Has “Rachel from Card Services” called you?

Telephone fraudsters know that Americans are fed up with high interest rates on their credit card balances and have for years been trying to cash in on that frustration by tricking consumers into paying them as much as several thousand dollars for bogus rate reduction programs.

This con, often initiated by pre-recorded robocallers like “Rachel,” has been going on for years. And despite numerous enforcement actions by the Federal Trade Commission (FTC), it just won’t go away.

'It's disheartening'

Bikram Bandy, coordinator of the FTC’s Do Not Call Program, says he is concerned that many people are falling for the scam – and losing money – when offered the “too-good-to-be true” promise of unrealistically low interest rates.

“It’s disheartening that this scam continues, and it does continue because the scammers are still making money from it,” Bandy told NBC News.

Like most telemarketing frauds these days, this scam typically starts with a recorded message from “credit services” or “card member services,” often in the voice of “Rachel” but also from others, saying you qualify for a special interest rate reduction program that will help you pay off your balance sooner.

Related: Robocallers Are Coming After Your Cell Phone

Respond to the message and you’ll be connected to a representative who falsely claims to work for your bank or credit card company.

Victims who take the bait either get nothing for their money or the scammer does something that they could have done on their own – for free – such as asking the credit card company for a hardship rate reduction.

In recent years, the FTC has sued more than a dozen boiler-room operations making these bogus credit card rate reduction offers. And yet, the calls keep going out. In fact, when it comes to robocall complaints, these rate reduction calls top the list.

Several weeks ago, the FTC and Florida Attorney General sued an Orlando-based telemarketer that allegedly had been bombarding people across the country with rate reduction robocalls since 2011. A federal district court judge agreed to temporarily shut down the company.

“Too often the services promised were never provided, and the consumer faced even more credit card debt through charges made without their consent,” Florida Attorney General Pam Bondi said in a statement.

They may say it’s ‘free,’ but it’s not

Rosa Pagan, who lives near Philadelphia, got one of these calls last year. She wound up talking to “Eugene,” who claimed to be associated with her Sears MasterCard. He claimed that because of her good payment history, she was “pre-qualified” to have the interest rate on her card reduced from 24 percent to zero.

“He had my complete credit card number and account information, so I really thought he was calling from Sears,” Pagan told NBC News. “And he assured me there was no charge for this; it was free.”

Once Eugene “verified” that she was qualified, he transferred Pagan to a “supervisor” who told her the service would cost $1,900, but he was willing to give her a special deal of $1,400. Pagan said “no,” and told him she didn’t want anything to do with the company.

Related: FCC Gives Phone Companies Power to Block Robocalls

When her next credit card statement arrived, Pagan found an unauthorized charge of $1,498 for the service she had declined. She complained to Sears, which reversed the fraudulent charge. Pagan told the FTC she did not give the company her card number and she does not know how they got it.

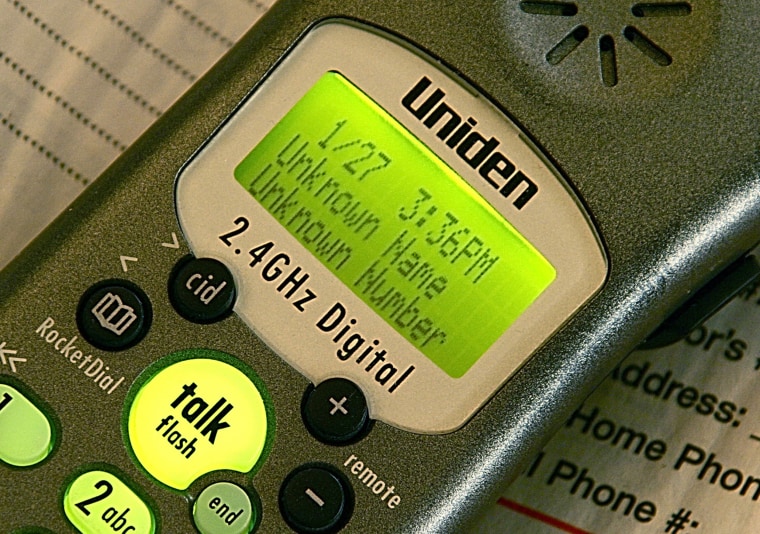

“It’s terrible what they’re doing to people,” Pagan said. “You have a phone in your house and you can’t pick it up because you never know what scam is going to come through the phone. We got caller ID and I will not answer the phone unless I am expecting the call or it’s from someone I know.”

Dealing with robocalls

Robocalls continue to be a serious problem. These automated calls are the cheapest and easiest way for telemarketing scammers to find their victims.

Remember: If you get a robocall that’s trying to sell you something, that call is illegal unless you have given that company specific permission to call you.

If you pick up the phone and it is a robocall – hang up. Don’t press any keys to speak to an operator or to add your number to their do not call list. These crooks don’t have a do not call list. And never call back. If you respond in any way, it will probably lead to more robocalls.

Never give personal information, such as credit card, checking account or Social Security number to an unknown caller, not even if the caller tries to “confirm” this information. That’s just a trick, possibly aimed at getting you to reveal your personal details or getting you to supply missing information, like a PIN, for data obtained from a hacker or some other nefarious source.

If you are struggling to make payments on your credit card, contact a reputable credit counselor. You can find a nonprofit agency near you by going to the National Foundation for Credit Counseling website.

Herb Weisbaum is The ConsumerMan. Follow him on Facebook and Twitter or visit The ConsumerMan website.