Starbucks Corp.'s annual shareholders meeting is typically as much a cheerleading session as an investor powwow, marked by song-and-dance routines, earnest employee testimonials and a host of other feel-good performances.

And, oh yeah, there’s free coffee.

It wouldn't be fair to say that this year’s shindig, held Wednesday in Seattle, was exactly somber. Still, it wasn’t hard to catch the faint whiff of anxiety among the top executives, and who could really blame them?

Shares in Starbucks have fallen more than 10 percent over the past year, amid concerns over whether the company can maintain its brisk store growth and reach its aggressive revenue targets without diluting its brand or making any other major missteps.

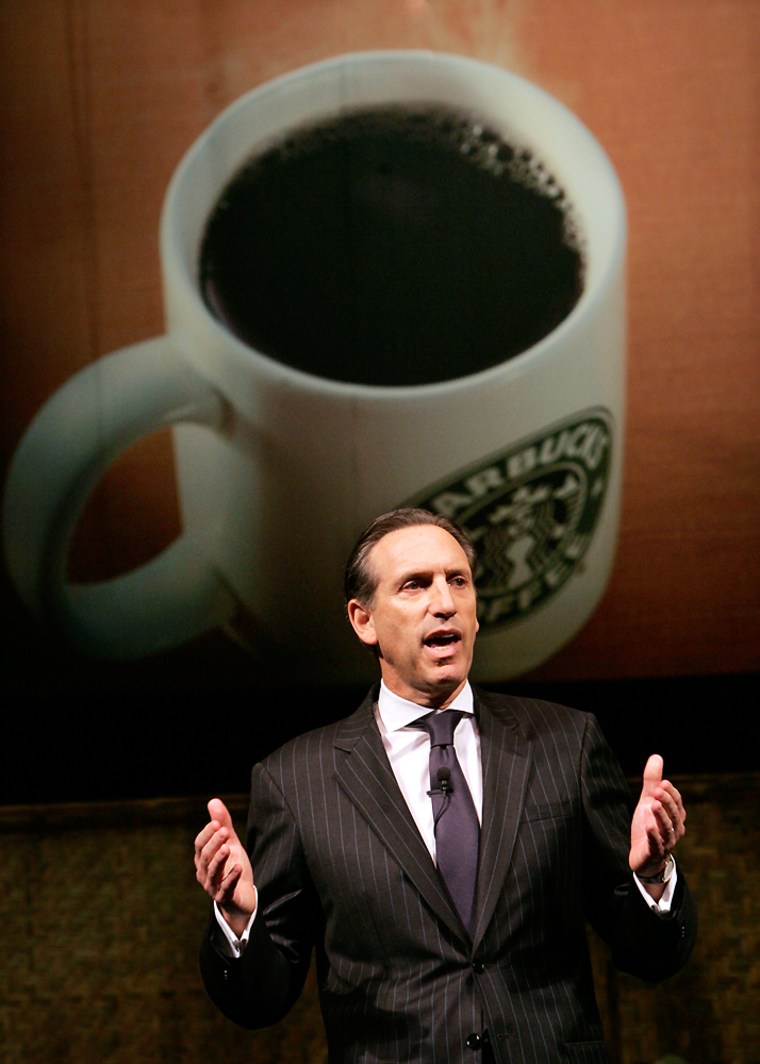

Those concerns were significantly exacerbated a few weeks ago, when a memo surfaced from the company’s chairman and most public face, Howard Schultz.

Writing to top executives, Schultz openly fretted about whether Starbucks’ brand is being watered down by steps the company took during its explosive growth, such as adding automated espresso machines and using pre-ground, pre-packaged coffee in stores. Both moves have robbed the stores of some of their aroma and romance, but have allowed customers to get their caffeine fix more quickly.

Starbucks has sought to downplay the hubbub, with Schultz on Wednesday again arguing that the memo was meant to prompt reflection rather than to spur wholesale changes.

“I am challenging the status quo at Starbucks,” he said.

Schultz also insisted Wednesday that Starbucks will not back down from its growth plan, which calls for eventually having 40,000 stores worldwide, up from around 14,000 today.

Nevertheless, executives told investors the company does plan to start reemphasizing the importance of its core product — coffee. Schultz also said the company was talking about other things that could make Starbucks’ stores seem less cookie-cutter, including finding ways each one can better reflect local communities.

Such individuality can be tough to achieve when a company is opening up seven stores per day, hiring about 400 people each day and drawing its popularity in part from the fact that people can expect a similar experience no matter whether they are at Starbucks in Dubai, Dublin or Detroit.

And really, would bringing back more manual espresso machines — which is unrealistic at this point anyway — really make customers happier?

If asked, plenty of people would likely say they’d love to smell the coffee as it was being ground just for their drink. But would they be willing to wait an extra minute — or two or five or 10 — so everyone in line could have that experience? Probably not.

Also, an increasing number of Starbucks loyalists now wait for their coffee behind a steering wheel, with nothing better to smell than the fumes of the car in front of them.

Does that make Starbucks’ drive-thrus bad? Certainly they aren’t in keeping with Starbucks’ legendary idea of creating a “third place,” full of comfy chairs where people can study, socialize or just escape home and work. But drive-thrus do provide a convenience for busy commuters and harried parents who want a premium cup of coffee and don’t want to get out of their car.

In fact, Starbucks Chief Executive Jim Donald said Wednesday, for those people the drive-thru has become a sort of third place in and of itself.

In other words, it’s hard to fault Starbucks for finding — and serving — a customer base, no matter how distasteful it may seem to coffee purists.

Starbucks also has found success transporting its brand to China, France, Japan and a host of other countries. Schultz lamented Wednesday that such ubiquity also has brought its own challenges, making the company a symbol of U.S. capitalization and globalization.

Starbucks has been targeted by union organizers and anti-development activists. Most recently, it became part of a public dispute over Ethiopia’s efforts to trademark names of certain coffees there, drawing yet more unwanted attention to the brand.

Meanwhile, Starbucks also has sought to expand its brand far beyond coffee.

The company recently announced plans to start a record label, extending its existing foray into the music business, and on Wednesday said Paul McCartney would be its first recording artist. It also has featured books in its stores and last year struck a deal to co-promote a movie.

Starbucks also has added more non-coffee items at its stores, such as hot breakfast sandwiches, lunch items and its own brand of bottled water.

Schultz said Wednesday that Starbucks plans to continue such expansion, although he did not say what kind of Starbucks-branded products might come next.

For now at least, the expansion is paying off with continued strong sales growth. But Starbucks still could be at risk of finding its brand diluted or marred going forward. Robert Passikoff, president of the brand consulting firm Brand Keys, believes it may already be happening.

For four years, Starbucks ranked No. 1 in Brand Keys’ customer loyalty engagement index, in the coffee and donuts category. But in this year’s survey, the company fell to second place, after Dunkin’ Donuts.

Passikoff doesn’t think Starbucks has been indiscriminate in its brand expansion. Still, he worries that Starbucks has perhaps taken its eye off the ball by adding things like CDs and books to its roster.

“I think they’ve moved too quickly,” he said.

Others disagree. Analyst Dan Geiman with McAdams Wright Ragen, points that Starbucks continues to turn in consistently strong financial results, and notes that the coffee company still makes the vast majority of its money from coffee sales, not other items.

“I happen to think the brand’s as strong as it’s ever been,” he said.

At Wednesday’s meeting, Schultz sought to convince investors of the same thing. Over the years, he said, he’s repeatedly asked shareholders the question, “Can a company get big and stay small?”

Not surprisingly, he still thinks the answer is yes. The question is whether customers will always agree.