienced, we apologize," he said.

In addition to the Web site, there are alternate methods for consumers to get their reports. They can call a toll-free number, 877-322-8228, or send written requests to Annual Credit Report Request Service, P. O. Box 105281, Atlanta, GA 30348-5281.

The free annual credit checkups were mandated by the Fair and Accurate Credit Transactions Act, signed into law last December by President Bush. The law includes a number of provisions designed to fend off identity theft, which hits millions of U.S. consumers each year.

"This is an important new right for consumers," said Peggy Twohig, assistant director in the Federal Trade Commission's division of financial practices.

A number of other Web sites offer what are described as free credit reports, but all require trial subscriptions to credit monitoring services. The new Web site is free of marketing, but consumers who march through the process of getting their credit report will find plenty of advertising at the end of the process. At Trans Union, for example, consumers are given the opportunity to pay $5.95 for a glance at the credit score along with the free credit report. Trans Union's service also, by default, gives the firm the right to send e-mail offers to consumers after requiring that they enter an e-mail address. Consumers can uncheck that preference.

Only Western states, for now

Only residents in the Western part of the United States can access the free reports currently. The region includes Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, New Mexico, Nevada, Oregon, Utah, Washington, and Wyoming.

The FTC is allowing the bureaus to roll out the service gradually to avoid being overwhelmed. The Midwest gets added to the system in March, the South in June. Residents in Eastern states will have to wait the longest, until September.

The next step: Correcting errors

The launching of the free credit report service will be watched carefully by consumer advocates. Several studies have shown that credit bureau data are riddled with errors. A study published in October by the National Association of State Public Interest Research Groups indicated four in five credit reports contain some error.

Mistakes can be as simple as a mistyped address or as complicated as a list of defaulted loans taken out by an identity thief in the victim's name and never repaid.

Privacy advocate Rob Douglas urged consumers to quickly take advantage of the Web site, and be prepared for some unhappy surprises.

"I think there will be a more than a substantial number of people who will discover there are errors on their credit report," he said.

"Whenever I'm asked what it is someone can do to protect themselves from identity theft, the first thing on the list is regularly checking their credit report. You don't want to discover the problem while you are in the process of a major purchase."

Consumers can dispute errors by following the instructions listed on the credit reports they receive. Procedures may differ slightly among companies.

In 2000, the three credit bureaus were fined $2.5 million by the FTC for not answering calls to toll-free numbers set up so consumers could dispute inaccuracies in their credit reports. The system was overwhelmed by complaints, and not enough employees were hired to handle the call volume, the FTC alleged. Last year, Equifax was fined again for the same problem.

Twohig said she was hopeful the bureaus would be prepared this time for an increase in complaints following the rollout of free credit reports.

"The bureaus are aware that's a likely result," she said. "The whole idea of rollout is so they can see how it goes and increase staff, so they can adjust as the nation comes online."

Consumer attorney David Szwak, who regularly sues credit bureaus on behalf of consumers, said free credit reports are a good idea — but they are only a first step. The process of fixing errors can be painstaking, he said.

"Just because you get a copy of the credit report doesn't mean you can get the errors corrected," he said. "What I would tell consumers is as soon as you are able to, get a copy of the report. Then, be sure you dispute everything that's wrong on there and follow up. And if don't get satisfaction, find an attorney. (Your credit) is your most valuable property right."

Bob Sullivan is author of "."