Drowning in daily deals that seem to multiply faster in your inbox than the typical zombie infestation? You're probably one of the reasons why Yelp has decided to cut back on its daily deals, following Facebook's decision to eliminate its four-month-old program altogether.

Bloomberg reportsthat Yelp, which focuses on member-based reviews of local businesses and entered the daily deals space only about a year ago, has now decided to cut its sales force dedicated to those deals in half. (Yelp Deals had expanded to 20 cities this year.) Facebook is also pulling back, phasing out its Deals on Facebook over the next few weeks.

There's plenty of reasons why those companies are re-assigning resources and re-evaluating where they stand in daily deals, but near the top, from what industry watchers are saying: the saturation of competitors in the market and consumer fatigue.

As someone who has no less than 20 emails a day from such daily deals, I can tell you that it is overwhelming, and I have to check my accounts at least once a week to make sure I'm using what I bought before it expires. It's exhausting. I've thought about putting myself on a break from such sites, but I've failed, not being able to resist a good deal I know I'll use. But I have become more discriminating, deleting more frequently and refusing to sign up to new sites.

There may be more than 600 competitors pawing at the wallets of local consumers, but only two sites seem to have the recognition and loyalty of the masses.

Together, Groupon and LivingSocial own nearly 75 percent of the business from daily deals across the country and Canada. Groupon still has the power of 115.7 million subscribers worldwide in 45 countries (40 million in the U.S. and Canada) and with 175 cities, commands almost half the North American market when it comes to these direct email daily deals. LivingSocial has about another 25 percent.

But neither have been immune from declines in the daily deal industry.

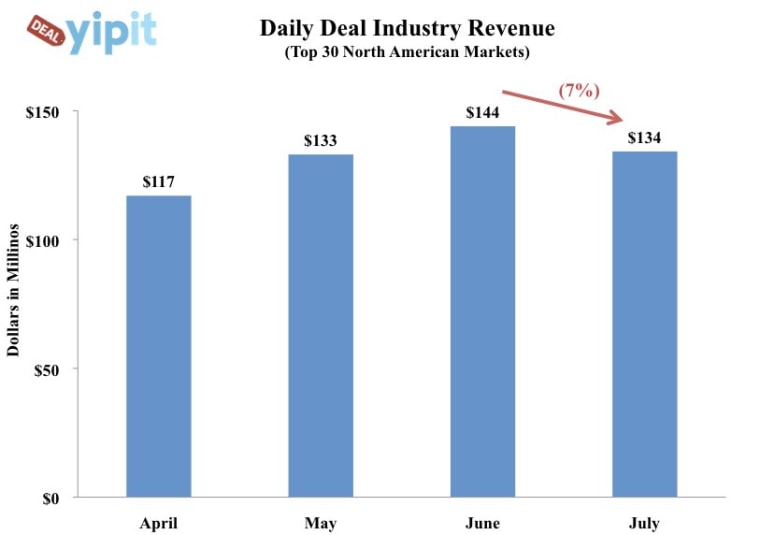

Yipit, which aggregates and recommends the best daily deals from 658 services, also does research on the daily deals market and found that revenue in that industry declined 7 percent in North America's largest markets. Groupon got hit with a 4 percent decline in revenue and LivingSocial, 18 percent. Yipit also noted that 38 daily deal sites called it quits in July.

One bright note: Travel daily deals now account for nearly 15 percent of industry revenue.

But, is it all too much?

A Groupon spokesman referred us to an internal memo from Groupon CEO and co-founder Andrew Mason to answer how the company has handled the massive influx of copycats:

"If there's a question I’ve received from Groupon skeptics more than any other, it’s, "How will you fend off the competition — especially massive companies like Google and Facebook?” I could give a dozen reasons to bet on Groupon, but it’s impossible to predict the future or the actions of others. Well, now the sleeping giants have woken up — and the numbers are showing that what was proven true with literally thousands of other competitors is just as true with the incumbents of the Internet: it’s kind of hard to build a Groupon. And since anyone with an Internet connection can track the performance of our competitors, I can be more specific:

- Google Offers is small and not growing. In the three markets where we compete, we are 450 percent of their size.

- Yelp is small and not growing. In the 15 markets where we compete, our daily deals are 500 percent of their size.

- Living Social’s U.S. local business is about one-third our size in revenue (and smaller in GP) and has shrunk relative to us in the last several months. This, in part, appears to be driving them toward short-sighted tactics to buy revenue, like buying gift certificates from national retailers at full price and then paying out of their own pocket to give the appearance of a 50 percent off deal. Our marketing team has tested this tactic enough to know that it’s generally a bad idea, and not a profitable form of customer acquisition.

- Facebook sales are harder to track, but are even less significant at present.

My point is not that our competitors will fail — some may actually develop sustainable businesses, or even grow — after all, local commerce is an enormous market. The real point is that our business is a lot harder to build than people realize and our scale creates competitive advantages that even the largest technology companies are having trouble penetrating. And with the launch of NOW, I suspect our competition will have an even harder time in light of the natural barriers to entry that are needed to build a real-time local deals marketplace."

"We've seen the flurry over the past year. It's easy for anyone to get into this game, but there's a lot of infrastructure on the back end to offer the quality deal: sales people to find good deals, infrastructure to support the vendors, such as our merchant services team," said LivingSocial spokesman Brendan P. Lewis.

With 32 million members in the U.S. (more than 42 million worldwide in 25 countries), in 209 markets in the U.S. (including multiple hyperlocal locations housed within one city), LivingSocial is not nearly as ubiquitous as Groupon, but those in major urban areas are probably familiar with it.

But don't think this spells the end for daily deals. A July survey from PriceGrabber found that 59 percent of a little over 2,000 respondents planned to use Groupon, LivingSocial and others of that ilk "for holiday or special occasion gift purchases." PriceGrabber also points to the purchasing power of 23 million Americans who bought daily deals last year as an indication that people are still voracious when it comes to bargains.

How have you coped with all those offers?

More stories:

- Next on Facebook chopping block: Deals

- How many Groupon rivals? Try 600

- Hotmail now more interactive thanks to Posterous and LivingSocial

- Now in 25 more cities: LivingSocial, trying to catch Groupon

Check out Technolog on Facebook, and on Twitter, follow Athima Chansanchai, who is also trying to keep her head above water in the Google+ stream.