Margaret Forehand, a self-proclaimed designer fashion junkie, has been pleased with the plentiful offerings found on luxury stores' Web sites recently.

"It's more reflective of the store experience," said the 33-year-old Tampa. Fla., resident who spent $5,000 on items like Gucci skirts and a Michael Kors handbag on sites like neimanmarcus.com and saks.com during recent months.

That's a big change from "all the basic clothing" she found online four years ago when she left Los Angeles for her hometown and turned to cyber shopping because the designer selection was limited.

Having overcome the challenge of persuading fashion designers to sell online and doubts that shoppers like Forehand won't buy expensive dresses without being able to try them on, retailers are finding a flourishing designer business in cyberspace.

According to Forrester Research, luxury online sales, including jewelry and designer fashions, rose 28 percent to $3.2 billion last year from the previous year. That was faster than the 22 percent increase in total online sales, excluding travel, which reached $109 billion in 2005.

It "looks like right now everyone is winning" in the online luxury business, said Sucharita Mulpuru, a luxury analyst at Forrester Research, a Cambridge, Mass.-based Internet research company.

Store executives see their Internet business as a way to drive new and younger customers to their stores. At saks.com, the average age of the customer is in her late 30s, compared to age 48 for the store shopper. About 40 percent of its online customers live outside of the Saks Fifth Avenue trading area, according to Denise Incandela, senior vice president of saks.com, which runs the company's online unit.

To keep sales churning, upscale department stores are expanding their selection online as they try to attract new and younger customers. And Internet-only global luxury players like net-a-porter.com and yoox.com are offering more cutting-edge designer labels and special services aimed at their biggest spenders.

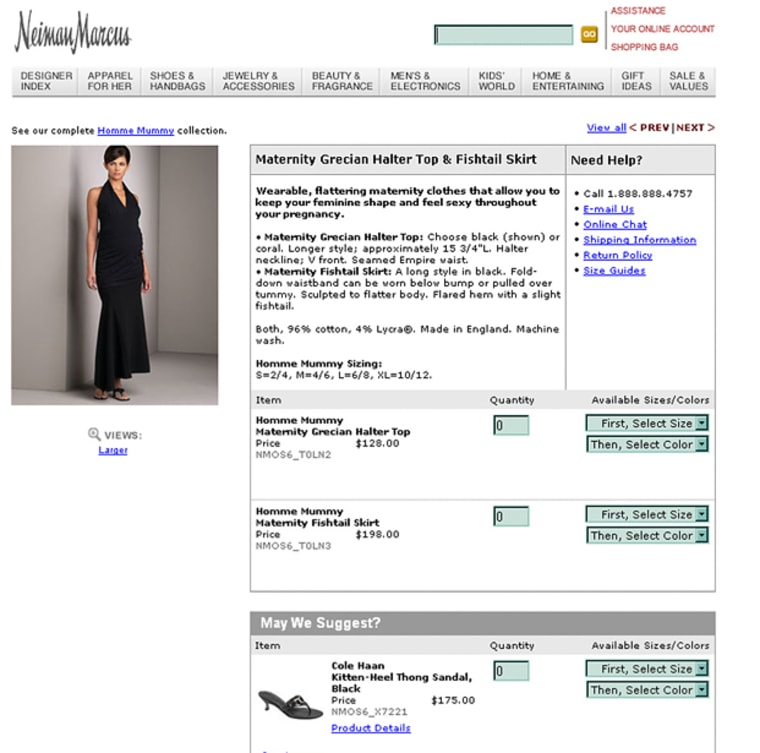

Last month, Saks Fifth Avenue's site launched an "incubator," featuring emerging clothing and accessories designers whose creations are not sold at its 55 department stores, and last fall added such top names as Michael Kors, Marc Jacobs and Giorgio Armani. Neiman Marcus Group Inc. recently expanded into maternity wear online and reported that last fall designer fashion became its fastest growing category online. And Nordstrom Inc. began selling top designers names online such as Armani Collezione, Burberry and Dolce & Gabbana in a new Web page unveiled in early February.

There are several big designer names that still refuse to sell their clothing on department store Web sites, worried that they won't have control of their image. They include Hermes International, Chanel SA and Louis Vuitton SA, a division of the world's largest luxury group, LVMH Moet Hennessy Louis Vuitton SA.

But resistance from designers is subsiding, and as more designer brands sell online, luxury sales are expected to grow even further. Mulpuru forecast that about 14 percent of all luxury merchandise sales will be sold online by 2010, up from 8 percent last year. Mulpuru estimated that the compound annual growth rate for luxury sales from 2005 to 2010 will be 13 percent, compared to 14 percent for overall online sales.

Sales at many of these sites are growing at a faster rate than the overall online luxury business. Sales at saks.com have increased 40 percent since 2004, according to Incandela. And she expects the online site — which is its fourth-largest store by sales — to be the third-largest behind its New York and Beverly Hills stores this year.

Such robust business has defied earlier analysts' predictions that only designer shoes and accessories would do well. Brendan Hoffman, president and CEO of Neiman Marcus Direct, which operates both the Neiman Marcus and Bergdorf Goodman sites, said he had first underplayed high fashion items. (The Bergdorf Goodman site was launched a year and a half ago.) Recent best sellers on neimanmarcus.com include a $3,325 silk georgette dress by Chloe and a $1,705 Versace floral blouse.

But Nordstrom is still "taking baby steps" as it expands its designer merchandise to make sure that what's on the Web site is reflective of what's in the stores, said Jamie Nordstrom, president of Nordstrom Direct and great grandson of its founder John W. Nordstrom. Within 18 months, customers will be able to make a sales transaction on the Nordstrom's designer area, but in the meantime, they can order by telephone or get help from a sales associate online.

Upscale department stores and pure luxury players say they'll keep rolling out new services and new categories to keep customers interested. Neiman Marcus e-mails its well-heeled customers five times a week; the Milan-based Yoox, which sells 300 designer brands, offers its biggest spenders a password-protected private area so they can preview clothes before other customers can and London-based Net-a-porter recently launched a twice yearly interactive diary and fashion magazine dedicated to the season's must-haves.

But Forehand, the Tampa resident, has her own suggestions. She would like to be able to create an outfit online.

"I would like to be able to put a dress with a handbag," and see if it goes together, she noted.