Apple Inc. said Wednesday its profit in the holiday quarter edged up 2 percent and beat Wall Street's expectations, but the iPod and iPhone maker's predictions for the current quarter came in lower than analysts were predicting.

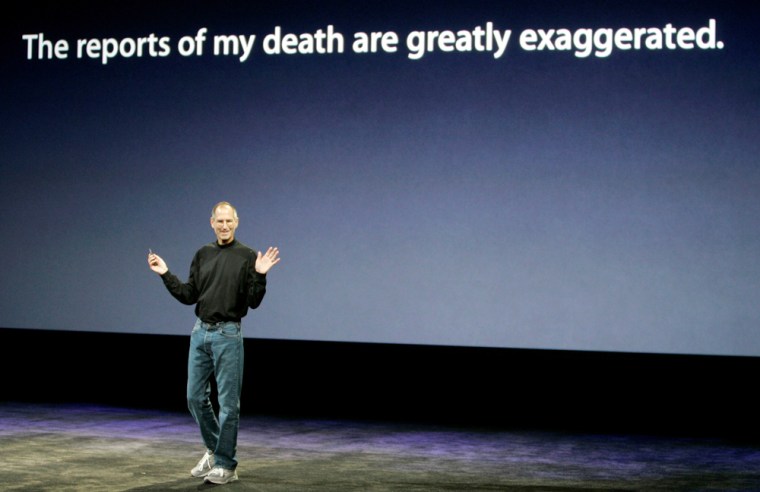

Earlier in the day, The Wall Street Journal reported on its Web site that the U.S. Securities and Exchange Commission will open an inquiry into Apple’s disclosure on the health of the technology company’s Chief Executive Steve Jobs.

The first question for executives in a conference call regarded the health of Jobs, who announced a week ago that he would take a six-month medical leave.

Apple gave no new details, but Tim Cook, the chief operating officer who is handling day-to-day operations in Jobs' absence, attempted to assure analysts that Apple will continue to do well no matter who's in charge.

"The values of our company are extremely well entrenched," Cook said. "We believe that we're on the face of the Earth to make great products, and that's not changing."

Apple’s co-founder Jobs said last week he is taking a medical leave days after the cancer survivor tried to assure investors and employees his recent weight loss was caused by an easily treatable hormone deficiency.

Apple’s shares have surged and crashed over the last year in step with rumors or news about the CEO’s health and his gaunt appearance. While the top executive’s health is an issue for investors in any company, at Apple the level of concern reaches fever pitch because Jobs has a hand in everything from ideas for new products to the way they’re marketed.

To bring any case, the SEC would probably have to show the company tried to benefit by withholding information about an unambiguous diagnosis, Peter Henning, a former federal prosecutor and SEC lawyer told Bloomberg news.

Spokespeople for both Apple and the SEC declined requests for comment from Bloomberg.

The SEC doesn't require companies provide health condition of their executives. But one observer told Bloomberg that Apple, because of Job's rock-star status among the company's customers, makes it a different case.

“Steve Jobs himself thinks the Steve Jobs mystique is of value — otherwise, why not have other people introduce those products over the past 10 years?” said Jeffrey Sonnenfeld, associate dean of the Yale University School of Management. “Steve Jobs, Martha Stewart and Donald Trump have all made the boss the brand. The boss is the brand at Apple.”

In the fiscal first quarter that ended Dec. 27, Apple's earnings rose to $1.61 billion, or $1.78 per share. In the comparable period last year, profit was $1.58 billion, or $1.76 per share.

Sales improved 6 percent to $10.2 billion.

The results topped analysts' forecast on both counts. Analysts surveyed by Thomson Reuters were looking for a profit of $1.39 per share on $9.75 billion in sales.

"This goes to show the point that the high-end consumer electronics market is not dead despite the challenging economy," said American Technology Research analyst Brian Marshall in an interview.

Cupertino, Calif.-based Apple said it sold a record number of iPods in the quarter — about 22.7 million, beating analysts' average expectations. In the conference call, Cook said all the growth in iPod sales came from outside the U.S. during the last week of the quarter.

"The iPod business was way better than anyone would have thought," said Kaufman Bros. analyst Shaw Wu. "It shows the economic malaise seems to be ... impacting the U.S. more."

Wu also pointed out that Apple's gross margin got a boost in the quarter as transportation and component costs dropped.

Macintosh computer sales grew 9 percent from the year-ago quarter and met analysts' view, thanks to booming laptop sales.

While the rest of the PC industry is looking to netbooks — cheap, low-powered laptops meant mostly for Web surfing and checking e-mail — Apple isn't rushing out with one of its own.

"The products in there are principally based on hardware that's much less powerful than we think customers want, software technology that is not good, cramped keyboards, small displays, etc.," said Cook. "We don't think that people are going to be pleased with those type of products. But we'll see."

Sales of Apple's iPhone clocked in at 4.4 million, shy of some analysts' predictions for about 5 million.

The recession made the holiday quarter the worst for the PC market in years. But it didn't seem to hit Apple quite as hard. At Apple's retail stores, which are concentrated in the U.S., average sales per store dropped to $7 million from $8.5 million last year.

Looking ahead, Apple said it expects to earn 90 cents to $1 per share on $7.6 billion to $8 billion in sales in the current quarter, which ends in March. That's lower than what analysts had been looking for — $1.13 per share of profit on $8.2 billion in revenue — but Apple is known for issuing guidance that falls well below Street estimates.

"It was better than the fears," Wu said.