Business News

Some of America's top corporate crooks

A look at some of the recent big-time offenders in corporate America through the past decades beginning with Raj Rajaratnam.

By Bill Briggs

msnbc.com contributor

Sure, the rich get richer.

But sometimes, the rich get the slammer.

The conviction Wednesday of former Wall Street star Raj Rajaratnam to multiple counts of conspiracy and securities fraud adds another financial luminary to the ever-expanding Who’s Who of white-collar criminals.

Prosecutors say Rajaratnam’s network of inside tipsters constituted the hedge-fund world’s biggest insider-trading bust.

From Ivan to Bernie to Martha, Raj – who remains under house arrest as his attorneys plan an appeal – soon may join a litany of convicted liars and cheats who ultimately traded their designer duds for prison jumpsuits.

Whether greed, corruption, hubris – or all of the above – fueled their crimes, this list of infamous business crooks is loaded with one thing: time.

When their collective sentences are totaled, these offenders were originally sentenced to almost 350 years behind bars.

Raj Rajaratnam

Convicted of: Five conspiracy counts and nine securities fraud charges. He faces a maximum term of more than 19 years in prison.

Currently: Under house arrest, free on $100 million bail; his attorneys say they plan to appeal the verdict.

The crime: He built a cadre of corporate sources to pass him secret information on looming deals, giving him an illegal edge on mega-trades involving tech companies and other stocks. According to prosecutors, Rajaratnam socked away $60 million from his tips. Meanwhile, his Galleon Group funds, prosecutors claim, erupted into a multi-billion force at the expense of everyday investors who were trading without knowledge of the same insider facts.

Notable: The creative use of wiretaps by government investigators to eavesdrop on Rajaratnam’s conversations may spark a spree of aggressive probes against other suspected Wall Street wrongdoers, experts say.

Bernie Madoff

Convicted of: He pleaded guilty in March 2009 to 11 counts of fraud, money laundering, perjury and theft – part of his running the largest Ponzi scheme in history.

Currently: He is serving a 150-year sentence at a federal prison in Butner, N.C.

The crime: Madoff stole money – in many cases, life savings – from thousands of investors around the world while hoodwinking regulators, banks and hedge funds about his actual investment returns. Prosecutors contend his Ponzi scheme began in the 1980s; Madoff claimed his fraud began in the early 1990s, possibly in a move to limit how deeply the government can tap his family business for restitution money.

Notable: Of the 16,518 investors who have filed claims against Madoff, a court-appointed trustee has determined that only 2,414 have legitimate claims, and those investors are entitled to receive about $6.9 billion.

Ivan Boesky

Convicted of: He pleaded guilty in 1986 to insider trading, then provided evidence against junk-bond king Michael Milken to investigators. Boesky was sentenced to 3 1/2 years in prison and spent it at a federal prison near Vandenberg Air Force Base in California.

Currently: Out of prison and staying out of the news. In 1993, Time magazine reported Boesky claimed he was broke, as he demanded nearly $50 million in alimony from his former wife, Seema.

The crime: The once-iconic Wall Street pit bull had built a $200 million-plus fortune by the mid-1980s via trading on looming corporate takeovers. The U.S. Securities Exchange Commission began scrutinizing his investments – many of which were been based on tips from corporate insiders. He reduced his possible prison penalties by cooperating with investigators in the Milken probe. Boesky also paid $100 million in fines. He was released from prison in 1990.

Notable: Boesky is often credited with inspiring the character Gordon Gekko in the 1987 movie “Wall Street,” and once told a college crowd, “I think greed is healthy.”

Michael Milken

Convicted of: In April 1990, Milken pleaded guilty to six charges mainly involving violations of securities-disclosure rules. He was sentenced to 10 years in prison and served 22 months.

Currently: After his release, he beat prostate cancer then raised hundreds of millions of dollars for medical research. Chairman of the Milken Institute which, according to its website, “is a nonpartisan, independent think tank whose work makes a difference in the lives of people worldwide by helping create a more democratic and efficient global economy.”

The crime: The finance legend built the modern junk bond market in the 1980s while at Drexel Burnham Lambert, amassing a reported $550 million in wealth. He gained Wall Street power as an investment banker to corporate raiders. Allegations followed that Milken was corrupting financial markets. In 1989, Rudy Giuliani, then the U.S. attorney in Manhattan, convinced a grand jury to indict Milken on 89 charges, including insider trading, securities fraud and racketeering.

Notable: He asked former presidents Bill Clinton and George W. Bush for formal pardons – noting his philanthropic work – and was denied each time.

Bernard Ebbers

Convicted of: Nine counts of conspiracy, securities fraud and making false regulatory filings in March 2005.

Currently: Serving 25 years at a federal prison in Louisiana

The crime: Ebbers co-founded WorldCom in 1995 and his company eventually succeeded in an unsolicited bid for MCI Communications. By 1999, Ebbers was worth an estimated $1.4 billion. But as WorldCom foundered financially, Ebbers faced allegations of conspiracy and fraud – in layman’s terms, book cooking. Although he resigned from WorldCom in 1999, the company loaned Ebbers $400 million. In 2002, the company admitted to improperly reporting $3.8 billion in expenses. That led the U.S. Justice Department to launch a criminal probe of the business. The SEC, meanwhile, examined the $400 million loan from WorldCom to Ebbers.

Notable: WorldCom investors lost $180 billion due to the scandal, the company went bankrupt and 20,000 lost their jobs.

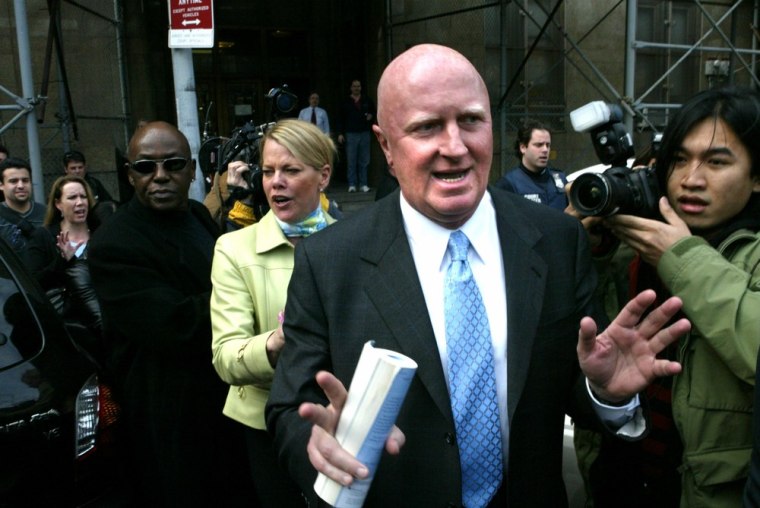

Ken Lay and Jeff Skilling

Convicted of: Tried together, the two Enron executives were convicted in May 2006 of fraud and conspiracy. Skilling appealed.

Currently: Shortly after the verdict, Lay, right, died of heart disease at age 64. His prison sentence could have been 45 years. Skilling was fined $45 million and is currently serving a 24-year sentence at a federal prison in Colorado. In 2010, the U.S. Supreme Court vacated part of Skilling’s conviction and sent his case back to a lower court for additional proceedings.

The crime: Lay and Skilling led Enron, the Houston-based energy-trading giant – by the early 2000s, the seventh-largest company in America. Government investigators later determined that the men used false accounting methods to show artificially inflated profits, helping fuel the company’s rapid growth. Enron filed for bankruptcy in 2001, shortly after Skilling resigned, turning his Enron stock holdings into $60 million in cash.

Notable: The Enron case forced many accounting firms to reexamine their practices and recommit to fundamental values, some experts have said.

Dennis Kozlowski

Convicted of: Misappropriation of corporate funds in June 2005.

Currently: Serving up to 25 years at a state prison in Upstate New York.

The crime: The former chief of Tyco International became the face of the CEO high life before his downfall. That life included a $30 million New York City apartment – reportedly paid for by his company – and a 2001 birthday party for his wife. The shindig cost $2 million, and it was later revealed that Tyco paid for half of the event – dubbed the “Tyco Roman Orgy” because it featured an ice sculpture depicting the Statue of David peeing high-end vodka. After one mistrial was declared, a second jury found him guilty of pocketing millions in unauthorized bonuses and receiving other illegal financial perks.

Notable: He once told “60 Minutes:” "I was a guy sitting in a courtroom making $100 million a year and I think a juror sitting there just would have to say, 'All that money? He must have done something wrong.' "

Martha Stewart

Convicted of: Four counts of conspiracy, obstruction and making false statements to investigators. The verdict was delivered in March 2004. She was sentenced to five months in prison and fined $30,000.

Currently: The lifestyle diva rebounded nicely. After her prison release, her company – Martha Stewart Living Omnimedia Inc. – pulled in a 2006 fourth-quarter profit, helped by advertising revenue at the flagship, Martha Stewart Living magazine.

The crime: Stewart avoided losing about $51,000 by selling nearly 4,000 shares of ImClone stock on Dec. 27, 2001. The next trading day, the stock’s value fell sharply after regulators rejected the company's application for a key cancer drug. Prosecutors argued that Stewart sold her ImClone stock only after her ex-broker, Peter Bacanovic, told his assistant to tell Stewart that ImClone founder Sam Waksal was trying to sell his shares.

Notable: Manhattan prosecutors were criticized for picking on Stewart over her relatively small profit of about $50,000.

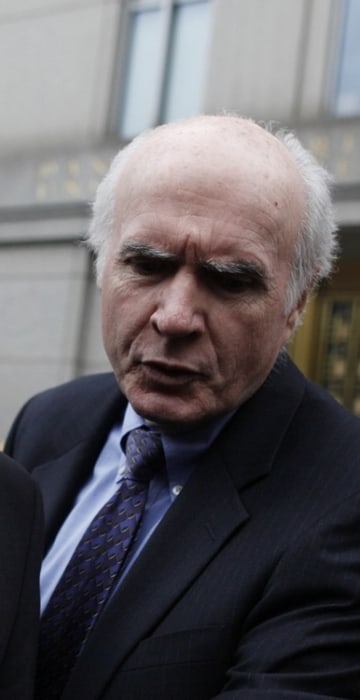

John Rigas

Convicted of: Bank, wire and securities fraud in July 2004. Sentenced to 15 years in prison.

Currently: Serving his sentence at a federal prison in Butner, N.C.

The crime: Rigas and his family built Adelphia Communications into one of the largest cable providers in America. Rigas also was majority owner of the NHL’s Buffalo Sabres. Prosecutors said Rigas personally misused Adelphia money and hid $2.3 million in liabilities from its investors. Adelphia filed for bankruptcy after acknowledging that Rigas and his family members had taken $3.1 billion in loans that were never recorded on the company’s books. Rigas’s son, Timothy Rigas, served as chief financial officer and he, too, was convicted and sentenced to prison as part of the schemes.

Notable: If John Rigas survives his prison sentence, he will be 92 when he is released. John and Timothy Rigas reported to prison together.

Richard Scrushy

Convicted of: Six counts of bribery, conspiracy and mail fraud in June 2006, receiving a sentence of nearly seven years.

Currently: Serving time at a federal prison in Beaumont, Texas.

The crime: He founded and once was the chief executive of HealthSouth Corporation. Prosecutors said Scrushy funneled $500,000 to former Alabama governor Don Siegelman in exchange for a seat on the state hospital regulatory board. This week, a federal appeals court tossed out two bribery convictions against Scrushy. While the 11th U.S. Circuit Court of Appeals ruled there wasn’t enough evidence to indict Scrushy and Siegelman on the two bribery counts, the court upheld the rest of the 2006 corruption convictions against the pair.

Notable: In March 2003, after allegations surfaced that HealthSouth had overstated its earnings, the board fired Scrushy. He later was charged with masterminding a $2.7 billion accounting fraud. Five former HealthSouth CFOs testified Scrushy directed the fraud. But in 2004, Scrushy was acquitted of all the fraud charges.

Joe Nacchio

Convicted of: 19 counts of insider trading in April 2007.

Currently: Serving a nearly six-year term at a federal prison camp in Schuylkill, Pa. His projected release date is May 2014.

The crime: Prosecutors said Nacchio, while CEO of Qwest Communications International Inc., illegally sold $52 million in stock in 2001, even as he knew the company was suffering financially. A jury convicted him on 19 counts of insider trading, finding that he based some of his stock sales on material information about Qwest's growing money woes – information that was not available to the public.

Notable: In late March, Nacchio sued his defense lawyers for overbilling, saying, in part, that he unknowingly paid for their underwear purchases as well as for their in-room movies during his federal trial in Denver.

Sanjay Kumar

Convicted of: He pleaded guilty in April 2006 to conspiracy, securities fraud and obstruction of justice.

Currently: Serving the remainder of his 12-year term at a federal prison in Fairton, N.J.

The crime: Once the CEO and chairman of Computer Associates International, Kumar triggered an accounting scandal that cost company shareholders more than $400 million. Kumar admitted to improperly booking software license revenue to meet Wall Street profit targets. He also admitted that he later lied to investigators about the fraud.

Notable: In 2007, a federal judge approved a settlement that required Kumar to pay nearly $800 million back to his victims. In 2007, Kumar agreed to pay $52 million by the end of 2008 by liquidating assets, including his yacht and cars.