Given how vague Mitt Romney and his campaign team are about most areas of public policy, it's exciting when Team Romney actually publishes a relatively detailed policy position paper on an important issue. Sure, it's the soft bigotry of low expectations -- a presidential campaign releasing a white paper should be routine, not cause for celebration -- but with Republicans in 2012, standards have fallen considerably.

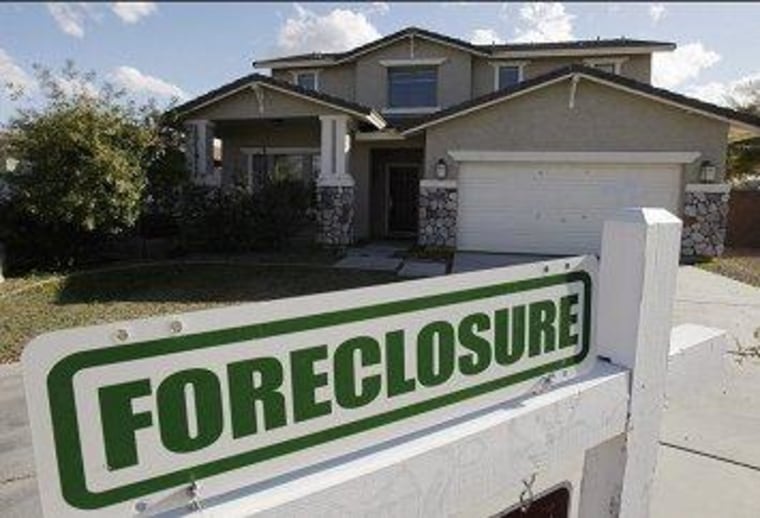

And with this in mind, I was delighted to see the Romney campaign release an actual white paper on housing policy. Up until now, about the only notable thing the candidate has said about housing is his desire to see foreclosures continue without government intervention.

So, is Romney's housing policy any good?

Well, the first hint something was amiss was the timing of the white paper's release -- the Romney campaign waited until after 4 p.m. on Friday afternoon to publish the policy, the same afternoon as the release of Romney's 2011 tax returns. In other words, Team Romney went out of its way to make sure no one saw or had any interest in the candidate's housing plan.

And after taking a look at it, we now know why. Romney/Ryan would address foreclosures, for example, by "bringing clarity in this area." What does this mean? I honestly have no idea and the white paper doesn't say. The Center for American Progress' John Griffith noted arguments from Romney's policy that are little more than "a string of platitudes."

The white paper goes to say Romney/Ryan intends to "completely end 'too-big-to-fail' by reforming the GSEs [Fannie Mae and Freddie Mac]." Matt Yglesias noted the problem.

The idea of "ending" "too-big-to-fail" is a great political slogan since it's super-popular and nobody's ever quite sure what it means. But there's no possible meaning under which this makes sense. Back in 2008, the feeling among leaders in both parties was that if something terrible happened to Citi or JP Morgan or Bank of America or Goldman Sachs the best policy response was to inject new public money into the capital structure rather than liquidate the enterprise. If in 2018 the same thing happens again is something different going to happen?

Reforming the GSEs has literally nothing to do with this. It's as if the Obama administration were claiming that they're going to end traffic jams with their new health care bill.

The Romney housing plan also vows to create "sensible" regulations on lenders, but the white paper -- the mechanism the campaign would use to go into some level of detail -- doesn't say a word about what these "sensible" regulations might look like.

If you missed the release of the policy on Friday, you really didn't miss much.