After seven seasons delving into New York's advertising industry and American culture in the 1960s and 1970s, AMC's hit show "Mad Men" aired its final episode on Sunday.

Although the series has ended, many of the iconic companies that ad man Don Draper and his fictitious team pitched in the '60s and '70s are still around today. In fact, they've performed quite well in the past five decades.

According to trading pros, there's still money to be made — and lessons to be learned — from "Mad Men"-mentioned companies.

In season 5, Don Draper and Roger Sterling pitched their ad agency to materials giant Dow Chemical. Draper said that although the company already had "diverse and charismatic" products like Zip Tape and Styrofoam, it keeps coming up with new ideas because "even though success is a reality, its effects are temporary."

Draper claimed his agency could bring even more success to Dow Chemical's brands.

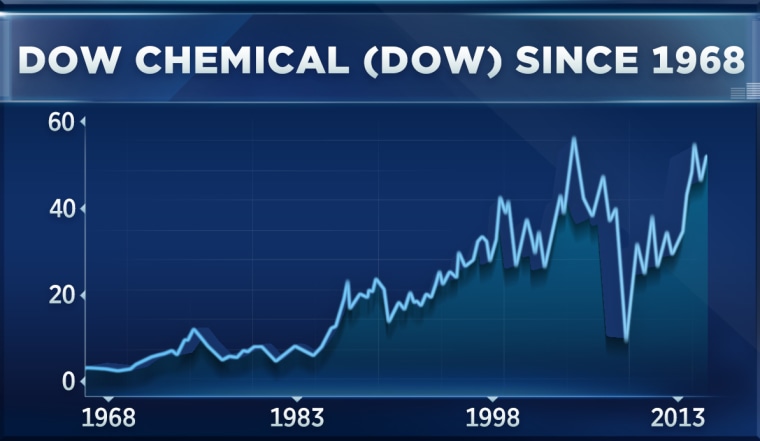

Dow Chemical has been around since the late 1800s, and currently has a market cap of more than $59 billion. Since January of 1968, in the heart of the "Mad Men" era, the stock is up more than 1,400 percent.

According to Triogem Asset Management's Tim Seymour, Dow Chemical is still a good buy today. "Their patent portfolio, their innovation, this is why you own the company. I would actually stay long."

Food companies have been a recurring theme throughout the series, with mentions of everything from Popsicle to Patio Cola. But it was Don Draper's season 6 pitch of chocolate juggernaut Hershey that triggered one of the show's most memorable moments.

Draper began his pitch by recalling a childhood story when his father bought him a chocolate bar, calling Hershey the "currency of affection." But a moment later, Draper breaks down and admits that he was actually an orphan.

Hershey has appreciated a whopping 9,147 percent since 1968, but as Stuart Frankel's Steve Grasso noted on CNBC's "Fast Money," the stock is "having a tough time this year...down a little over 7 percent year-to-date."

Regardless of performance this year, many of the iconic brands profiled on "Mad Men" are likely to continue to thrive, Grasso said, calling Hershey and Dow Chemical "hereditary brands."

"They are the brands that not only placed their flag of dominance in the ground early but have adapted and changed to fit different needs," he said.

That dominance, according to Grasso, has allowed companies like Dow Chemical and Hershey to "become so big that the possibility of toppling them has become terribly difficult."

Brian Kelly of Brian Kelly Capital said that long-term success, in many cases, is "a direct result of the power of branding. There are plenty of chocolate makers...but consumers buy Hershey's because they trust the brand," he said.

Kelly drew a comparison between the companies of Don Draper's day and one enterprising tech company of today.

"This is why I say Xiaomi is not a threat to GoPro," he said, referring to the new Chinese entrant into the action camera market. Kelly said that unlike Xiaomi, GoPro CEO Nick Woodman isn't just building a device, he's "building a brand."