In the debt ceiling impasse, the Moody’s bond rating agency added another improbable choice Monday to those facing Congress: why not get rid of the legal limit on federal borrowing altogether?

After all, the debt limit statute hasn’t had a restraining effect on spending or borrowing, as Congress' fiscal watchdog, the Government Accountability Office, noted in a recent report.

Congress is voting on the debt limit this year to allow for more borrowing to finance the programs that lawmakers, or their predecessors, created years earlier.

The fiscal conservatives in Congress who are resisting tax increases and oppose raising the debt ceiling did not vote for the $830 billion stimulus in 2009 and they probably didn’t vote for adding a prescription drug benefit to the Medicare program in 2003.

Many of these lawmakers now find themselves stuck with the consequences of spending decisions they weren't involved in and are unwilling to approve tax hikes to raise the revenue to bankroll them.

To end the impasse, President Barack Obama and Congress will need to muddle through with a plan that commits them to cutting future spending as the price for getting enough votes to raise the borrowing limit.

Willing to compromise, but how?

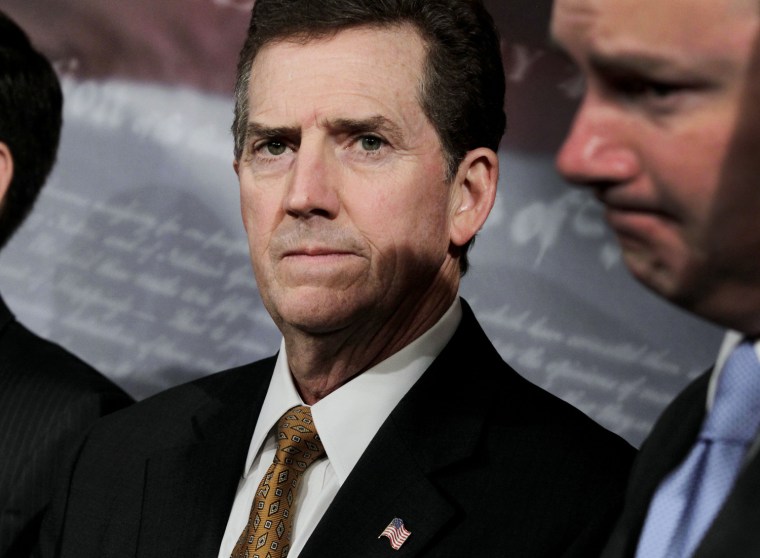

One legislator who as a House member voted "no" to that Medicare expansion in 2003 was Jim DeMint. He's now a senator and a leader of his chamber's fiscal conservatives.

He seemed to hold out some hope for an end to the impasse on NBC’s "Meet the Press" on Sunday. “We certainly are willing to compromise,” DeMint said. “We're willing to give the president an increase in the debt limit.”

DeMint supports a bill to enact a constitutional amendment to require a balanced budget and to limit spending to fixed amounts. But revenue isn't on the table. The bill requires tax increases be approved by a two-thirds vote in both the House and Senate.

Obama said Monday he’d veto that bill. But perhaps getting the chance to vote for the legislation and get on the record might be enough to satisfy some GOP members.

DeMint said of the balanced budget amendment, “that is a place that we have to get to.” But he didn’t specify when or how.

And DeMint said Democrats ought to agree with the GOP that “sometime in the next decade” that “we have to stop spending more than we're bringing in.” But again, he didn’t specify when this ought to occur.

If Congress doesn't raise debt limit

Critical to the outcome is the judgment that members of Congress will make as to how — if they don’t vote to increase borrowing — the Treasury could manage for a few days or longer.

The GAO said in a legal opinion in 1985 that the Treasury secretary has "the authority to choose the order in which the pay obligations of the United States" and the department can do this "in any order it finds will best serve the interest of the United States."

“That is an open question. There is no statute that says if the executive branch runs short of cash, it can decide which of Congress’s binding spending laws it will carry out and which it will ignore,” said former Under Secretary of the Treasury Jay Powell, who is now a visiting scholar at the Bipartisan Policy Center. He also said there’s no law telling the Treasury secretary he cannot do this either.

As Powell told the House Republican caucus in a briefing last Friday, if Congress does not raise the borrowing limit, then on Aug. 3 “the federal government will be unable to pay about 50 percent of its bills, other than interest ... You can’t cut the budget by 50 percent without cutting popular and important programs.”

Which bills to pay?

"There's the legal issue and there's the operational challenge,” said Susan Irving, GAO’s Director for Federal Budget Analysis. “You're talking about intervening in an automated system that electronically pays about 80 million bills" — the approximate number of bills the Treasury says it pays per month.

The Standard & Poor’s rating agency reminded Congress last week that the question for investors isn’t so much whether Congress and Obama can find a stopgap solution to get past the 2012 election. The question is how credible the bond market will find a plan that would pledge to cut future spending.

“There is an increasing risk of a substantial policy stalemate enduring beyond any near-term agreement to raise the debt ceiling," S&P said.

A nation which deserves an AAA bond rating doesn’t allow itself to reach this point, it implied. "We view an inability to timely agree and credibly implement medium-term fiscal consolidation policy as inconsistent with a 'AAA' sovereign rating.”

S&P said it would downgrade Treasury bonds "if we conclude that Congress and the administration have not achieved a credible solution to the rising U.S. government debt burden and are not likely to achieve one in the foreseeable future.”

Credible and creditworthy

The crucial question: Are Congress and the president credible enough for the U.S. government to be deemed creditworthy?

There’s plenty to reason to doubt: for example, since 2003, Congress has chosen to circumvent a law it had passed in 1997 to control the growth in Medicare outlays that pegged payments to doctors to the growth rate of the economy.

More recently House Republicans have railed against a provision in last year’s health care law that’s designed to limit future Medicare spending — the Independent Payment Advisory Board (IPAB), which takes some of the politically sensitive spending decisions out of the hands of members of Congress.

"A politically appointed 15-member board that's unelected and unresponsive to the will of the people called IPAB will make the decisions about what care we get and what care we don't," GOP presidential contender Michele Bachmann said last month.

The credibility that would come from reducing the debt rests on someone, whether members of Congress or the members of IPAB, making exactly those kinds of decisions. It's the actual decision to cut or restrain spending, and not the statutory debt limit, that will gain credibility and protect the government's creditworthiness.