Trains, trucks and steel containers. To get a glimpse at how the economy is improving, you can parse all the normal indicators – jobless claims, mortgage applications, etc. – or you can look at the nation’s roads and rails.

Last year, American truckers hauled 6.2 percent more tonnage than the year before, the best showing since 1998, according to the latest figures released Wednesday by the American Trucking Association. A pickup in those numbers in the second half of the year bodes well for 2014.

Trucking is a good barometer for the overall U.S. economy because more than two-thirds of American manufactured and retail goods are carried by over-the-road freight transportation.

As that tonnage has bounced back from the Great Recession, the trucking industry has had to roll out more trucks to haul it. During the early stages of the recovery, the industry relied on spare capacity and held off on buying new equipment until trucking companies were convinced the recovery was going to keep on rolling.

Now that the recovery looks real, trucking companies are buying new equipment, according to ATA spokesman Sean McNally.

"December truck orders were just off the charts," he said. "We're seeing more fleets go out and buy new equipment in part because they need the extra capacity and in part because they have to start repacking older trucks that are on the road."

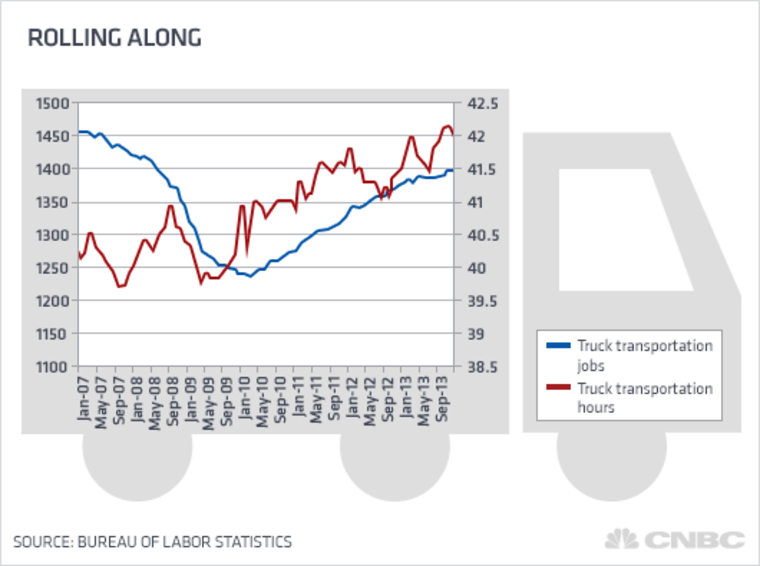

Those new truck orders, in turn, are helping drive the ongoing recovery for truck makers. And the fleet expansions have created more jobs for truck drivers. Since early 2010, overall employment in truck transportation is up 13 percent. And the average weekly hours worked in that employment segment is up 6 percent.

As shipping volume has expanded, makers and sellers of goods need more packaging to contain that cargo. Though shipments of corrugated boxes are still well below pre-recession levels, they've been expanding since early 2009.

Railroads are also seeing their share of increased traffic, thanks in part to the boom in oil and natural gas production in many parts of the country not served by pipelines. Railcar loadings are still below their 2006 peak, but they bounced back sharply after the Great Recession and continue to post new highs.

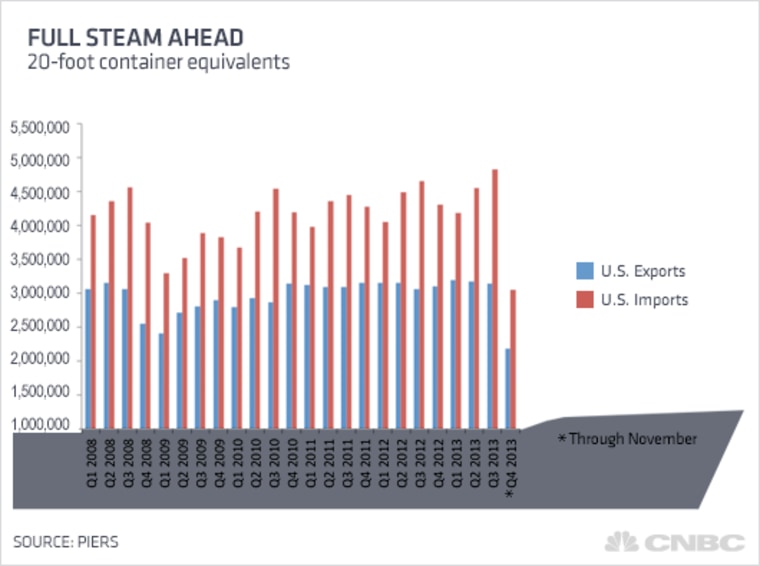

U.S. manufacturers are also making slow but steady progress boosting exports, and much of that cargo reaches its destination in steel containers loaded on ships. Since bottoming in 2009, the volume of steel containers moving in and out of U.S. ports has rebounded and reached a new post-recession high in 2013.

Imports have also gained steadily as the recovery picks up speed. Rising household spending is boosting imports of consumer goods from overseas; the ongoing U.S. rebound in car buying is driving rising shipments of vehicles and auto parts made outside the U.S.

—By CNBC's John Schoen. Follow him on Twitter@johnwschoen or email him.