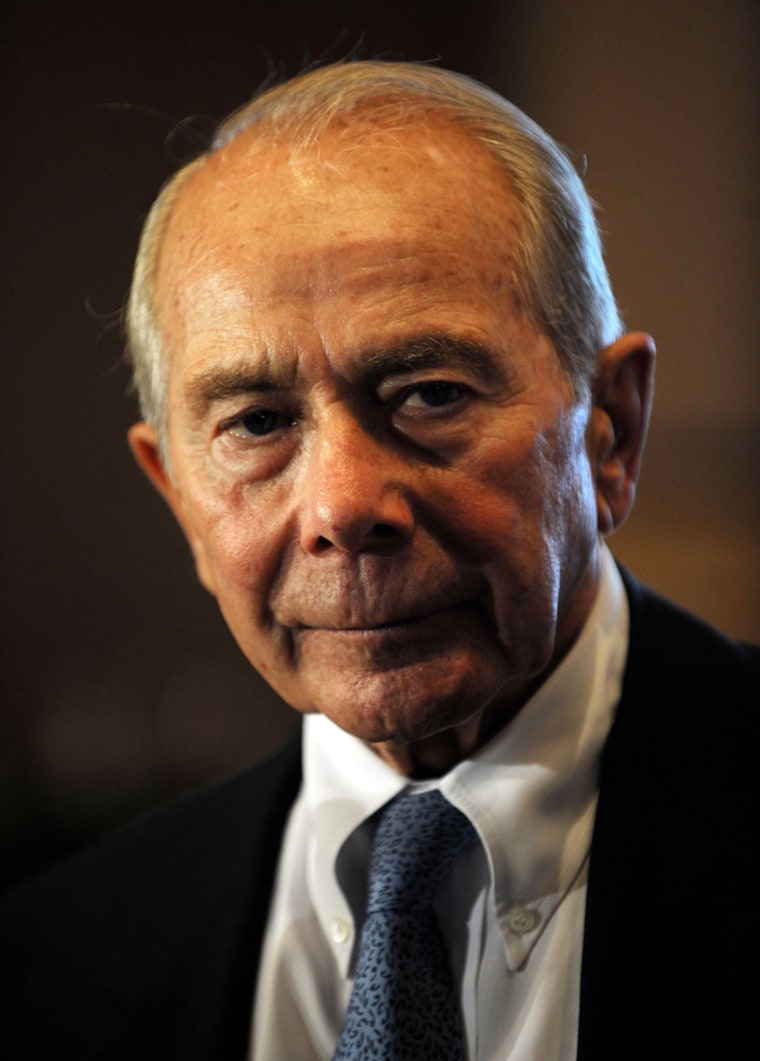

Maurice R. Greenberg, who built the American International Group into an insurance behemoth with an impenetrable maze of on- and offshore companies, is at it again.

Even as he has been lambasting the government for its handling of A.I.G. after its near collapse, Mr. Greenberg has been quietly building up a family of insurance companies that could compete with A.I.G. To fill the ranks of his venture, C.V. Starr & Company, he has been hiring some people he once employed.

Now, Mr. Greenberg may have received some unintended assistance from the United States Treasury. Just last week, the Treasury severely limited pay at A.I.G. and other companies that were bailed out by taxpayers. That may hasten the exodus of A.I.G.’s talent, sending more refugees into Mr. Greenberg’s arms, since C. V. Starr is free to pay whatever it wants.

“Basically, he’s just starting ‘A.I.G. Two’ and raiding people out of ‘A.I.G. One,’ ” said Douglas A. Love, an insurance executive who has also hired A.I.G. talent for his company, Investors Guaranty Fund of Pembroke, Bermuda.

While America generally loves stories of entrepreneurs making a comeback, Mr. Greenberg’s success may be at the expense of taxpayers. People who work in the industry say that if he is already luring A.I.G.’s people, he may soon be siphoning off its business and, therefore, its means to repay its debt to the government.

“To me, it’s just going to be a matter of time before the valuation of what he’s building is greater than the valuation of A.I.G.,” said Andrew J. Barile, an insurance consultant in Rancho Santa Fe, Calif.

Larger than life

A.I.G., meanwhile, is struggling to regain its footing. The recipient of the biggest taxpayer bailout in history, it has been ordered by the government to restructure, unwind its complex derivatives and pay back the taxpayers.

At 84, Mr. Greenberg remains larger than life. He spent nearly four decades forging A.I.G. out of private companies, devising its Rubik’s Cube structure and building it into the world’s largest insurance group, with a $1 trillion balance sheet. He lost most of his fortune when the company nearly collapsed last year.

And now, he appears to be starting over.

He was ousted from A.I.G. in an accounting scandal in 2005, and has insisted that he was not responsible for the problems that almost brought down A.I.G. last year — extremely risky trading in derivatives by its financial products unit. At the moment, C. V. Starr does not have a financial products unit, a spokesman for Mr. Greenberg said.

After he was pushed out, Mr. Greenberg fought bitterly with A.I.G. over how to untangle assets that they both laid claim to. Over the summer, he won, earning the rights to $4.3 billion in A.I.G. stock that he had removed from an unusual offshore retirement plan. The company had argued that he had improperly cashed out the stock and used the money to finance new business ventures that were competing with his former company.

With his battles with A.I.G. now largely resolved, Mr. Greenberg is free to use that money as the seed for his latest ventures. Just this month, C. V. Starr leased 141,000 square feet of space — three stories — on Park Avenue in Manhattan, in one of Lehman Brothers’ old headquarters. Previously, he had expressed an interest in buying one of A.I.G.’s prizes, a sprawling global insurance group, but only if he could buy the whole thing. A.I.G. is trying to keep a stake.

Key shareholder

Mr. Greenberg declined to comment. But his lawyer, Lee Wolosky, said he was not trying to undercut his former company. “Mr. Greenberg built A.I.G. and wants to see it succeed,” Mr. Wolosky said. He added that since the bailout Mr. Greenberg had been trying to offer consistent advice, both in public and private settings, “about the best course to restore A.I.G. for the benefit of all its stakeholders.” After all, Mr. Greenberg remains A.I.G.’s largest shareholder aside from the government.

As to whether Mr. Greenberg was poaching his former employees, Mr. Wolosky said, “C. V. Starr does employ a number of former A.I.G. personnel, but far fewer than the global insurance companies that are A.I.G.’s direct competitors.” He declined to provide a specific number.

A.I.G. declined to comment.

Treasury officials said their special master for pay, Kenneth R. Feinberg, was aware that if he set pay standards that were too stringent, he could further harm A.I.G. by driving away its executives. “We’re acutely aware of this possibility,” said Andrew Williams, a department spokesman. “That’s why Ken Feinberg spent hours at A.I.G. trying to understand that specific dynamic and strike the right balance.”

Unlike A.I.G., C. V. Starr is privately held, so there is no stock to entice investors, and no disclosure of financial information. Little is known about its business plan, although it has been announcing ventures to insure things as diverse as wayward corporate directors and construction accidents on the bridges and roads being built under the Obama administration’s fiscal stimulus program.

The firm seems to be focusing on the specialized lines of business insurance that once made A.I.G. stand out. The government had hoped to leave those businesses at A.I.G. intact after selling off most of its other operations, like life insurance and household finance.

C. V. Starr is also taking on the same form as A.I.G. — an intricate group of companies, each with its own line of business.

For now, most of those companies do not sell their own insurance, but operate as general agencies, representing insurers from rival groups on products that C. V. Starr does not yet sell.

That way, if C. V. Starr does not yet profit from the underwriting of a line of insurance, it can still receive commission income by selling it. “That’s the beauty of how he structures the company,” Mr. Barile said. “Everything is in such silos that every time you make a transaction, the outside world thinks you’re competing, but you aren’t.”

In March, the Starr Indemnity & Liability Company named Charles H. Dangelo its president and chief executive, after bringing him from A.I.G. Global Risk Management.

A few months later, Starr Indemnity hired another executive from A.I.G., Jim Vendetti, making him its senior vice president and chief underwriting officer. The company also hired a former A.I.G. crisis manager, Alex Pittignano, to build up its businesses of insuring against specialized risks like environmental disasters.

Mr. Greenberg has found ways to exploit A.I.G. without directly hiring former employees. Starr has formed a joint venture with Ironshore, led by the former chief executive of an A.I.G. company called Lexington Insurance. Each of Ironshore’s five new businesses is headed by still more A.I.G. alumni. The joint venture, called Iron-Starr Excess Agency Ltd., is headed by Geoff Smith, an executive hired away from A.I.G. in December. It provides insurance to businesses after they have exhausted their primary insurance.

This story, "Ex-A.I.G. Chief Is Back, Luring Talent From Rescued Firm," originally appeared in The New York Times.